1984 Chrysler Lebaron Base Convertible 2-door 2.2l on 2040-cars

Salt Lake City, Utah, United States

Fuel Type:GAS

Engine:2.2L 135Cu. In. l4 GAS SOHC Turbocharged

Vehicle Title:Clear

Number of Cylinders: 4

Make: Chrysler

Model: LeBaron

Trim: Base Convertible 2-Door

Mileage: 12,000

Drive Type: FWD

Chrysler LeBaron for Sale

1991 chrysler lebaron gtc convertible 2-door 3.0l

1991 chrysler lebaron gtc convertible 2-door 3.0l 1992 chrysler lebaron lx convertible 3.0l v6 cold air, low miles, excellent(US $2,995.00)

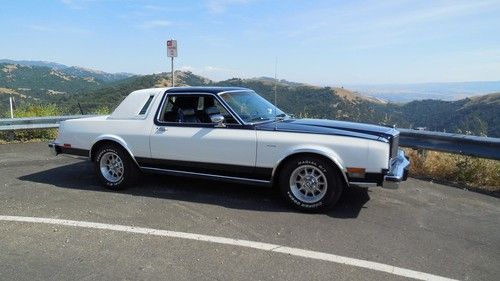

1992 chrysler lebaron lx convertible 3.0l v6 cold air, low miles, excellent(US $2,995.00) 1980 chrysler lebaron medallion coupe 2-door 5.2l

1980 chrysler lebaron medallion coupe 2-door 5.2l 1989 maserati tc convertible rare plum turbo super nice actual miles no reserve

1989 maserati tc convertible rare plum turbo super nice actual miles no reserve 1986 chrysler lebaron base convertible 2-door 2.2l low miles nice

1986 chrysler lebaron base convertible 2-door 2.2l low miles nice 1983 chrysler lebaron convertible mark cross(US $4,500.00)

1983 chrysler lebaron convertible mark cross(US $4,500.00)

Auto Services in Utah

Toyota & Lexus Repair Speclsts ★★★★★

Rand`s Auto Sales ★★★★★

No Crack Glass & Mirror ★★★★★

Montella`s Repair ★★★★★

Labrum Chevrolet Buick Inc. ★★★★★

Labrum Chevrolet Buick Inc. ★★★★★

Auto blog

Chrysler banks $507 million in Q2, trims 2013 earnings forecast

Tue, 30 Jul 2013Chrysler has some good news and some bad news. First, profits were up 16 percent over the second quarter of 2012, bringing the Auburn Hills, Michigan-based manufacturer $507 million on the back of strong demand for trucks and SUVs (a recurring theme this quarter, particularly in the US). Q2 revenue was up as well, from $16.8 billion in 2012 to $18 billion in 2013. The bad news is that the Pentastar's overall earnings forecast for net income in 2013 has been trimmed from $2.2 billion to between $1.7 and $2.2 billion, according to Automotive News.

In addition to the adjusted net income forecast, Chrysler tweaked its operating profit from $3.8 billion to between $3.3 and $3.8 billion. This has gone largely unexplained by Chrysler, perhaps hoping the news of a three-percent increase in its transaction prices for Q2 will allow it to sweep this adjustment under the rug.

The star of the show for Chrysler has been its US sales, which saw a 10-percent jump, both bettering the industry average of eight percent and improving over the same stretch of 2012. As with the increase in transaction prices, Chrysler has the new Ram pickup and Jeep Grand Cherokee to thank. Perhaps most worrying from this report, though, is that every brand in the automaker's stable saw an increase in sales... except for the Chrysler brand itself.

2018 Chrysler Pacifica Hybrid Long-Term Update | Nokian winter tires in a winter wonderland

Wed, Mar 27 2019Winter is technically over now, but the cold and snow are maintaining their grip here in Michigan. While much of the country is bouncing right along into a warm spring, we're happy to still be wearing our Nokian Hakkapeliitta winter tires on our long-term Chrysler Pacifica Hybrid. You can't count out another massive blizzard even into late April here. That said, we're hoping the worst is over, so it's time to take stock of how the winter tires performed on the front-wheel-drive minivan. Nokian produced the first winter tire ever in 1934, so one could say that they've had awhile to figure this out. The tire model we were provided for our van is the Hakkapeliitta R3 SUV. The Pacifica is obviously no SUV, but at almost 5,000 pounds it's perfect for this flavor of tire. Nokian says they're designed for high performance SUVs and are made with Aramid sidewalls to resist punctures or cuts. Chrysler fits the Pacifica Hybrid with all-season tires from the factory, but we were determined to make it a proper seven passenger sleigh. We got a fair amount of snow this year in Michigan, but I encountered the worst conditions on a road trip to Buffalo, N.Y. I was actually sort of hoping a lake-effect blizzard might present itself as a challenge, and my snow prayers were answered with authority. Inches of snow don't usually pile up on highways here easily with the amount of plows and salt typically employed, but it did in this storm. The Pacifica hardly flinched from the deep tracks of powder on the road. Near-whiteout conditions forced slow driving, but the Pacifica never felt like it was going to slip and slide out of its lane as I tracked around highway bends with increasing speed. Braking was impressive, as the tires managed to find grip in the snow that all-season tires just can't match. Thankfully, I never needed 100 percent lock in any emergency situations, but I tried it out in some empty parking lots to see how well it does at hauling everything to a stop. The Nokians performed admirably here, too. With ABS firing away, the winter rubber finds grip in places all-seasons would just slide on by. Starting wasn't much of an issue, either. We tested the tires in anything from dustings to snow that was about six inches deep and largely untouched by other vehicles. The front tires would scrabble for grip initially with greater throttle inputs in the deep stuff, but they'd hook and pull the van forward with authority after a quick second.

Chrysler recalls 2013 Ram pickups, 2014 Jeep Grand Cherokee

Wed, 17 Jul 2013Chrysler's spate of successful products is about to be marred by a trio of recalls. The Pentastar is recalling 51,477 Ram trucks and Jeep SUVs. According to the National Highway Traffic Safety Administration, there have been no reported accidents, injuries or deaths related to the affected vehicles.

The largest action covers the Ram 1500, which is seeing 45,961 trucks being recalled. Models built between June 26, 2012 and February 5, 2013 are being recalled due to a potential software issue in the electronic stability control. Apparently, the system can be randomly deactivated upon vehicle startup.

Chrysler is also recalling 4,458 2014 Jeep Grand Cherokee models. Covering everything but the SRT models, the potentially defective SUVs were built between January 14 and March 20, 2013. This recall focuses on "premium headlights," which means cars equipped with LED running lights. During the switch from the bright daytime running lamp setting to the low-intensity parking light setting, an electrical spike can cause one of the Jeep's computers to go into a safe mode, turning off the LEDs. This violates Federal Motor Vehicle Safety Standards.