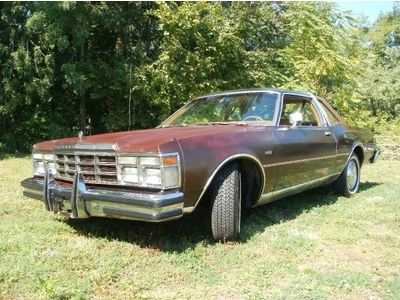

Chrysler LeBaron for Sale

Collectors spectacular 1986 chysler lebaron turbo only 18k original miles mint

Collectors spectacular 1986 chysler lebaron turbo only 18k original miles mint

Beautiful in and out! runs excellent! check out this awesome convertible! look!!

Beautiful in and out! runs excellent! check out this awesome convertible! look!! Town & country coupe 2 door rare low miles (like park fifth ave ) no reserve

Town & country coupe 2 door rare low miles (like park fifth ave ) no reserve 1992 chrysler lebaron base convertible 2-door 3.0l(US $3,500.00)

1992 chrysler lebaron base convertible 2-door 3.0l(US $3,500.00) 1987 chrysler lebaron town and country 2.2l turbo station wagon, 85k

1987 chrysler lebaron town and country 2.2l turbo station wagon, 85k

Auto blog

Ram helps power Chrysler to 11% gain in May

Mon, 03 Jun 2013Increasing consumer demand for Ram pickup trucks and big SUVs has helped to boost May sales for Chrysler. Ram sales were up a total of 24 percent year-over-year for the month of May. In addition, Dodge sales increased by 23 percent in May, with the standout Durango clocking a 24-percent year-over-year improvement (with an updated 2014 model in the wings, incentives are thick on the ground for 2013 inventory). Fiat and Jeep were up only a modest one percent, however, and Chrysler brand sales were down by two percent against last year's figures.

Chrysler is quite pleased overall with brand performance, saying that this May marks the company's strongest in the past six years. It was also the 38th consecutive month showing year-over-year sales gains.

Eight of the automaker's vehicles set sales records for May, as well: Jeep Wrangler and Compass, Dodge Avenger and Challenger, Fiat 500, Chrysler 200 and Ram pickups. Scroll down to read more detail in Chrysler's press release.

Chrysler slows minivan production, hasn't built VW Routan this year

Wed, 13 Mar 2013Chrysler has slowed production of its Town and Country and Dodge Grand Caravan minivans this week, Automotive News reports. The Windsor, Ontario plant will cut its three shifts from eight hours each to four hours each in an effort "to align production with market demand," a Chrysler spokesperson told AN. Chrysler also builds the closely related Routan minivan for Volkswagen at its Ontario facility, but has not built a single example thus far in 2013.

Sales of Chrysler's minivans fell 15 percent for the first two months of 2013, and a large part of that has to do with the 26-percent drop of the Grand Caravan alone (the T&C was only down by one percent). According to Automotive News data, as of March 1, Chrysler had an unsold inventory of 24,713 Town and Country models and 18,547 Grand Caravans - a 69- and 43-day supply, respectively.

"No sense running full speed now, then have a lot of vehicles sitting around a few months down the line," Chrysler spokeswoman Jodi Tinson told AN. Full production is expected to resume again on March 18.

Are you the 2015 Chrysler 300?

Tue, 16 Sep 2014When Chrysler showed us its hand and revealed its five-year product plan to the world, we learned that the updated 300 sedan will bow at the LA Auto Show in November. Now, thanks to Allpar, we might have our first (super grainy) look at the new sedan a full two months ahead of its official debut.

Unlike its Dodge Charger platform mate, the new 300 isn't really all that different from the model currently on sale. That said, we're not sure if the changes shown here really reflect styling that we'd call "better," with the company's logo sort of floating at the top of the grille, and a more simplistic front end that lets the schnoz stick out a bit. Again, nothing drastic to talk about, but the new tweaks are kind of weak. Of course, we'll wait until we see the finished product in the metal before we make up our minds.

Don't expect things to change too much in terms of interior refinement or powertrain offerings, as well, with all the same leather and technology we've enjoyed in the 300 before, and the usual 3.6-liter Pentastar V6 and 5.7-liter Hemi V8 powertrain options. We'll know for sure when the car shows its freshened face in Los Angeles in November.