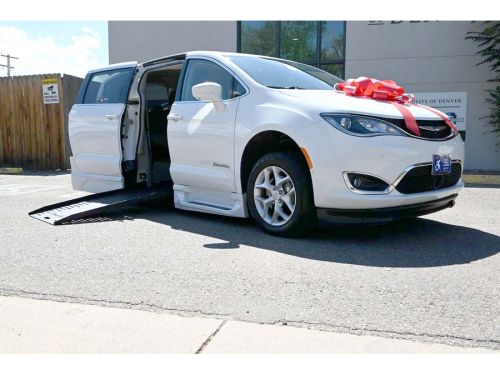

2020 Chrysler Pacifica Touring Mobility Handicap Van Handicap on 2040-cars

Denver, Colorado, United States

Engine:Pentastar 3.6L V6 287hp 262ft. lbs.

Fuel Type:Gasoline

Body Type:PV

Transmission:Automatic

For Sale By:Dealer

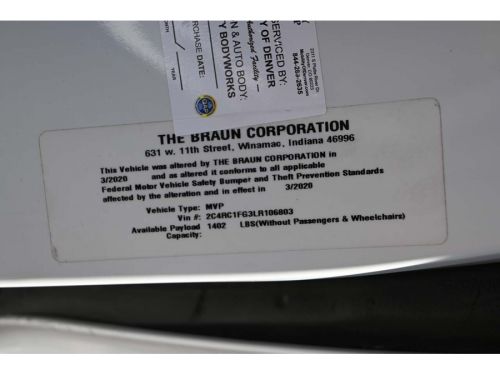

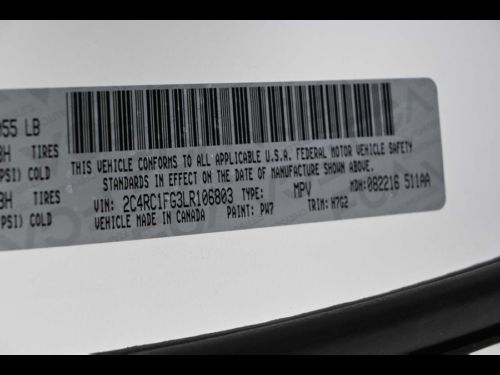

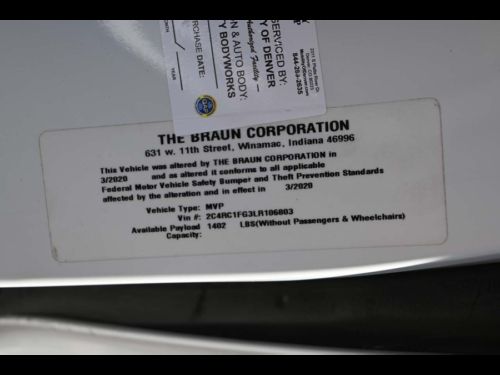

VIN (Vehicle Identification Number): 2C4RC1FG3LR106803

Mileage: 55644

Make: Chrysler

Trim: Touring Mobility Handicap Van Handicap

Features: --

Power Options: --

Exterior Color: White

Interior Color: Black

Warranty: Vehicle does NOT have an existing warranty

Model: Pacifica

Chrysler Pacifica for Sale

2022 chrysler pacifica touring l(US $29,759.00)

2022 chrysler pacifica touring l(US $29,759.00) 2024 chrysler pacifica limited(US $47,434.00)

2024 chrysler pacifica limited(US $47,434.00) 2024 chrysler pacifica limited(US $46,172.00)

2024 chrysler pacifica limited(US $46,172.00) 2024 chrysler pacifica pinnacle(US $49,948.00)

2024 chrysler pacifica pinnacle(US $49,948.00) 2022 chrysler pacifica limited(US $28,808.00)

2022 chrysler pacifica limited(US $28,808.00) 2023 chrysler pacifica touring l(US $27,673.00)

2023 chrysler pacifica touring l(US $27,673.00)

Auto Services in Colorado

Tim`s Paintless Dent Repair ★★★★★

Three G Body & Paint Incorporated ★★★★★

Sun Valley Automotive ★★★★★

Sanitaire Parts & Service ★★★★★

Sabaru Import Motors Inc ★★★★★

Rickenbaugh Cadillac-Volvo ★★★★★

Auto blog

Peugeot maker PSA posts record profits ahead of FCA merger

Wed, Feb 26 2020PARIS — Peugeot maker PSA Group said its profitability reached a record high in 2019 but the French carmaker forecast falling industry sales in Europe this year as it pursues its merger with Fiat Chrysler, which is strong in North America. PSA has trimmed costs in areas such as the procurement of components as it has integrated its acquisition of Opel and Vauxhall, boosting operating margins to 8.5% last year. The group, which also produces cars under the Citroen and DS brands, offset a slump in vehicle sales by selling pricier SUV models, with launches including the Citroen C5 Aircross helping to lift revenues by a higher-than-expected 1% to $81.2 billion (74.7 billion euros). That helped it stand out in a car market where some rivals including France's Renault have struggled with sliding revenues and profits, amid a broader downturn in demand. PSA's group net profit increased 13.2% to a record 3.2 billion euros, and the company increased its dividend against 2019 results to 1.23 euros per share, up 58% from 2018 levels. The carmaker was "once again very solid", analysts at brokerage Oddo-BHF said in a note, adding the results confirmed the company's "best-in-class status." However PSA forecast a 3% contraction in Europe's car market this year, by far its biggest market. The tie-up with Fiat Chrysler will help it gain exposure to that group's strong presence in North America with brands like Jeep. The two companies struck a deal in December to create the world's No.4 carmaker, to better cope with market turmoil and the cost of making less-polluting vehicles. Fiat also posted more upbeat results than most rivals this year. CORONAVIRUS WEIGHS PSA boss Carlos Tavares told a news conference that the two groups were both in good shape and well placed to face market challenges together. He said he did not expect any major regulatory hurdles to the merger, adding it had so far submitted 14 approval requests to competition authorities out of the 24 it needs. There are no immediate plans to change anything in the large portfolio of brands within the combined group, he added. However the companies still face problems this year, including the coronavirus outbreak which has paralyzed production in China and hits carmakers' supply chain. PSA said the coronavirus impact was still difficult to assess. It factories in Wuhan, at the epicenter of the outbreak, are due to reopen in the second week of March.

Bob Lutz, UAW rep commend Chrysler for not bowing to NHTSA recall pressure [w/poll]

Mon, 10 Jun 2013Bob Lutz, the well-known executive with a range of automakers including both General Motors and Chrysler, says he supports Chrysler for not caving under federal pressure to issue a recall on 2.7 million Jeep vehicles. The National Highway Traffic Safety Administration is arguing that the plastic fuel tanks positioned behind the axles of certain 1993-2004 Grand Cherokee models and 2002-2007 Liberty models may become punctured in a collision and potentially catch fire, so it has called upon Chrysler to recall the vehicles. 15 deaths and 46 injuries have been attributed to the issue. For its part, Chrysler has maintained that its models "met and exceeded" all safety applicable mandates when they were manufactured, and furthermore, they argue that the government agency's own data proves that the vehicles are no more dangerous than similar SUVs produced by other automakers at the time. As a result, it is taking the unusual step of refusing to recall the vehicles.

According to The Detroit News, Lutz says Chrysler is right to push back when the government is out of line. Lutz also said that he wished he could have done the same when NHTSA urged Chrysler to issue a recall on certain minivans back when he was with the automaker 25 years ago.

Meanwhile, United Auto Workers Vice President General Holiefield also defended Chrysler by saying, "Our legendary Jeeps are crafted with pride by our dedicated UAW American workforce who work tirelessly to ensure the utmost quality of each Jeep that is produced for customers."

Jeep and Ram could be spun off from FCA, says Marchionne

Thu, Apr 27 2017Jeep is surely the biggest single feather left in the cap of the Fiat Chrysler Automobiles portfolio. Under Sergio Marchionne's leadership, Jeep went from fewer than 500,000 annual sales in 2008 to 1.4 million in 2016, and is on track for 2 million by 2018. Add in the brand's legacy, status as one of the most recognizable nameplates in the world, and rabid fan base, and Jeep has extraordinary monetary value to its parent company. Investors and analysts have certainly noticed Jeep's inherent value. According to The Detroit Free Press, Morgan Stanley's Adam Jonas asked FCA chief Sergio Marchionne if he would ever consider spinning Jeep and Ram, FCA's dedicated truck brand, into a separate corporate entity, and he responded with a simple "Yes." Jonas estimated Jeep's worth in January of this year at $22 billion. Ram was valued at $11.2 billion. Marchionne has a history of spinning off brands while keeping them part of FCA's corporate umbrella. The most noteworthy example of this value maximization was with Ferrari, which now trades on the New York Stock Exchange and rakes in $3.4 billion in annual revenue and close to $435 million in net income, reports the Free Press. Marchionne still serves as chairman and CEO of Ferrari, and Fiat heir John Elkann owns 22 percent of the Italian marque's shares. Even if the offloading of Jeep and Ram into a separate entity would amount to little more than a profit-driven ownership change on paper, it would be huge news to the brands' loyal fanbases. In any case, such a move would likely take years to actually happen and probably wouldn't mean much at all to the products that Jeep and Ram produce. In other words, Jeep fans can keep the pitchforks in the shed ... for now. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.