Original Paint Chrysler Newport Convertible on 2040-cars

Los Angeles, California, United States

|

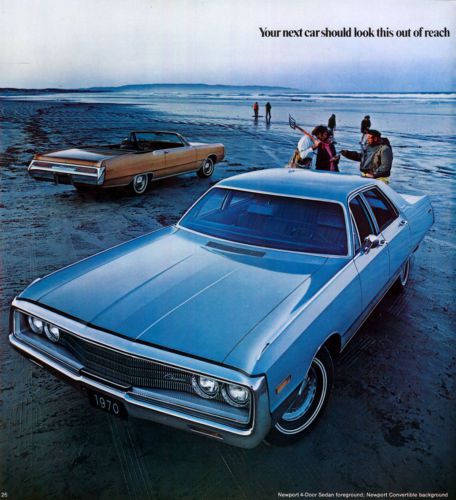

UP FOR SALE IS A NICE TWO OWNER NEWPORT CONVERTIBLE. THIS CAR COMES WITH ORIGINAL PAINT AND HAS SPENT IT'S LIFE IN SUNNY CALIFORNIA. THE CAR IS FULLY LOADED AND RUNS GREAT A REAL PLEASURE TO CRUISE DOWN THE ROAD IN. THE PAINT AND CHROME ARE NOT PERFECT AS THEY ARE 47 YEARS OLD ACTUALLY THE SAME AGE AS ME BUT THE CAR IS IN MUCH BETTER SHAPE. THE INTERIOR , CARPET , AND TOP ARE IN GOOD SHAPE NOT PERFECT BUT GOOD. NEW TIRES AND EXHAUST HAVE TITLE IN HAND CAN DROP OFF TO SHIPPER SO OVERSEAS BUYERS ARE NOT A PROBLEM YOU ARE WELCOME TO COME INSPECT ANYTIME THE CAR IS LISTED LOCALLY FOR SALE SO IT MAY BE GONE AT ANYTIME. LOCATED 10 MILES FROM LAX AIRPORT COME FLY DOWN AND HAVE A GREAT CRUISE HOME, IF YOU HAVE ANY QUESTIONS CALL 310 990-8628 SOLD AS IS NO WARRANTY IF YOU HAVE A LOW RATING CONTACT ME PRIOR TO BIDDING. THANKS FOR LOOKING AT MY AD HAVE TITLE IN HAND |

Chrysler Newport for Sale

Beautiful black convertible - push button auto -361ci v8-stunning color combo(US $31,900.00)

Beautiful black convertible - push button auto -361ci v8-stunning color combo(US $31,900.00) 1970 chrysler newport base hardtop 4-door 6.3l(US $4,299.00)

1970 chrysler newport base hardtop 4-door 6.3l(US $4,299.00) 1963 chrysler station wagon 4dr hard top 9 passenger project hot rat rod gasser(US $2,750.00)

1963 chrysler station wagon 4dr hard top 9 passenger project hot rat rod gasser(US $2,750.00) 1966 chrysler 300, v8, auto, new paint, rust free, nice, two door hardtop(US $9,500.00)

1966 chrysler 300, v8, auto, new paint, rust free, nice, two door hardtop(US $9,500.00) 1968 chrysler newport base convertible 2-door 6.3l

1968 chrysler newport base convertible 2-door 6.3l 1969 chrysler newport convertible base 6.3l

1969 chrysler newport convertible base 6.3l

Auto Services in California

Z Auto Sales & Leasing ★★★★★

X-treme Auto Care ★★★★★

Wrona`s Quality Auto Repair ★★★★★

Woody`s Truck & Auto Body ★★★★★

Winter Chevrolet - Honda ★★★★★

Western Towing ★★★★★

Auto blog

Zombie cars roundup: Dodge has sold 3 new Vipers this year

Thu, Jan 6 2022Car models come and go, but as revealed by monthly sales data, once a car is discontinued, it doesn't just disappear instantly. And in the case of some models, vanishing into obscurity can be a slow, tedious process. That's the case with the 12 cars we have here. All of them have been discontinued, but car companies keep racking up "new" sales with them. There are actually more discontinued cars that are still registering new sales than what we decided to include here. We kept this list to the oldest or otherwise most interesting vehicles still being sold as new, including a supercar. We'll run the list in alphabetical order, starting with *drumroll* ... BMW 6 Series: 55 total sales BMW quietly removed the 6 Series from the U.S. market during the 2019 model year. It had been available in three configurations, a hardtop coupe, a convertible and a sleek four-door coupe-like shape. Â BMW i8: 18 total sales We've always had a soft spot for the BMW i8, despite the fact that it never quite fit into a particular category. It was sporty, but nowhere near as fast as similarly-priced competitors. It looked very high-tech and boasted a unique carbon fiber chassis design and a plug-in hybrid powertrain, but wasn't really designed for maximum efficiency or maximum performance. Still, the in-betweener was very cool to look at and drive, and 18 buyers took one home over the course of 2021. Â Chevy Impala: 750 total sales The Impala represented classic American tastes at a time when American tastes were shifting away from soft-riding sedans with big interior room and trunk space and into higher-riding crossovers. A total of 750 sales were inked last year. Â Chrysler 200: 15 total sales The Chrysler 200 was actually a pretty nice sedan, with good looks and decent driving dynamics let down by a lack of roominess, particularly in the back seat. Of course, as we said regarding the Chevy Impala, the number of Americans in the market for sedans is rapidly winding down, and other automakers are following Chrysler's footsteps in canceling their slow-selling four-doors. Even if Chrysler never really found its footing in the ultra-competitive midsize sedan segment, apparently dealerships have a few leftover 2017 200s floating around. And for some reason, 15 buyers decided to sign the dotted line to take one of these aging sedans home last year.

Stellantis tells UK: Change Brexit deal or watch car plants close

Wed, May 17 2023LONDON - British car plants will close with the loss of thousands of jobs unless the Brexit deal is swiftly renegotiated, Stellantis has told the UK parliament, the latest in a series of warnings from the industry since the country left the European Union. The world's No. 3 carmaker by sales and owner of 14 brands including Vauxhall, Peugeot, Citroen and Fiat said that under the current deal it would face tariffs when exporting electric vans to Europe from next year, when tougher post-Brexit rules come into force. "If the cost of EV (electric vehicle) manufacturing in the UK becomes uncompetitive and unsustainable, operations will close," Stellantis said in a submission to a House of Commons committee examining the prospects for Britain's EV industry. Stellantis urged the government to reach an agreement with the European Union about extending the current rules on the sourcing of parts until 2027 instead of the planned 2024 change. In response, a government spokesperson said the business secretary had raised the issue with the EU. "Watch this space, because we are very focused on making sure that the UK gets EV and manufacturing capacity," Britain's finance minister Jeremy Hunt said on Wednesday at a British Chambers of Commerce event. The potentially existential problem facing Britain's car industry is closely tied to the shift to EVs. Under the trade deal agreed when Britain left the bloc, 45% of the value of an EV being sold in the European Union must come from Britain or the EU from 2024 to avoid tariffs. The problem is that a battery pack can account for up to half a new EV's cost. Batteries are also heavy and expensive to move long distances. Experts have been warning since Britain left the EU at the end of 2020 that the country would need a number of EV battery gigafactories or potentially lose a hefty chunk of its car industry. Only Japan's Nissan has a small EV battery plant in Sunderland, with a second one on the way. Cost of failure Britishvolt, a startup which received UK government support for an ambitious 3.8 billion pound ($4.80 billion) battery plant at a site in northern England, filed for administration in January after struggling to raise funds. The company was then bought by Australia's Recharge Industries, which has yet to unveil plans for the site.

As it did with Ferrari, Fiat Chrysler spinning off Magneti Marelli

Thu, Apr 5 2018MILAN — Fiat Chrysler said on Thursday its board had tasked management to proceed with spinning off Magneti Marelli and distributing shares in a new holding for the 99-year old parts business to FCA investors. The spinoff is part of a plan by FCA Chief Executive Sergio Marchionne to "purify" the Italian-American carmaker's portfolio and to unlock value at Magneti Marelli, which sits within FCA's components unit alongside robotics specialist Comau and castings firm Teksid, and which analysts say could be worth between 3.6 and 5 billion euros ($4.4-6.1 billion). "The separation will deliver value to FCA shareholders, while providing the operational flexibility necessary for Magneti Marelli's strategic growth in the coming years," Marchionne said in a statement. Magneti Marelli, which employs around 43,000 people and operates in 19 countries, is a diversified components supplier specialized in lighting, powertrain and electronics, and its spinoff is part of a five-year business plan FCA is due to present on June 1. "The spinoff will also allow FCA to further focus on its core portfolio while at the same time improving its capital position," Marchionne added. Marchionne has a long history of such moves. The 65-year-old was behind the spinoff and listing of trucks and tractor maker CNH Industrial and supercar brand Ferrari. The Magneti Marelli separation is expected to be completed by the end of this year or early 2019, with shares in the company expected to be listed on the Milan stock exchange. FCA's advisers initially looked at a possible initial public offering for the business to raise cash to cut FCA's debt, but the Agnelli family - FCA's main shareholder - were put off by low industry valuations and did not want their stake in Magneti Marelli to be diluted, three sources close to the matter told Reuters last month. Magneti Marelli has often been touted as a takeover target and FCA has fielded interest from various rivals and private equity firms over the years. South Korea's Samsung Electronics made a bid approach in 2016 but negotiations fell through as it was only interested in parts of the business, other sources have said. The spinoff is subject to regulatory approvals, tax and legal considerations and a final approval by the FCA board. The carmaker may modify or call off the transaction at any time and for any reason, it added.