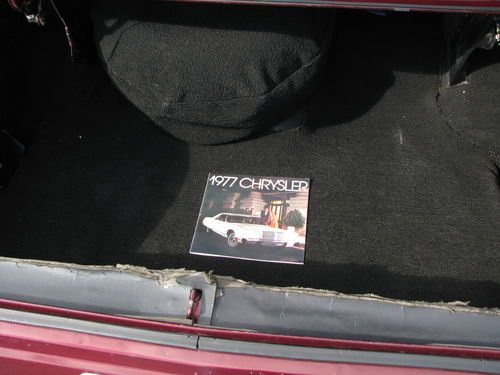

1977 Chrysler New Yorker Brougham on 2040-cars

Stoughton, Wisconsin, United States

Body Type:Sedan

Engine:V8

Vehicle Title:Clear

For Sale By:Private Seller

Interior Color: Burgundy

Make: Chrysler

Number of Cylinders: 8

Model: New Yorker

Trim: BROUGHAM

Warranty: Vehicle does NOT have an existing warranty

Drive Type: AUTOMATIC

Mileage: 44,156

Power Options: Air Conditioning, Power Locks, Power Windows, Power Seats

Exterior Color: Burgundy

CLEAN, LOW MILE CLASSIC.

Chrysler New Yorker for Sale

1962 chrysler new yorker all original paint, interior, drive train mint original(US $13,900.00)

1962 chrysler new yorker all original paint, interior, drive train mint original(US $13,900.00) No reserve auction 51,000 miles new yorker classic mark cross mopar clean

No reserve auction 51,000 miles new yorker classic mark cross mopar clean 1967 chrysler new yorker one owner 31,000 miles no reserve

1967 chrysler new yorker one owner 31,000 miles no reserve 1991 chrysler new yorker fifth avenue sedan 4-door 3.3l(US $3,895.00)

1991 chrysler new yorker fifth avenue sedan 4-door 3.3l(US $3,895.00) 1962 chrysler new yorker sedan low mileage unrestored driver(US $4,500.00)

1962 chrysler new yorker sedan low mileage unrestored driver(US $4,500.00) 1942 chrysler new yorker luxury 2-door coupe 6 passenger - rare

1942 chrysler new yorker luxury 2-door coupe 6 passenger - rare

Auto Services in Wisconsin

Versus Paint & Collision ★★★★★

U S Speed Research ★★★★★

Topel`s Towing & Repair Inc ★★★★★

Tj`s Auto Body ★★★★★

Swant Graber Ford ★★★★★

Sebring Garage ★★★★★

Auto blog

Trump is pleased with FCA's investment in Michigan and Ohio, but it wasn't done for him

Mon, Jan 9 2017Fiat Chrysler announced yesterday that it would be spending $1 billion on vehicle production in both Michigan and Ohio. The company estimates that its investment will yield about 2,000 jobs between both states. In addition to attracting our attention, it caught the gaze of President-elect Donald Trump, who tweeted praise to both FCA and the Ford Motor Company. He praised the latter for the company's move to cancel a new factory in Mexico. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Trump's writing also seems to imply he deserves a certain amount of credit for these shifts to American production. However, as Sergio Marchionne, CEO of FCA, explained to the press in a conference today, Trump and his impending administration had nothing to do with the decision. He said the decision to invest in the plants in Michigan and Ohio were in place well before Trump was going to be the President of the United States. In addition, he said that FCA has not been in contact with Trump or any of his colleagues regarding the decision. Marchionne also stated that neither he nor the company was making any preemptive plans for manufacturing locations the light of the upcoming Trump presidency. Rather, he said that the company will change to address regulations that are actually passed, and the only way the company could change plans ahead of new laws or taxes would be with more information and clarity. We assume that a "big border tax" isn't specific enough. Still, the fact that automakers are going out of their way to make and clarify announcements about manufacturing illustrates the massive attention Trump brings with every Tweet. Related Video: Government/Legal Plants/Manufacturing Detroit Auto Show Chrysler Fiat Sergio Marchionne FCA 2017 Detroit Auto Show

Baby Jeep to join Renegade in FCA's plan for new Italian-built models

Tue, Nov 27 2018FCA is boosting its European production, introducing new models that will be built in currently under-utilized manufacturing facilities. Among the new models is a new small Jeep, smaller than the current Renegade, as Automotive News reports. FCA's Mike Manley mentioned the entry-level Jeep model earlier this year, also saying that the vehicle is targeted to European and possibly Latin American customers; in the summer, Autocar placed the launch date in 2022. The new "baby" Jeep would be made in the same factory in Pomigliano, Italy, as the small Fiat Panda, which is a top seller in Italy. The current generation Panda was introduced in 2011; if it gets a replacement in 2022, it could possibly share a platform with the Jeep model — or, the Jeep could be an eventual outright replacement for the Panda. One of Fiat's earlier core products, the Punto hatchback, was canned in August, and that production capacity will be used to make the Jeep Compass instead, at the Renegade-producing Melfi factory in southern Italy. The Compass has not previously been built in Europe. The Fiat model portfolio would be shrunk to just the 500 model family and the Panda — the 500 would also be FCA's key electric vehicle offered in Europe. It is not yet clear whether the electric 500 would be made in Turin, Italy, or in Poland; Turin might also get a Giardiniera-badged wagon version of the refreshed 500. As for the Alfa Romeo brand, it is set to gain an even bigger SUV model than the Stelvio, based on the Maserati Levante's platform. The Levante's sales have suffered recently in China, but Maserati does have light in the horizon: The Alfieri 2+2 grand tourer is still in the cards, with a launch expected for 2020 and both a convertible and an electrified version planned to follow. The Alfieri would be made in Modena, Italy, according to Automotive News' sources. None of these plans namedrop the storied Lancia brand, which has been shrunk to just the Ypsilon hatchback, based on the same platform as the current 500 and Panda. Despite that, the Ypsilon was again the second-bestselling car in Italy after the Panda in October. It is unlikely that FCA will be able to ignore this, but it is just as unlikely that any development money will be afforded to come up with a replacement for the Ypsilon, which is as similarly old as the Panda. Perhaps official announcements expected on Thursday will also clarify what will happen to Lancia.

Weekly Recap: Chrysler forges ahead with new name, same mission

Sat, Dec 20 2014Chrysler is history. Sort of. The 89-year-old automaker was absorbed into the Fiat Chrysler Automobiles conglomerate that officially launched this fall, and now the local operations will no longer use the Chrysler Group name. Instead, it's FCA US LLC. Catchy, eh? Here's what it means: The sign outside Chrysler's Auburn Hills, MI, headquarters says FCA (which it already did) and obviously, all official documents use the new name, rather than Chrysler. That's about it. The executives, brands and location of the headquarters aren't changing. You'll still be able to buy a Chrysler 200. It's just made by FCA US LLC. This reinforces that FCA is one company going forward – the seventh largest automaker in the world – not a Fiat-Chrysler dual kingdom. While the move is symbolic, it is a conflicting moment for Detroiters, though nothing is really changing. Chrysler has been owned by someone else (Daimler, Cerberus) for the better part of two decades, but it still seemed like it was Chrysler in the traditional sense: A Big 3 automaker in Detroit. Now, it's clearly the US division of a multinational industrial empire; that's good thing for its future stability, but bittersweet nonetheless. Undoubtedly, it's an emotion that's also being felt at Fiat's Turin, Italy, headquarters as the company will no longer officially be called Fiat there. Digest that for a moment. What began in 1899 as the Societa Anonima Fabbrica Italiana di Automobili Torino – or FIAT – is now FCA Italy SpA. In a statement, FCA said the move "is intended to emphasize the fact that all group companies worldwide are part of a single organization." The new names are the latest changes orchestrated by CEO Sergio Marchionne, who continues to makeover FCA as an international automaker that has ties to its heritage – but isn't tied down by it. Everything from the planned spinoff of Ferrari, a new FCA headquarters in London and the pending demise of the Dodge Grand Caravan in 2016 has shown that the company is willing to move quickly, even if it's controversial. While renaming the United States and Italian divisions were the moves most likely to spur controversy, FCA said other regions across the globe will undergo similar name changes this year. Despite the mixed emotions, it's worth noting: The name of the merged company that oversees all of these far-flung units is Fiat Chrysler Automobiles. Obviously the Chrysler corporate name isn't completely history.