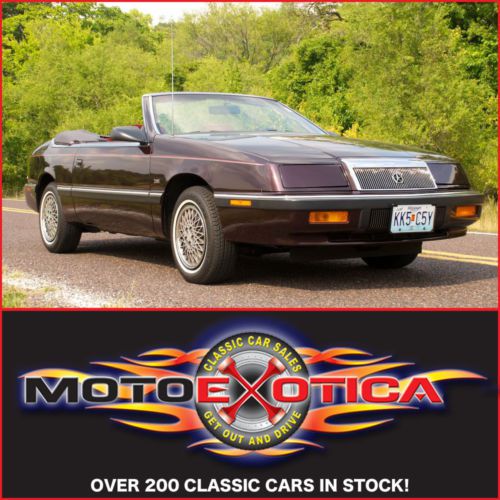

1985 Chrysler Lebaron on 2040-cars

5427 S Campbell Ave, Springfield, Missouri, United States

Engine:2.2L I4 8V SOHC

Transmission:Automatic

VIN (Vehicle Identification Number): 1C3BC55D1FG115025

Stock Num: 5025

Make: Chrysler

Model: LeBaron

Year: 1985

Exterior Color: Cayenne Red

Interior Color: Red

Drive Type: FWD

Number of Doors: 2 Doors

Mileage: 45493

ONE OF A KIND WITH ACTUAL MILES, A/C CONVERTED TO NEW SPEC'S ALREADY, BRAKES REDONE AND READY FOR FUN

Chrysler LeBaron for Sale

1993 chrysler lebaron landau(US $4,999.00)

1993 chrysler lebaron landau(US $4,999.00) 1993 chrysler lebaron base convertible 2-door 3.0l - 98,500 miles - wonderful

1993 chrysler lebaron base convertible 2-door 3.0l - 98,500 miles - wonderful Pristine 1990 chrysler lebaron convt! super low original miles! 3.0l v6 auto

Pristine 1990 chrysler lebaron convt! super low original miles! 3.0l v6 auto 1989 chrysler lebaron base coupe 2-door 2.2l clean & very low mileage! lqqk(US $3,200.00)

1989 chrysler lebaron base coupe 2-door 2.2l clean & very low mileage! lqqk(US $3,200.00) 1993 chrysler lebaron base convertible 2-door 3.0l(US $995.00)

1993 chrysler lebaron base convertible 2-door 3.0l(US $995.00) Convertible, low miles, good on gas, clean,sharp,vert

Convertible, low miles, good on gas, clean,sharp,vert

Auto Services in Missouri

Yocum Automotive ★★★★★

Wright Automotive ★★★★★

Winchester Cleaners ★★★★★

Taylor`s Auto Salvage ★★★★★

STS Car Care & Towing ★★★★★

Stepney`s Towing ★★★★★

Auto blog

Former Chrysler dealers could reopen under appeals court ruling

Thu, Jan 22 2015Years after the bankruptcies and subsequent bailouts of Chrysler (now FCA) and General Motors, the automotive industry is still seeing legal decisions about them come through the courts. The latest ruling from a US appeals court has given 4 of the 789 dealers that Chrysler closed in its Chapter 11 process one less hurdle towards reopening. Following the bankruptcy, 105 of the shuttered dealers went through an arbitration process in hopes of reopening, and 32 won their arguments. However, a victory in that undertaking didn't necessarily mean that the stores could reestablish themselves. For these three showrooms in Michigan and one in Las Vegas, state laws allowed nearby competitors from the same automaker to stand in the way of restarting, according to Automotive News. This problem brought yet another lawsuit, and a US district court found that the arbitration decisions did not overrule state laws. The latest appeals court ruling overturned that decision. However, as with many legal proceedings, the process for reopening for these dealers still isn't exactly easy. The latest decision only covers the nearby dealers' ability to protest; it doesn't mandate FCA actually to open the stores again. According to a statement from Michael Palese of FCA legal communications to Automotive News, the ruling, "did not provide for reinstatement of the dealers who prevailed in arbitration, but only gave them a right to a 'customary and usual' letter of intent." It means for these showrooms to start selling again, now they need to work things out with Chrysler's new owner.

Detroit's new emergency city manager worked on Chrysler bankruptcy [w/video]

Fri, 15 Mar 2013

Kevyn Orr, the new emergency city manager of Detroit, has a history with one of Michigan's most famous residents: Chrysler. Governor Rick Snyder (at right) appointed Orr to the position yesterday with the belief that Detroit needs outside assistance to right the city's mounting financial woes. Orr (at left), a partner with the Jones Day law firm, will begin work on March 25 and receive $275,000 a year for his work. While state officials believe the new city manager will be able to complete his duties in 18 months, the contract is technically open-ended.

The 54-year-old attorney helped steer Chrysler through its 2009 bankruptcy, earning $700 per hour for his efforts. He was also instrumental in convincing the courts to allow Chrysler to shutter 789 dealerships in a single month. Orr says he's aware that his efforts won't have made him any friends in Southern Michigan.

Chrysler Voyager minivan goes fleet-only for 2022

Thu, Oct 7 2021Private motorists will not be able to buy a new Chrysler Voyager in the 2022 model year; the minivan is now a fleet-only model. The cheaper alternative to the Pacifica loses most of its trim levels, but it gains a longer list of standard features during the transition. Fleet buyers take on many shapes and forms, but in minivan-speak the term usually denotes rental car companies. Chrysler simplified buying by paring down the lineup from three to one trim. Called LX, it gains a 7.0-inch touchscreen that runs the Uconnect 5 infotainment system, second-row Stow 'n Go seats, power-operated sliding doors, heated front seats, and a heated steering wheel; that's not bad for something you're picking up at the airport to spend a weekend in. There's also a new air filtration system shared with the Pacifica. Related: Least expensive vehicles to insure in America The list of options now includes a package called Safety and Premium Group that bundles a blind-spot monitoring system, rear parking sensors, rear cross-path detection, full-speed forward collision warning, automatic emergency braking, and a 10.1-inch touchscreen with navigation. However, upmarket features like leather upholstery and a 19-speaker Harman-Kardon surround-sound system are not offered. Chrysler is not making mechanical changes, so power for the Voyager comes from a 3.6-liter Pentastar V6 rated at 287 horsepower and 262 pound-feet of torque. It spins the front wheels via a nine-speed automatic transmission. All-wheel drive is not available; only the Pacifica can get its power sent to four wheels. Similarly, there are no visual changes to report. The Voyager still looks like a pre-facelift Pacifica. Pricing information for the 2022 Voyager will be announced closer to its on-sale date. At launch, buyers will have five colors called Silver Mist, Brilliant Black, Bright White, Granite Crystal, and Velvet Red, respectively. The former (shown in the gallery) is new for 2022. Related video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. How to use the Stow 'N Go seats on the 2021 Chrysler Pacifica