2024 Chrysler Pacifica Touring 4dr Mini Van on 2040-cars

Engine:3.6L V6

Fuel Type:Gasoline

Body Type:Minivan

Transmission:Automatic

For Sale By:Dealer

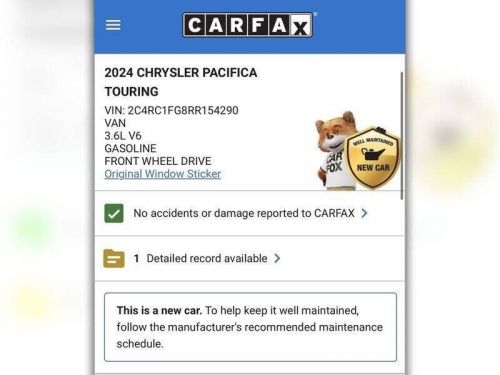

VIN (Vehicle Identification Number): 2C4RC1FG8RR154290

Mileage: 28

Make: Chrysler

Trim: Touring 4dr Mini Van

Drive Type: --

Number of Cylinders: 3.6L V6

Features: --

Power Options: --

Exterior Color: White

Interior Color: Black

Warranty: Unspecified

Model: Pacifica

Chrysler Pacifica for Sale

2021 chrysler pacifica touring l(US $16,774.00)

2021 chrysler pacifica touring l(US $16,774.00) 2022 chrysler pacifica touring l(US $21,794.00)

2022 chrysler pacifica touring l(US $21,794.00) 2024 chrysler pacifica touring l(US $45,940.00)

2024 chrysler pacifica touring l(US $45,940.00) 2024 chrysler pacifica touring l(US $39,450.00)

2024 chrysler pacifica touring l(US $39,450.00) 2024 chrysler pacifica touring l(US $39,255.00)

2024 chrysler pacifica touring l(US $39,255.00) 2024 chrysler pacifica touring l(US $43,945.00)

2024 chrysler pacifica touring l(US $43,945.00)

Auto blog

Chrysler de Mexico to sell rebadged Mitsubishi model in shades of Colt deal

Wed, 02 Jul 2014Chrysler and Mitsubishi have had a close relationship since the early '70s. Back then, they partnered up to sell the Japanese brand's models under American names as captive imports in the US. Vehicles like the Dodge Colt, Eagle Summit, and eventually the 3000GT/Stealth twins and lots of other cars and trucks became the fruits of that alliance. In fact, the two companies still maintain a good rapport, as evidenced by reports of a new deal to sell the Mitsubishi Attrage, also known the Mirage G4, in Mexico starting in November.

The Attrage is a small, four-door sedan that borrows many of the mechanical bits from the Mitsubishi Mirage hatchback. According to Automotive News, the deal allows Chrysler to sell the model in Mexico for the next five years. The deal could be a win-win for both companies. Mitsubishi gets to use more capacity at its Laem Chabang, Thailand factory where the car is made, and Chrysler gets a new vehicle for a growing market with almost zero development costs. At this time, there's no indication of the new model's name in Mexico, though.

There's also still a chance the Attrage might make it to the US market as well. The automaker showed off the sedan as the Mirage G4 at the 2014 Montreal Motor Show ahead of promised sales in small-car-friendly Canada. The Mirage hatchback was introduced to the US in a similar way, debuting in Canada first and then crossing the border. While reviews for the Mirage have been pretty atrocious, it would still be interesting to see Mitsubishi further expanding its lineup in North America.

Pickup prices rising at 2x industry average

Tue, 11 Jun 2013We've said it before, but bears repeating: Pickup trucks are the financial engines of America's automakers. Good thing, then, that the segment is in rude health - in fact, Automotive News is suggesting that pickup truck sales are arguably healthier than they were pre-recession, even though the segment's volume is still significantly down from where it was before the bottom fell out of the US economy. That's because per-unit profits on full-size trucks are skyrocketing, outpacing the industry's average price increases by more than double since 2005. According to data from Edmunds, the average transaction price of a full-size pickup is now $39,915 - a heady increase over the $31,059 average price in 2005 - a gain of over 8 percent after inflation is factored in.

Just how important are trucks to automakers' bottom lines? Automotive News quotes a Morgan Stanley analyst as saying the Ford F-Series is responsible for 90 percent of the company's 2012 profits, and General Motors isn't far behind, with the Chevrolet Silverado and GMC Sierra twins chipping in about two-thirds of the automaker's earnings.

Automotive News points out that Detroit's automakers now have the money to invest in modernizing their full-size truck offerings, in part because they don't have the same overhead and legacy costs that pushed General Motors and Chrysler into bankruptcy. Certainly, the pickup segment has seen a lot of innovations as of late, including turbocharged V6s, coil-spring rear suspensions and active aero. Those improvements in important areas like fuel economy and ride comfort have given existing pickup buyers new reasons to upgrade. In addition, automakers are piling on the tech and luxury goodies, creating more and more high-content, high-profit models like the Ford F-150 King Ranch, Ram 1500 Laramie Longhorn and Chevrolet Silverado High Country (shown).

For his last act, Marchionne will outline an EV/hybrid roadmap this week

Wed, May 30 2018MILAN/LONDON — Fiat Chrysler (FCA) boss Sergio Marchionne is expected to outline new plans for electric and hybrid cars in a strategy presentation on Friday, aiming to ensure the world's seventh-largest carmaker remains in the race in the absence of a merger. The 65-year-old will present FCA's strategy to 2022, his final contribution to the company he turned around and multiplied in value through 14 years of canny dealmaking. After failing to secure a tie-up he said was necessary to manage the costs of producing cleaner vehicles, Marchionne needs to show the group can keep churning out profits on its own, even as emissions rules tighten, SUV competition intensifies and worries around his succession abound. Marchionne had long refused to jump on the electrification bandwagon, saying he would only do so if selling battery-powered cars could be done at a profit. He even urged customers not to buy FCA's Fiat 500e, its only battery-powered model, because he was losing money on each sold. But Tesla's success and the need to comply with tougher emissions rules have forced Marchionne to commit to what he calls "most painful" spending. "FCA is way behind rivals in terms of hybrid and electric vehicles and they need to hit the accelerator to convince investors they can close that gap," said Andrea Pastorelli, a fund manager at 8a+ Investimenti. Germany's Volkswagen, Daimler, BMW and U.S. rivals GM and Ford have committed to spending billions of euros each in coming years to try produce profitable cars powered by cleaner fuels. FCA needs to present a clear roadmap, just like Volvo Cars, which ditched diesel from its best-selling XC60 SUV, launched a new electric brand and pledged to shift all brands to hybrid by 2019, a banking source close to FCA said, noting: "The tech divide determines winners and losers in the industry." Marchionne has already said half of the wider FCA fleet will incorporate some elements of electrification by 2022, while luxury marque Maserati will spearhead FCA's electrification drive by making all new models due after 2019 electric. But its plans remain vaguer and less advanced than most big rivals and some investors wonder about the capital required to make vehicles compliant, and what share of spending can go to electrification given FCA's numerous demands.