1950 Crysler New Yorker/ Newport Needs To Be Restored on 2040-cars

Newport News, Virginia, United States

Drive Type: auto

Make: Chrysler

Mileage: 67,663

Model: New Yorker

Sub Model: Newport

Trim: Newyorker

Exterior Color: Blue

Interior Color: white,black

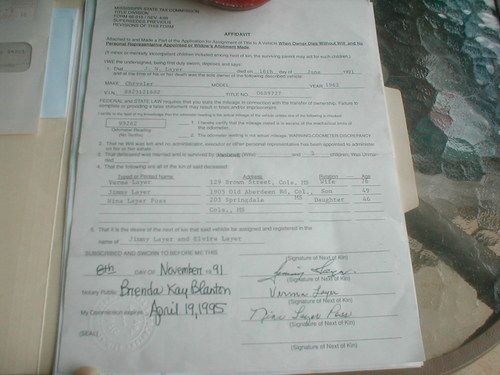

Not sure of running condition. Body , drivetrain ,frame all there. Rust in all usual spots trunk and decklid near perfect. This car needs to be restored I some papers on car as well as shop manual. Will be sold with car.see photos. Thanks

Chrysler New Yorker for Sale

1956 chrysler new yorker st. regis 2dr ht - 331ci hemi v8 - very rare!!

1956 chrysler new yorker st. regis 2dr ht - 331ci hemi v8 - very rare!! No reserve auction! highest bidder wins! check out this beautiful new yorker!!

No reserve auction! highest bidder wins! check out this beautiful new yorker!! 1955 chrysler windsor deluxe runs great 6 volt original classic car low reserve

1955 chrysler windsor deluxe runs great 6 volt original classic car low reserve 1965 chrysler new yorker town & country wagon - they're only original once!

1965 chrysler new yorker town & country wagon - they're only original once! 1992 chrysler new yorker ice cold a/c 3.3 v6 beautiful car dodge plymouth

1992 chrysler new yorker ice cold a/c 3.3 v6 beautiful car dodge plymouth 1962 chrysler new yorker 4 door

1962 chrysler new yorker 4 door

Auto Services in Virginia

Universal Ford Inc ★★★★★

United Solar Window Film and Grphics Corporation Window Tint ★★★★★

Rose Auto Clinic ★★★★★

R&C Towing & Repair Company ★★★★★

Overseas Imports ★★★★★

Olympic Auto Parts ★★★★★

Auto blog

Recharge Wrap-up: Renault-Nissan at COP22, BMW launches Cruise e-Bike

Thu, Oct 6 2016The Renault-Nissan Alliance has been chosen to provide a fleet of electric cars for the UN's COP22 Climate Conference in Marrakesh, Morocco. The group will provide 50 passenger EVs – the Renault Zoe, Nissan Leaf, and Nissan e-NV200 – to shuttle delegates to and from conference venues. The Alliance will also provide more than 20 charging stations to support the shuttle fleet. The group provided electric shuttles for the historic COP21 summit in Paris last year. Read more from Renault-Nissan. FCA, Iveco, and gas grid company Snam have signed an agreement to boost natural gas as a cleaner alternative fuel for Italy. Under the Memorandum of Understanding, FCA and Iveco will work together to develop CNG vehicles, while Snam will invest in CNG supply facilities like filling stations to support a growing fleet. Italy leads Europe in the amount of natural gas consumed for transport, with 1 million vehicles currently on the road. Read more at Green Car Congress. LG Chem has officially announced it will build a battery plant in Poland to the tune of about $340 million. Located near Wroclaw in southwestern Poland, the plant is expected to produce 100,000 batteries a year for 200-mile EVs beginning in 2019. The plant could help Poland in its goal to reduce pollution by introducing a million EVs on its roads by 2025. "We will turn the Poland EV battery plant into a mecca of battery production for electric vehicles around the world," says UB Lee, President of LG Chem's Energy Solution Company. Construction begins in the second half of 2017. Read more from Automotive News Europe. BMW has introduced the Cruise e-Bike. Its Bosch Performance Line electric motor provides electric assistance at speeds of up to 15 mph. The battery can be either be removed or remain on the bike for charging, which takes 3.5 hours for a full charge. "BMW aims to be the leading provider of premium mobility services, and our bicycle collection furthers that mission," says BMW Accessory and Lifestyle Manager Eric Riehle. "As we enter the holiday season, these bikes make the perfect present for those wishing for their first BMW." The BMW Cruise e-Bike costs $3,430. Read more from BMW.

Germany says Fiat Chrysler also cheats on diesel emissions

Thu, Sep 1 2016In May, Germany threatened to ban Fiat Chrysler vehicles because they supposedly had diesel emissions cheat devices. The guilty vehicle at the time was a Fiat 500X. Since then, Italian regulators looked into the issue and said they found no such device. But Germany didn't back down, and filed papers today with the European Commission (EC) and the Italian Transport Ministry saying, again, that there were questionable emissions results in four FCA vehicles. According to Reuters, the Germany's new tests proved there was an, "illegal use of a device to switch off exhaust treatment systems" in the four FCA vehicles. According to Der Spiegel, the four vehicles in the latest batch of offenders are the two new 500Xs, a Fiat Doblo, and a Jeep Renegade. Alexander Dobrindt, Germany's Federal Minister of Transport, noted the vehicles in the letter to the EC, which also said that the EC should communicate with Italian regulators as the next step. Related Video: News Source: Reuters, Der SpiegelImage Credit: GIUSEPPE CACACE/AFP/Getty Images Government/Legal Green Chrysler Fiat Diesel Vehicles vw diesel scandal FCA diesel scandal

Marchionne emailed Barra about merger between FCA and GM

Mon, May 25 2015Sergio Marchionne is adamant that global automakers will have to merge to remain profitable in the near future, and he'll tell that to anyone who's listening. Mary Barra, however, is not interested. According to The New York Times, the Fiat-Chrysler chief proposed a merger with General Motors via email to his counterpart back in March. Marchionne proposed meeting to discuss the matter, but Barra and her team reportedly rejected even entertaining the idea. This of course is not the first time Marchionne has raised the idea of a merger. He masterminded the marriage between Fiat and Chrysler, and reports have since suggested further mergers with Volkswagen, Peugeot, Ford, and others – including GM's own Opel unit. Some have taken his calls for consolidation as a weakness, but Marchionne insists that his empire is in good health – and that it's the industry as a whole which is in an untenable position. According to his view, automakers around the world need to align themselves into larger groups in order to reduce redundancy in investment, development and infrastructure – the duplication of which he terms as wasteful. "It's fundamentally immoral to allow for that waste to continue unchecked," said Marchionne to the Times. "I think it is absolutely clear that the amount of capital waste that's going on in this industry is something that certainly requires remedy," he said in a conference call with industry analysts late last month following the rejected GM approach. "A remedy in our view is through consolidation." News Source: The New York TimesImage Credit: Paul Sancya/AP Chrysler Fiat GM Sergio Marchionne merger fiat chrysler automobiles