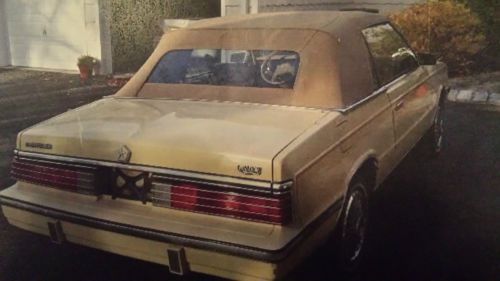

1985 Chrysler Lebaron on 2040-cars

Elizabeth, New Jersey, United States

|

A True Jem.

|

Chrysler LeBaron for Sale

1988 chrysler lebaron premium convertible 2-door 2.2l

1988 chrysler lebaron premium convertible 2-door 2.2l 1986 chrysler lebaron base convertible 2-door 2.2l(US $2,500.00)

1986 chrysler lebaron base convertible 2-door 2.2l(US $2,500.00) 1993 chrysler lebaron le sedan 53k low miles automatic 6 cylinder no reserve

1993 chrysler lebaron le sedan 53k low miles automatic 6 cylinder no reserve 1985 chrysler lebaron convertible complete resto super clean!!! new everything

1985 chrysler lebaron convertible complete resto super clean!!! new everything 1982 chrysler lebaron medallion mark cross edition convertible low mileage k car

1982 chrysler lebaron medallion mark cross edition convertible low mileage k car Chrysler tc convertible by masterati. 1989 turbocharged 41,182 miles. very nice

Chrysler tc convertible by masterati. 1989 turbocharged 41,182 miles. very nice

Auto Services in New Jersey

Vitos Auto Electric ★★★★★

Town Auto Body ★★★★★

Tony`s Auto Svc ★★★★★

Stan`s Garage ★★★★★

Sam`s Window Tinting ★★★★★

Rdn Automotive Repair ★★★★★

Auto blog

Weekly Recap: Lincoln Continental serves up the style, Cadillac CT6 delivers the substance in New York

Sat, Apr 4 2015Lincoln and Cadillac grabbed the spotlight this week at the New York Auto Show in a dramatic fashion that evoked the brands' glory days. America's two luxury carmakers went toe-to-toe with their glittering reveals and plans for ambitious expansion. Both were selling their technology, style and the promise of a better future. Cadillac vs. Lincoln. At the Javits Center, 2015 seemed a lot like 1956. Neither company was interested in drawing comparisons with the other, which is fair, and accurate. They're in vastly different places in terms of sales and the pace of their turnarounds, but they hope to reach the same eventual destination at the pinnacle of the luxury-car world. Lincoln used the element of surprise to great effect with the Continental concept. A production version is still at least a year away, and the company was vague on details. Officially, we don't even know if it is front- or rear-wheel drive, though speculation abounds. Who cares? The seats can be adjusted 30 ways! The Continental also showed off a bold chrome grille that will be the new face of Lincoln. The blue bomber also rolled on blinged-out 21-inch polished aluminum wheels, used a 3.0-liter EcoBoost engine and had huge LED head lights with "laser-assisted" high beams. All of this resulted in almost blinding attention. The concept drew rave reviews, stirred controversy with Bentley designers who argued Lincoln ripped them off, and most importantly, pointed a way forward for the newly determined brand that hopes to compete with Mercedes, BMW, Audi, Cadillac and Lexus. View 32 Photos Meanwhile, Cadillac showed the CT6, a finished product that will top its range and is loaded with the best and latest technologies General Motors has at its disposal. With production starting late this year, Cadillac had more specifics at the ready. Engines? Cadillac has a couple V6s and a turbo four for sure. It's working on a hybrid, and has considered a V-Series variant. It's based on a new rear-wheel-drive, aluminum-intensive chassis called Omega, features an advanced collision-mitigation system with automatic braking and has a cabin that's laden with "leathers, exotic woods and carbon fiber." It will be assembled at GM's Detroit-Hamtramck factory and goes on sale next year. At this point, Cadillac is more than willing to talk about every except for the price. The devil was not in the details for Cadillac, as evidenced by the CT6. But it wasn't for Lincoln either.

Fiat Chrysler open to mergers, and PSA is looking for one

Fri, Mar 8 2019GENEVA — Fiat Chrysler (FCA) is open to pursuing alliances and merger opportunities if they make sense, but a sale of its luxury brand Maserati is not an option, Chief Executive Mike Manley said on Tuesday. "We have a strong independent future, but if there is a partnership, a relationship or a merger which strengthens that future, I will look at that," Manley told reporters at the Geneva Motor Show. Asked whether he would consider selling Maserati to China's Geely Automobile Holdings, as suggested by recent media reports, Manley said: "Maserati is one of our really beautiful brands and it has an incredibly bright future. ... No." FCA is often cited as a possible merger candidate. Bloomberg said this week that the Italian-American carmaker was attractive to France's PSA Group given its exposure to the U.S. market and its popular Jeep brand. The Detroit News' headline on the situation Friday read, "Fiat Chrysler CEO open to a deal as PSA circles" and stated that Manley's open-to-just-about-anything comments were aimed directly at PSA. Bloomberg said talks between the two were preliminary and said PSA chief Carlos Tavares has also contemplated mergers with General Motors or Jaguar Land Rover, which is losing money for Indian owner Tata. PSA has enjoyed a decade of turnaround and has $10.2 billion in net cash available. The maker of Peugeot, Citroen and DS, acquired Opel and Vauxhall in 2017 and made them almost instantly profitable. Manley, who took over after the death of Sergio Marchionne, said he currently had no news on possible deals. Manley also said the world's seventh-largest carmaker, which is lagging rivals in developing hybrid and electric vehicles, would take the least costly approach to comply with increasingly more stringent European emissions regulations. "There are three options. You can sell enough electrified vehicles to balance your fleet. Two: You can be part of a pooling scheme. Three is to pay the fines," he said. "I don't see a scenario when (carmakers) continue to subsidize technologies ... indefinitely." The carmaker had said last June it would invest 9 billion euros ($10.19 billion) over the next five years to introduce hybrid and electric cars across all regions to be fully compliant with emissions regulations. Asked about a 5-billion-euro investment plan for Italy FCA announced in November but then put under review, Manley said the plan had been confirmed as originally presented.

Toyota Land Cruiser, GMC Sierra and the long-term fleet | Autoblog Podcast #558

Mon, Oct 22 2018On this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Consumer Editor Jeremy Korzeniewski. They talk about driving a pair of short-term test cars, the Toyota Land Cruiser and GMC Sierra AT4, as well as two of Autoblog's long-term test cars, the 2018 Kia Stinger GT and 2018 Chrysler Pacifica Hybrid. Following the test fleet talk is a discussion of a new program from Lyft and the Chinese-market Ford Territory. And of course everything is wrapped up with yet another Spend My Money segment in which we Autoblog editors help a reader choose a car to buy.Autoblog Podcast #558 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Short-term cars: Toyota Land Cruiser and GMC Sierra AT4 Long-term cars: Kia Stinger GT and Chrysler Pacifica Hybrid Lyft subscription program Ford Territory Spend My Money Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video: Podcasts Chrysler GMC Kia Toyota toyota land cruiser chrysler pacifica chrysler pacifica hybrid kia stinger gt