1968 Chrysler Newport Base Convertible 2-door 6.3l on 2040-cars

El Paso, Texas, United States

Engine:6.3L 383Cu. In. V8 GAS Naturally Aspirated

Body Type:Convertible

Fuel Type:GAS

Vehicle Title:Clear

Exterior Color: Burgundy

Make: Chrysler

Interior Color: White

Model: Newport

Number of Cylinders: 8

Trim: Base Convertible 2-Door

Drive Type: U/K

Warranty: Vehicle has an existing warranty

Mileage: 0

Sub Model: newport - 300 - special edition

up for bid is this 68 newport 300 convertable // car has no title // does come with a bill of sale // this car can be a good resto or a good parts car // car is equiped with original 383 motor and 727 trans // car is very solid all throw out / has a small rust spot on passanger floor // car has been sitting i was told that engine was running car has all trim and glass as well as the convertable frame console all are very good solid condition // undercarrge seems to be good // looks like car was painted some time back / but original color was consort blue metalic with whit top // note i am listing this car for a friend // for questions you can contact 505 721 8031 thanks for looking car sold as is no warannty implied buy rersponsable for shiping of vehicle a deposit of 500 doliors is required at end of auction balance to be paid in full upon pick up of car

Chrysler Newport for Sale

1966 chrysler newport convertible(US $9,900.00)

1966 chrysler newport convertible(US $9,900.00) 1961 chrysler newport sedan factory 361-stickshift! 3 speed with floor shifter

1961 chrysler newport sedan factory 361-stickshift! 3 speed with floor shifter Blue with metallic flake,22 inch rims,2 door classic

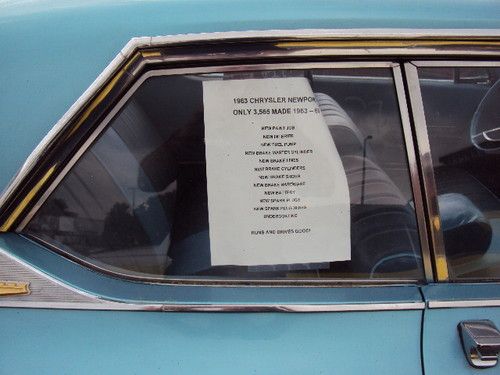

Blue with metallic flake,22 inch rims,2 door classic 1963 chrysler newport coupe

1963 chrysler newport coupe 1966 red runs & drives great body very nice interior fair!

1966 red runs & drives great body very nice interior fair! 1968 chrysler newport, blue with metallic flake, project car needs finished

1968 chrysler newport, blue with metallic flake, project car needs finished

Auto Services in Texas

Your Mechanic ★★★★★

Yale Auto ★★★★★

Wyatt`s Discount Muffler & Brake ★★★★★

Wright Auto Glass ★★★★★

Wise Alignments ★★★★★

Wilkerson`s Automotive & Front End Service ★★★★★

Auto blog

Ferrari and FCA are officially separated

Mon, Jan 4 2016It's been a long time in the making, but it's officially happened: Ferrari is no longer part of Fiat Chrysler Automobiles. Following the Italian automaker's initial public offering, it has officially split off from its former parent company. As part of the spin-off, FCA's stakeholders will each receive one common share in Ferrari for every ten they hold in Fiat Chrysler. Special voting shares will be distributed in the same proportions to certain shareholders as well. Those shares being distributed will account for 80 percent of the company's ownership. Another ten percent was floated as part of the company's IPO, while the remaining 10 percent is held by Enzo's son Piero Ferrari (pictured above at center), who serves as vice chairman of the company. The shares will continue to be traded under the ticker symbol RACE on the New York Stock Exchange, and will begin trading this week as well under the same symbol on the Mercato Telematico Azionario, part of the Borsa Italiana in Milan. Since the extended Agnelli family headed by chairman John Elkann (above, right) holds the largest stake in FCA, expect it to continue controlling the largest portion of Ferrari shares as well. Between them, nearly half of the shares in the supercar manufacturer – and we suspect a little more than half of the voting rights – will be controlled by the Agnelli and Ferrari families, who are expected to cooperate to ensure the remaining shareholders don't attempt a takeover of the company. Similar to its former parent company, which operates out of Turin and Detroit, the Ferrari NV holding company is nominally incorporated in the Netherlands, but the automaker will continue to base its operations in Maranello, Italy. That's where it's always been headquartered, on the outskirts of Modena. For the time being, Sergio Marchionne (above, left) remains both chairman of Ferrari and chief executive of FCA – a position to which he is not unaccustomed, having previously headed both Fiat and Chrysler before the two officially merged. Related Video: Separation of Ferrari from FCA Completed LONDON, January 3, 2016 /PRNewswire/ -- Fiat Chrysler Automobiles N.V. ("FCA") (NYSE: FCAU / MTA: FCA) and Ferrari N.V. ("Ferrari") (NYSE/MTA: RACE) announced today that the separation of the Ferrari business from the FCA group was completed on January 3, 2016. FCA shareholders are entitled to receive one common share of Ferrari for every 10 FCA common shares held.

CEO Sergio Marchionne curses FCA spokesman for emissions cheating denial

Tue, May 15 2018WASHINGTON — Fiat Chrysler Chief Executive Officer Sergio Marchionne reprimanded the company's top U.S. spokesman for issuing press releases about Fiat's vehicle emissions practices days after Volkswagen's disclosure in September 2015 that the German automaker had used illegal software to evade emissions tests, documents released Monday show. Lawyers suing Fiat Chrysler Automobiles in a securities case filed excerpts of an email from Marchionne to Gualberto Ranieri, then the company's U.S. spokesman, in a filing in federal court in New York criticizing him for saying that the company does not use defeat devices. "Are you out of your goddam mind?" Marchionne wrote in an email on Sept. 22, 2015, adding that Ranieri should be fired and calling his actions "utterly stupid and unconscionable." The company said in a statement on Monday it was "understandable that our CEO would have a forceful response to any employee who would opine on such a significant and complex matter, without the matter having been fully reviewed through its appropriate channels." The statement added that Ranieri's comments came just days after VW's emissions issue became public "and before a comprehensive internal review and discussions with component suppliers was possible." Fiat Chrysler was sued in 2015 along with Marchionne and other executives over claims it defrauded shareholders by overstating its ability to comply with vehicle safety laws. An amended version of the complaint filed in 2017 added claims about its compliance with emissions laws. The shareholders accused the defendants of inflating Fiat Chrysler's share price by hundreds of millions of dollars from October 2014 to October 2015 by downplaying safety concerns. They said the shortcomings materialized in 2015 when the automaker was fined $175 million by the National Highway Traffic Safety Administration, and took a roughly $670 million charge for recalls. Plaintiffs filed the excerpts seeking approval to take up to 40 additional depositions, including Marchionne's. The U.S. Justice Department sued Fiat Chrysler in May 2017, accusing it of illegally using software to bypass emission controls in 104,000 diesel vehicles sold since 2014. Fiat Chrysler has held numerous rounds of settlement talks with the Justice Department and California Air Resources Board to settle the civil suit, including talks as recently as earlier this month. It faces a separate criminal probe into the matter.

2015 Chrysler 200S AWD

Mon, 02 Jun 2014I love road trips. Honestly, one of the best parts about this job is the freedom we're given to experience the open road, whether at new car launches or while bombing around with whatever we're testing on our home turf. But the longer-form road trip is equally special to me, and it's something I'm always eager to do. Air travel stinks - that's not news. So if I can drive, I will. And without our dear TSA to fight with, I can pack all the chainsaws and gallon jugs of chocolate milk that I want.

So when it came time to attend the 2014 New York Auto Show this past April, I thought, "Why not drive?" Typically, the route from downtown Detroit to Manhattan is something like 10 hours, but I decided to bake some extra time into the journey and planned for the vast majority of my travels to be off the beaten path. Doing the "avoid expressways" route allows you to see parts of America you've never encountered before, and to meet people with stories and opinions that you've never heard. It's a great way to travel if you have the time. There's something uniquely serene about seeing the country in a great car on a great road.

Let's talk about that "great car" line for a moment. Ideally, long stretches of backroads are best done in something fast, comfortable and involving - a Porsche 911 comes to mind. Or, another school of thought says to pick some fun little spitfire like the always-lovely Mazda MX-5 Miata, for top-down, sun-drenched fun. But for this trip, I chose the 2015 Chrysler 200, in fully loaded S guise with all-wheel drive. Now, settle down; I'm not about to compare it to either the Porsche or Mazda. The point I'm making is this: after 1,500 test miles under my butt, I can emphatically state that the new 200 is indeed a great car in its own right.