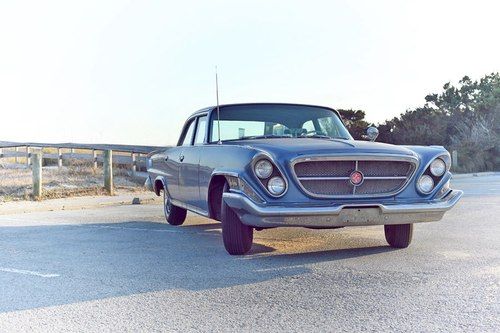

1962 Chrysler New Yorker Sedan Low Mileage Unrestored Driver on 2040-cars

Raleigh, North Carolina, United States

Vehicle Title:Clear

Engine:6.7L 6769CC 413Cu. In. V8 GAS OHV Naturally Aspirated

Fuel Type:GAS

Mileage: 39,342

Make: Chrysler

Number of Cylinders: 8

Model: New Yorker

Trim: Base

Drive Type: U/K

For sale is a 1962 Chrysler New Yorker 4-dr Sedan. The documentation I received with the car outlines 4 previous owners, though I cannot be certain that the documentation is complete. I have owned the car since May of 2011, at which point the odometer read about 33,000 miles. Over the course of my ownership, I have made a few minor repairs/improvements, but mostly just driven and enjoyed the car, which is currently licensed and insured and driven approximately once a week. During my ownership, it has been garage kept.

The engine is the original 413 ci v8 rated at 340 hp and 470 ft-lbs torque. The transmission is the original Torqueflite 727 3-speed, followed by a 2.93:1 rear axle. I have records indicating replacement of the water pump, thermostat, and basic tuneup items. I rebuilt the original Carter AFB 4-barrel carburetor. The engine is strong, with very little blowby, excellent responsiveness, near-silent operation, and 13-mpg average fuel economy. It is so smooth and quiet that it often feels like it has stopped running at traffic lights. Cosmetically, the finish on the engine is in poor condition, but there are no major fluid leaks. I wouldn't hesitate to drive cross-country.

In addition to the carburetor rebuild, I installed a pair of new Eaton Detroit Spring rear leaf springs arched for stock ride height and adjusted the front torsion bars to specification. At purchase, a set of Imperial springs had been installed on the car, which gave incorrect ride height and stiffness. I inspected the brake system and had the dual-diaphragm power booster rebuilt. Braking performance is excellent. Also new are all 4 tires, which I replaced with correct BF Goodrich Silvertown 8.50-14 bias-plys from Coker Tire. The fuel tank was removed and relined with KBS Coatings product.

At some point, the body was given what appears to have been an inexpensive respray. The trim was not removed, but masked off. Prior to my ownership, the car sat outside in full sun for several years, which has faded and oxidized the paint on top of the hood, roof, trunk, and other upward-facing areas. There are a few minor spots of the first signs of corrosion near the chrome and stainless trim on the car. There has been moisture in the trunk, which at some point was brushed with a red paint, but there is no rust through there or anywhere on the body that I have found. The original undercoat still covers the underside of the car. There is minor body damage on the passenger front fender where a close swipe must have pulled the side Chrysler emblem off the fender, leaving a shallow dent and somewhat flattening the stainless trim around the wheel arch. There is a shallow dent under the driver side taillight, and a more noticeable dent in the rear bumper. Otherwise, the body is straight and solid.

The dash pad and upholstery have also suffered from the solar exposure; the pad has some cracks and a sun-burned texture on the top surfaces and the upholstery is faded and the seams have separated as it has become dry and fairly brittle. Needless to say, these items would need to be renewed for the interior to present well. All of the metalwork and paint inside the car are in good condition. The chrome could use polish but should shine up very nicely. The headliner is excellent, as is all glass.

Overall, this car is an unmolested, mostly original example of the '62 New Yorker. It was initially delivered in Schenectady, NY to a lady who clearly seldom drove it. The driver door jamb wears two Texaco stickers from 1978 and 1979, bearing the odometer readings 32422 and 32674, respectively. It currently reads 39342, and knowing its history back to 2003, and given the operational refinement of the chassis and drivetrain, I believe that to be actual mileage. I haven't driven a new '62 New Yorker, but I can't imagine that this car's ride, handling, power, braking, comfort, and refinement have significantly deteriorated. It is a pleasure to drive. I have chosen to sell it in order to focus on another classic project. A modest investment in restoration would yield a like-new car to be enjoyed for years to come. I have a clear NC title in my own name.

I will be happy to show the car and give test drives to interested local parties. If you would like more information or to talk on the phone, please contact me through Ebay.

The buyer will need to make arrangements to come pick up the car in the Raleigh, NC area within 1 week of purchase. I will require a Paypal deposit of $200 within 24 hours of purchase; the remainder can be paid in cash upon collection of the vehicle.

Thanks for your interest!

Chrysler New Yorker for Sale

1942 chrysler new yorker luxury 2-door coupe 6 passenger - rare

1942 chrysler new yorker luxury 2-door coupe 6 passenger - rare 1953 chrysle new yorker v 8 hemi engine fully restored drives and runs 100%

1953 chrysle new yorker v 8 hemi engine fully restored drives and runs 100% 1956 chrysler new yorker base 5.8l - convertible!

1956 chrysler new yorker base 5.8l - convertible! '87 chrysler new yorker 5th ave

'87 chrysler new yorker 5th ave Super clean 93 new yorker 5th ave rust free southern classic very low reserve

Super clean 93 new yorker 5th ave rust free southern classic very low reserve 1948 chrysler new yorker club coupe 8 cly rare restored solid west coast car(US $41,900.00)

1948 chrysler new yorker club coupe 8 cly rare restored solid west coast car(US $41,900.00)

Auto Services in North Carolina

Westside Motors ★★★★★

VIP Car Service ★★★★★

Vann York Toyota Scion ★★★★★

Skip`s Volkswagen Service ★★★★★

Sharky`s Auto Glass ★★★★★

Randy`s Automotive Repair ★★★★★

Auto blog

Federal grand jury issues subpoenas to U.S. FCA dealers

Wed, Jul 27 2016Despite an attempt to clarify and backtrack, it seems the investigation into Fiat Chrysler Automobile's false sales reporting is picking up steam. According to Automotive News, FCA dealers and regional offices have received subpoenas ordering them to supply documents and testimony to a grand jury in Detroit. Of course, the dealers are objecting to the request. They claim the subpoenas are too broad and would require them to hand over too much personal information, like personal phone numbers of dealer employees going back years. The group wants to make it clear that FCA has clarified its sales reporting and that the issue is with the manufacturer, not dealers. The dealers say that FCA employee records and testimony should be enough. It's rumored that a dealer group is the one that sparked the investigation in the first place. FCA confirmed on July 18 that it indeed was under investigation by a number of federal agencies. Although they've clarified their position regarding sales reporting, the fraud investigation continues full steam. Related Video:

Waymo self-driving taxis in Arizona are now carrying paying passengers

Wed, Dec 5 2018CHANDLER, Ariz. — Alphabet's Waymo on Wednesday launched a significant development in its costly, decade-long quest for autonomous transportation: Its self-driving taxis are now actually generating fares. With little fanfare, the company has begun charging passengers to use its driverless vehicles in a roughly 100-mile (160 km) zone in four Phoenix suburbs — Chandler, Tempe, Mesa and Gilbert — where it has been testing its technology since 2016. Producing revenue is a strategic milestone, putting Waymo ahead of U.S. rivals, primarily General Motors' Cruise Automation and Uber Technologies, which have yet to launch their own paid self-driving services. All are racing to win customers and recoup billions spent developing the technology. To use Waymo's service, dubbed Waymo One, riders must download an app and provide a credit card number, similar to ride-sharing services Uber and Lyft. A human driver will be behind the wheel, but only to intervene in case of emergency. Major challenges remain, starting with technical hurdles. A Waymo One taxi tested by Reuters last week proved slow and jerky at times. Whether customers will continue using the service once the novelty wears off remains to be seen. Regulations governing the industry across the country are an incoherent patchwork, a significant hurdle to fast expansion. Waymo would not say exactly how many of its cars would be on the road in Arizona. It said its around-the-clock service initially would be limited to "hundreds" of people invited to sign up last year. For now, pricing is roughly in line with that of Uber and Lyft. A 15-minute, 3-mile (4.8 km) drive taken by Reuters last week cost $7.59, just above the $7.22 offered by Lyft. "Over time, we hope to make Waymo One available to even more members of the public," Chief Executive John Krafcik wrote in a blog on Wednesday. "Self-driving technology is new to many, so we're proceeding carefully." 10 million miles, $1 billion The company has been testing its driverless cars for a decade. Its fleet, now numbering 600 vehicles, has logged more than 10 million miles on public roads in and around 25 U.S. cities. Alphabet does not disclose its total investment, but industry experts put that sum at well over $1 billion. Monetizing driverless technology has been slow going.

Fiat Chrysler and Renault are in advanced partnership talks

Sun, May 26 2019Fiat Chrysler Automobiles and Renault are in advanced discussions about a possible alliance, according to a report from the Financial Times citing an anonymous "person familiar with the matter." The news isn't particularly surprising, as FCA has been a constant subject of merger and alliance talks for as long as many of us can remember. We've reported on a potential tie-up between these two automakers several times, as far back as 2008 and as recently as two months ago. FCA CEO Mike Manley has mentioned the company's openness to merging with another automaker. At the Geneva Motor Show a few months back, he said, "We have a strong independent future, but if there is a partnership, a relationship or a merger which strengthens that future, I will look at that." It's no secret that FCA is much stronger in the United States than it is in Europe. For its part, Renault has basically zero presence in the United States. A partnership or potential alliance between the two could shore up each automaker's weak spots and allow the group to split investment money into new technologies, including electric vehicles and autonomy. Of course, Renault is already tied up with Nissan and Mitsubishi, but that partnership has been a little tattered since the arrest of former Nissan and Renault CEO Carlos Ghosn on charges of financial misconduct in Japan. And in addition to Renault, FCA is understood to have discussed various partnership strategies with the PSA Peugeot Citroen group. What a final agreement – if there's any agreement at all – could look like between the two global automakers remains to be seen, and the report from Financial Times cautions that many different options for FCA and Renault are currently on the table. In other words, stay tuned.