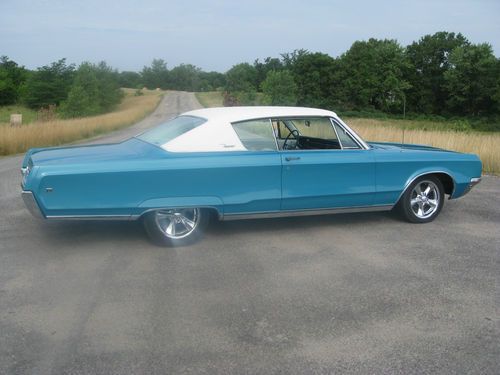

1967 Chrysler Newport 4-door 6.3l on 2040-cars

Somerset, Kentucky, United States

Body Type:Coupe

Vehicle Title:Clear

Engine:383

Fuel Type:GAS

For Sale By:Private Seller

Number of Cylinders: 8

Make: Chrysler

Model: Newport

Trim: Fastback

Power Options: Air Conditioning

Drive Type: Rear wheel drive

Mileage: 151,114

Exterior Color: Gold

Warranty: Vehicle does NOT have an existing warranty

Interior Color: White

Chrysler Newport for Sale

1968 chrysler newport custom hardtop 2-door mopar big block(US $7,750.00)

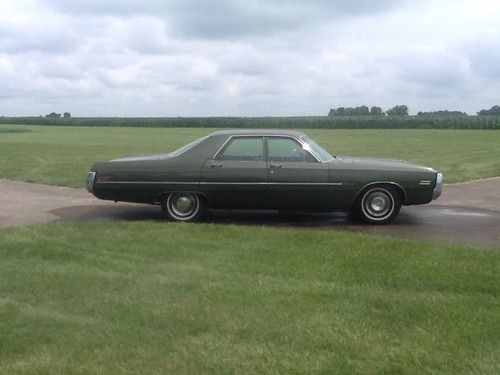

1968 chrysler newport custom hardtop 2-door mopar big block(US $7,750.00) 1971 chrysler newport royal 6.3l(US $5,500.00)

1971 chrysler newport royal 6.3l(US $5,500.00) 1962 chrysler newport, 4 door, all original, mopar, classic car, 383 big block

1962 chrysler newport, 4 door, all original, mopar, classic car, 383 big block 1965 chrysler newport base sedan 4-door 6.3l

1965 chrysler newport base sedan 4-door 6.3l 1978 chrysler newport has been in storage four years-private colletor-runs/drive(US $4,999.00)

1978 chrysler newport has been in storage four years-private colletor-runs/drive(US $4,999.00) 1962 chrysler newport(US $3,000.00)

1962 chrysler newport(US $3,000.00)

Auto Services in Kentucky

Todd`s Auto Repair ★★★★★

Seibert Auto Svc & Towing ★★★★★

Schneider Auto Parts ★★★★★

Mid-City Body Shop ★★★★★

Maaco Collision Repair and Auto Painting ★★★★★

Haddad`s Auto Service Inc ★★★★★

Auto blog

Refreshed Chrysler 300 SRT won't be sold in NA

Mon, 20 Oct 2014It looks like it might be time to bid farewell to the V8 rumble from the Chrysler 300 SRT - at least if you live in North America. The reported change comes as Fiat Chrysler Automobiles reshuffles its ranks with the Dodge brand, re-absorbing SRT and building its muscular reputation with the Challenger and Charger Hellcat models. Meanwhile, Chrysler is taking a more mainstream approach, and that likely means the end of overt high-performance models from the division for now.

According to Automotive News, the 300 SRT will be discontinued in the US for 2015, but it won't be totally dead. Some right-hand drive markets will still get the brawny V8 sedan next year, a distinction that goes a long way toward explaining some spy shots we've seen recently.

The 300 SRT's North American demise probably shouldn't come as a total shock. In FCA's five-year plan, it says that the 300 is destined for a refresh to be unveiled later this year, presumably at the upcoming Los Angeles Auto Show. There's no mention of the SRT model in the document, though, which seems to signal its end.

Mopar maneuvers into SEMA with a multitude of modified models

Wed, 05 Nov 2014As the aftermarket and performance arm of Fiat Chrysler Automobiles, Mopar has a duty to extract everything from the company's models that it can, and there's no better place to show all of its work off than the annual SEMA Show.

Dodge really gets in on the act this year with several customs to show off different parts of the brand's performance heritage. Perhaps the most interesting among them is the track-prepped Viper ACR Concept (pictured above). It wears a custom body kit to produce even more downforce, thanks in no small part to a monstrous wing at the back. To shed weight, most of the interior is stripped out, as well. Next up, the Challenger T/A Concept takes inspiration from '70s Trans-Am racing in a livery of Sublime Green and matte black paint. The center scoop in the hood keeps the 6.4-liter V8 fed with cool air, and the special's 20-by-9.5-inch matte black wheels keep it planted in the corners.

Also getting the once-over from Mopar is the Charger R/T. It wears the division's body kit, and under the hood, a cold-air intake keeps the 5.7-liter V8 breathing. The suspension is retooled to hold the road better with a coil-over kit, upgraded sway bars and strut tower braces for the front and rear. The company is also showing off a snazzy blue Charger with a mean look. The final Dodge getting work from Mopar is the Dart R/T Concept with bright, O-So-Orange paint and a matte black hood with a scoop hooked directly to the air intake. The performance-oriented design is finished off with a coil-over suspension and big brake kit, as well.

Fiat Chrysler posts record Q3 profit thanks to U.S. trucks and Jeep

Wed, Oct 28 2020MILAN — A rebound in car production in Fiat Chrysler on Wednesday reported record third-quarter earnings as production returned to nearly pre-pandemic levels. The Italian-American automaker, which is finalizing its full merger with French rival PSA Peugeot, reported a net profit in the three months ending Sept. 30 of $1.4 billion (1.2 billion euros). That compares with a loss of 179 million euros a year earlier. The carmaker reported adjusted earnings before tax and interest in North America of 2.5 billion euros. That offset deepening losses in Europe, Asia and at its Maserati luxury marquee. Latin America, the only other region to post a profit, saw it narrow by two-thirds to 46 million euros. “Our record results were driven by our teamÂ’s tremendous performance in North America,” CEO Mike Manley said in a statement. Overall, the carmaker said global earnings before tax and interest were a record 2.3 billion euros despite a 6% fall in revenues to 26 billion euros. Global shipments were down 3%, due largely to plant retooling in North American to produce the new Jeep Grand Wagoneer in the luxury SUV segment and the discontinuation of the Dodge Grand Caravan classic minivan. Fiat Chrysler announced earlier Wednesday that its merger with PSA Peugeot is on track to be finalized by the end of the first quarter of 2021, as planned. To meet regulatory concerns, the French carmaker is selling a small stake in a components maker to get below 40% ownership. The new automaker, to be called Stellantis, will be the fourth biggest producer in the world. Earnings/Financials Chrysler Dodge Fiat Jeep RAM Citroen Peugeot