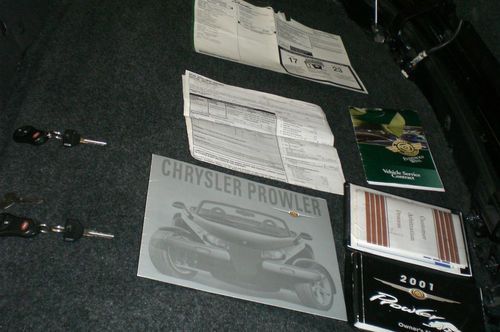

2001 Chrysler Plymouth Prowler. L O W R E S E R V E on 2040-cars

Clermont, Florida, United States

Body Type:Convertible

Vehicle Title:Clear

Engine:3.5L V6 HIGH OUTPUT

Fuel Type:Gasoline

For Sale By:Private Seller

Number of Cylinders: 6

Make: Chrysler

Model: Prowler

Trim: BASE

Options: Leather Seats, CD Player, Convertible

Drive Type: RWD

Safety Features: Anti-Lock Brakes, Driver Airbag

Mileage: 47,900

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows

Exterior Color: Blue

Interior Color: Gray

Chrysler Prowler for Sale

Auto Services in Florida

Zych`s Certified Auto Svc ★★★★★

Yachty Rentals, Inc. ★★★★★

www.orlando.nflcarsworldwide.com ★★★★★

Westbrook Paint And Body ★★★★★

Westbrook Paint & Body ★★★★★

Ulmerton Road Automotive ★★★★★

Auto blog

Consumer Reports says Ram 1500 tops fuel economy fight [w/video]

Wed, Aug 27 2014Consumer Reports takes its independent vehicle testing procedures seriously. In an era when we have to question the EPA's official ratings thanks to recent re-evaluations from Ford and Hyundai, an independent voice is important. So, when CR says something is the best, it's worth paying attention to. The Ram 1500 EcoDiesel has "about the same fuel-economy numbers that we typically see in a midsized SUV." – Jake Fisher In this case, CR took a look at the fuel economy of the 2014 Ram 1500 EcoDiesel and found that it came out on top of the fullsize pickup truck pack. The Ram did so with 20 miles per gallon overall and 27 mpg on the highway. CR gave the truck a total road test score of 82. The EPA says that the EcoDiesel 1500 gets 28 mpg on the highway, 20 mpg city and 23 mpg combined. Comparing official EPA numbers, the Ram is also the best among trucks in its class. It's nice when people agree on something. As we know from first-hand, long-distance experience, you can push the 1500 EcoDiesel to 38 mpg. CR found in its own testing that the truck had, "about the same fuel-economy numbers that we typically see in a midsized SUV," said Jake Fisher, CR's director of automotive testing, in a statement. Speaking of midsized SUVs, CR also announced this week that the new Toyota Highlander Hybrid got the top spot in CR's ratings in that category. CR liked pretty much everything about the SUV, saying that the "transitions between electric power and the gas engine are seamless" and that, "the new Highlander also handles better, with a steadier ride and reduced body lean in corners." You can find more at the CR website, in the October print issue of Consumer Reports or in the video and press release below. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. RAM ECODIESEL 1500 TOPS CONSUMER REPORTS FULL-SIZE PICKUP TRUCK RATINGS Redesigned Toyota Highlander Hybrid Climbs to Top of Midsized SUV List Yonkers, N.Y.- The Ram 1500 EcoDiesel climbed to the top of Consumer Reports' full-size pickup truck ratings with an impressive performance in the organization's fuel economy tests. The EcoDiesel (82 point overall road test score) turned in a best-in-class fuel economy of 20 mpg overall and 27 mpg on the highway, to help it score better than the previously tested Ram 1500 V8 (81) regular gas version and Chevrolet Silverado 1500 LT (80).

Chrysler unveils Dodge Charger SRT8 392, 300 SRT Concept to the faithful

Tue, 26 Mar 2013Our man Steven J. Ewing recently spent some time in a 2013 Dodge Charger SRT8 Super Bee, and while he found a lot to love - particularly underhood - he didn't care for the sedan's retro-steeped visuals, preferring the standard SRT's look instead. Perhaps he'll dig this throwback look instead. Over the weekend, Chrysler unveiled this handsome 2013 Dodge Charger SRT8 392 Appearance Package at the eighth annual Spring Festival of LXs, a gathering of Charger, Challenger and Chrysler 300 enthusiasts held in Irvine, California.

Unveiled by SRT CEO Ralph Gilles in front of an estimated 2,500 Spring Fest goers, the 392 features 20-inch Black Vapor Chrome alloys set off by a black-painted roof panel, hood bulge, spoiler and mirror caps. Additional exterior changes include model-specific striping and badging along with the requisite serialized dash plaque inside. The 392 will be available in five colors - Billet Silver Metallic, Bright White, Hemi Orange, Plum Crazy and the TorRed pain seen here.

Performance-wise, the 392 remains unchanged from standard SRT8s, but that's hardly a slight - the 6.4 liter Hemi V8 continues to churn out 470 horsepower and 470 pound-feet of torque to the rear wheels. Like other 2013 SRT8s, the 392 benefits from the institution of a new launch control system and a retuned three-mode adaptive suspension.

China's Geely says it has no plan to buy Fiat Chrysler — as FCA stock leaps

Wed, Aug 16 2017HONG KONG — Chinese carmaker Geely Automobile denied media speculation on Wednesday that it planned to make a takeover bid for Fiat Chryslerk Automobiles (FCA), the world's seventh-largest automaker. Geely was one of several Chinese carmakers cited in by Automotive News, which said representatives of "a well-known Chinese automaker" had made an offer this month for FCA, which has a market value of almost $20 billion. "We don't have such a plan at the moment," Geely executive director Gui Shengyue told reporters at an earnings briefing, when asked if Geely was interested in Fiat. He said a foreign acquisition would be complicated, but he did not elaborate. "But for other (Chinese) brands, it could be a fast track for their development," Gui added. However, a source close to the matter said FCA and Geely Automobile's parent firm, Zhejiang Geely Holding Group, had held initial talks late last year, without disclosing their nature. The source confirmed Geely was no longer interested in FCA, noting that the parent company had only three months ago announced its first push into Southeast Asia with the purchase of 49.9 percent of struggling Malaysian carmaker Proton, a deal that also included a stake in Lotus. Geel's denial failed to dent FCA's stock. The price of its Milan-based shares has jumped more than 10 percent to a 19-year high since Automotive News first reported on Monday, citing unnamed sources, that FCA had rejected the Chinese offer as too low. FCA stock on the New York Stock Exchange rose sharply on Monday from $11.60 to $12.38 and on Wednesday was trading at $12.84. FCA declined to comment on Wednesday. FCA Chief Executive Sergio Marchionne has repeatedly called for mergers as a way of sharing the costs of making cleaner, more advanced cars, but he has repeatedly failed to find a partner and retreated from his search for in April, saying FCA would stick to its business plan. He has also spoken of spinning the successful Jeep and Ram divisions off from FCA. Europe's largest carmaker, Volkswagen, and General Motors have both said they are not interested in talks with FCA. On Wednesday, Geely Automobile reported a doubling of first-half profit, above expectations, as cars designed with Sweden's Volvo won over domestic consumers. Volvo is a unit of the Zhejiang Geely group, and has recently announced it will share its technology with Geely.

2001 chrysler prowler

2001 chrysler prowler 2002 chrysler (plymouth) prowler convertible 2-door 3.5l

2002 chrysler (plymouth) prowler convertible 2-door 3.5l 2001 chrysler / plymouth prowler base convertible 2-door 3.5l

2001 chrysler / plymouth prowler base convertible 2-door 3.5l 2002 chrysler prowler - select luxury cars - prem

2002 chrysler prowler - select luxury cars - prem 2002 chrysler prowler

2002 chrysler prowler 2002 chrysler prowler

2002 chrysler prowler