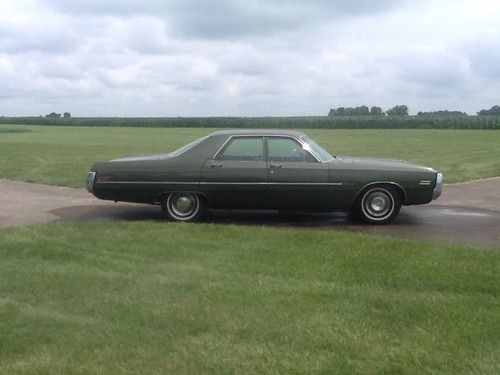

1961 Chrysler Newport 2-dr Hardtop Coupe on 2040-cars

Tiffin, Iowa, United States

Body Type:2 door hartop - coupe

Engine:361 V-8

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Private Seller

Number of Cylinders: 8

Make: Chrysler

Model: Newport

Drive Type: 3-speed torquflite automatic

Mileage: 78,000

Exterior Color: White

Warranty: Vehicle does NOT have an existing warranty

Interior Color: red and white

Trim: stock

This car has only 78,000 miles on it. It was owned by one family since new. To make this car safe to drive anywhere, we just spent $7,400 on the following:

New bias-ply tires, all SIX new wheel cylinders, new master cylinder, new rear shoes, (front ones were new), power steering seals kit, it has a brand new Tourquflite transmission, new carb kit, recent tuneup, new battery, new belts and hoses, all new dual exhaust, new idler arm, new fuel sending unit, new oil and air filters, newer shocks, and the underside of this car has just been completely media blasted and primed, painted black, and undercoated as appropriate. The entire bottom was and IS rust free. The 361 engine holds 50#+ oil pressure at idle. Runs GREAT. Body, glass, bumpers, and stainless are all excellent. One small dent in rear bumper and one fixable stone nick in windshield. Needs only upgraded interior and new paint to be a true show car. Only options are: power steering, dual mirrors, day-night dash mirror, and special order steering wheel. Everything is original and everything works! Even the radio!

Will help load when your trailer or truck comes to get it in Tiffin, Iowa (right by Iowa City). $1,000 Pay-Pal deposit must be received within 24 hours of sale or car will be relisted. No warranty expressed or implied. Buyer pays ALL shipping costs. Cashier's check or money order or wire transfer must clear BEFORE CAR IS RELEASED. Call with any questions, or to make purchase and pick up arrangements - 319-331-1949 = Tiffin, IA, ask for Mark or Connie.

Chrysler Newport for Sale

1967 chrysler newport 4-door 6.3l

1967 chrysler newport 4-door 6.3l 1968 chrysler newport custom hardtop 2-door mopar big block(US $7,750.00)

1968 chrysler newport custom hardtop 2-door mopar big block(US $7,750.00) 1971 chrysler newport royal 6.3l(US $5,500.00)

1971 chrysler newport royal 6.3l(US $5,500.00) 1962 chrysler newport, 4 door, all original, mopar, classic car, 383 big block

1962 chrysler newport, 4 door, all original, mopar, classic car, 383 big block 1965 chrysler newport base sedan 4-door 6.3l

1965 chrysler newport base sedan 4-door 6.3l 1978 chrysler newport has been in storage four years-private colletor-runs/drive(US $4,999.00)

1978 chrysler newport has been in storage four years-private colletor-runs/drive(US $4,999.00)

Auto Services in Iowa

Woody`s Automotive Upholstery ★★★★★

Shaffer`s Auto Body Co. Inc ★★★★★

Scotty`s Body Shop ★★★★★

Midwest Auto Repair Ctr ★★★★★

Midtown Auto Repair ★★★★★

Magic Mufflers & Brakes ★★★★★

Auto blog

Chrysler recalling nearly half a million vehicles with active head restraints

Thu, 04 Jul 2013Chrysler has announced that it will recall roughly 490,000 vehicles around the globe due to a potential active head-restraint problem. The problem is being blamed on "potentially faulty microcontrollers" that may keep the vehicles' anti-whiplash active safety feature from working properly. Chrysler says it has no knowledge of any accidents or injuries related to the issue. Models covered under the recall include the 2011-2013 Chrysler Sebring, 200 (shown) and Dodge Avenger models, along with 2011-2013 Jeep Liberty and 2011-2012 Dodge Nitro SUVs.

Interestingly, the Pentastar notes that the faulty part came from an (unnamed) supplier who furnished the parts in the wake of Japan's 2011 earthquake and tsunami, natural disasters which decimated the world's supply of microcontrollers.

Chrysler says of those nearly half a million vehicles affected, around 442,000 of them reside in the US, with an additional 25,000 in Canada and 10,000 units in Mexico. A further 12,000 models were shipped beyond the NAFTA region. The Auburn Hills automaker will begin sending out recall notices shortly, and technicians will upgrade the system software or replace the microcontroller as necessary at no cost to owners.

Apple picks up former FCA quality boss Doug Betts

Wed, Jul 22 2015Apple made a significant personnel move that further signals its entry into the automotive world, hiring former Fiat Chrysler executive Doug Betts for an unspecified role. The information was obtained by The Wall Street Journal, which cites Betts' LinkedIn page. His career included stints at Toyota and Nissan before joining Chrysler Group (now FCA US LLC) in 2007, although his time there didn't end well. He left FCA, where he served as the automaker's head of quality, after the company's dismal showing in Consumer Reports' 2014 Annual Auto Reliability Survey. According to Betts' LinkedIn profile, which has since been pulled down, his job title reads "Operations – Apple Inc" in the San Francisco Bay area. Apple, meanwhile, was unwilling to divulge anything to the WSJ, although there's plenty to infer based on the hire. Betts wasn't the only big auto-related hire. According to the WSJ, Cupertino also lured an unnamed but "leading" autonomous vehicle researcher from Europe, who will be part of a team being setup to study driverless systems. Related Video:

FCA workers get raises, health care co-op in new UAW deal

Mon, Sep 21 2015The pending labor agreement between FCA US and the United Auto Workers is now in the hands of union members to confirm. It's expected to be accepted, but a final decision could take weeks, The Detroit News reports. Employees didn't get everything they were hoping for, and contrary to earlier reports, the two-tier wage system remains in place. However, there are attempts to lessen the difference between the levels in this four-year deal. Assuming FCA US workers agree to this offer, the starting pay for tier-two workers would go up around a dollar to $17 an hour. The other level would now begin at $25.35, about a $6 increase, and they would receive 3 percent raises in the first and third year of the deal. Both groups also get $800 in profit sharing for each percent the automaker's profit margin rises above two percent. Extra money kicks in for the second tier above eight percent. Union members get a $3,000 bonus for accepting this contract, as well. The other major change under the pending agreement is the previously rumored switch to a healthcare co-op. The goal is to collect members from the Big Three together to create a huge member base for leverage to negotiate better rates with insurance companies. The UAW is promising no increase in cost to workers, according to The Detroit News. The idea was inspired by the similar structure for the Voluntary Employee Beneficiary Association for union retirees. UAW boss Dennis Williams expects the agreement to be approved. "Once the membership looks at it, hears the explanation for it, I think they'll ratify it," he said, according to The Detroit News. The next step is to craft similar deals with General Motors and Ford. Related Video: