1932 Chrysler Imperial Imaculate Blue Antique Classic Collector Car New Old Used on 2040-cars

Winchester, Virginia, United States

Vehicle Title:Clear

Engine:straight 8

Fuel Type:Gasoline

For Sale By:Private Seller

Number of Cylinders: 8

Make: Chrysler

Model: Imperial

Warranty: Vehicle does NOT have an existing warranty

Trim: chrome

Drive Type: standard

Mileage: 26,000

Number of Doors: 4

Exterior Color: Blue

Chrysler Imperial for Sale

Auto Services in Virginia

Wilson`s Auto Repair ★★★★★

Wicomico Auto Body ★★★★★

Valley Collision Repair Inc ★★★★★

Toyota of Stafford ★★★★★

Tire City New & Used tires & Affordable Auto Repair ★★★★★

The Brake Squad - Mobile Brake Repair Service ★★★★★

Auto blog

Zombie cars: 9 discontinued vehicles that aren't dead yet

Thu, Jan 6 2022Car models come and go, but as revealed by monthly sales data, once a car is discontinued, it doesn't just disappear instantly. And in the case of some models, vanishing into obscurity can be a slow, tedious process. That's the case with the 12 cars we have here. All of them have been discontinued, but car companies keep racking up "new" sales with them. There are actually more discontinued cars that are still registering new sales than what we decided to include here. We kept this list to the oldest or otherwise most interesting vehicles still being sold as new, including a supercar. We'll run the list in alphabetical order, starting with *drumroll* ... BMW 6 Series: 55 total sales BMW quietly removed the 6 Series from the U.S. market during the 2019 model year. It had been available in three configurations, a hardtop coupe, a convertible and a sleek four-door coupe-like shape. Â BMW i8: 18 total sales We've always had a soft spot for the BMW i8, despite the fact that it never quite fit into a particular category. It was sporty, but nowhere near as fast as similarly-priced competitors. It looked very high-tech and boasted a unique carbon fiber chassis design and a plug-in hybrid powertrain, but wasn't really designed for maximum efficiency or maximum performance. Still, the in-betweener was very cool to look at and drive, and 18 buyers took one home over the course of 2021. Â Chevy Impala: 750 total sales The Impala represented classic American tastes at a time when American tastes were shifting away from soft-riding sedans with big interior room and trunk space and into higher-riding crossovers. A total of 750 sales were inked last year. Â Chrysler 200: 15 total sales The Chrysler 200 was actually a pretty nice sedan, with good looks and decent driving dynamics let down by a lack of roominess, particularly in the back seat. Of course, as we said regarding the Chevy Impala, the number of Americans in the market for sedans is rapidly winding down, and other automakers are following Chrysler's footsteps in canceling their slow-selling four-doors. Even if Chrysler never really found its footing in the ultra-competitive midsize sedan segment, apparently dealerships have a few leftover 2017 200s floating around. And for some reason, 15 buyers decided to sign the dotted line to take one of these aging sedans home last year.

FCA recalls Fiat 500e to fix cruise control

Thu, Jun 11 2015Fiat is recalling almost 4,000 of its 500e electric vehicles because of a malfunction related to the model's cruise-control feature. The glitch causes the car's powertrain to be put into neutral under certain situations. It's the second recall on the 500e this year. Specifically, Chrysler-Fiat is recalling 3,975 cars. The issue is that the car's system can misread the motor's torque figures in cruise control, causing the sprightly EV to mistakenly shift into neutral in what was designed as a safety-precaution measure. The good news is that restarting the vehicle gets the car back to normal, but being dropped into neutral in highway mode is certainly no fun. Chrysler-Fiat said in a statement this week that it was "unaware" of injuries, accidents, or customer complaints caused by the issue. In April, the 500e was subject to a recall that impacted about 5,600 vehicles and stemmed from a March 2015 update. The update allowed the car to go into so-called "Limp Home Mode" to better extend range. The problem is that it inadvertently caused the car to stall. Range anxiety, indeed. Take a look at Chrysler-Fiat's press release on the most recent recall below. Related Video: Statement: Software Upgrade June 9, 2015 , Auburn Hills, Mich. - FCA US LLC is voluntarily recalling an estimated 3,975 cars to upgrade cruise-control software. A review of warranty data led to an investigation by FCA US LLC engineers. The investigation discovered certain Fiat 500e hatchbacks were inadvertently equipped with software that may misread torque levels generated by their motors, causing them to shift into neutral – a prescribed failsafe mode. This condition may occur only while cruise-control is engaged and the driver attempts to override the feature with accelerator-pedal applications or rapid tapping of the accelerate/decelerate buttons. Restarting the vehicle restores normal function. The campaign is limited to certain model-year 2013-2015 vehicles. The Company is unaware of any related injuries, accidents or customer complaints. New software will be available when affected customers are advised of this action by FCA US. Service instructions are being sent to FCA US dealers today. Customers with questions may call the FCA US Customer Information Center at 1-800-853-1403.

Google-FCA deal is a coup for both sides

Fri, May 6 2016FCA made a savvy play this week to team with internet giant Google. It's not as sexy as partnering with Apple, but it's almost as good. This move positions FCA to expand its capabilities in the autonomous driving field, and connecting with Google could boost the automaker's image. FCA will provide Google with about 100 Chrysler Pacifica hybrid minivans specially developed for autonomous testing. Google will integrate its sensors and computers into the vehicles. They'll work together at a site in Southeast Michigan and test the prototypes on Google's private test track in California. It's looks like an equitable deal and a win for both sides. "This marks a watershed event for the auto industry on two major levels: contract manufacturing for high tech firms and allowing such firms a clear pathway into the brain of the car," Morgan Stanley researchers said in a note. Don't underestimate how big this is for Google. The deal more than doubles the size of the tech firm's fleet, and does so with the Pacifica, a potentially segment-defining entry. Currently, it's using Lexus vehicles and other modified prototypes as testers. Though FCA is the smallest of Detroit's carmakers, it's also viewed as nimble and willing to embrace change. The Jeep and Ram divisions are as strong as any brand in the industry, and the Hellcats and Viper reinforce FCA's enthusiast cred. Google doesn't need those things, but they're pretty cool associations, nonetheless. If Ferrari can try to position itself as a leather goods maker, Google can have a little octane in its system. While experts expect Google to eventually partner with other automakers or to license its technology (FCA chief Sergio Marchionne reportedly said the deal isn't exclusive), FCA is positioned to get a head start. IHS Automotive predicts there will be 10.5 million self-driving or driverless cars used around the world by 2030. General Motors, Mercedes, Tesla, Volvo, Ford, and others have launched or are planning to roll out their own versions of autonomous driving technology. For now, FCA goes from having no apparent autonomous plans to potentially being among the leaders, and Google secures a legitimate automotive partner. Like we said, it looks like a win-win. NEWS & ANALYSIS News: Sergio Marchionne is taking over the CEO job at Ferrari. Analysis: This is a consolidation of Marchionne's power over the famous Italian sports-car maker and racing team.

1953 chrysler custom imperial four door sedan

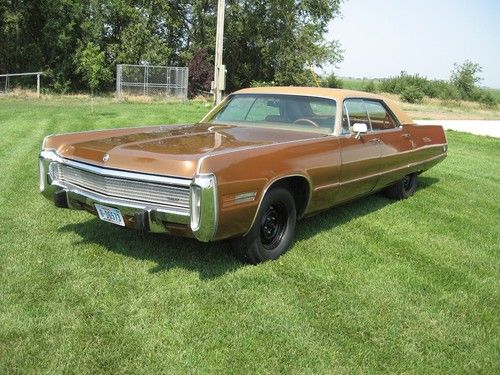

1953 chrysler custom imperial four door sedan 1973 chrysler imperial 4dr hardtop 440-4 bbl car

1973 chrysler imperial 4dr hardtop 440-4 bbl car 1963 chrysler crown imperial southamptom hardtop sedan

1963 chrysler crown imperial southamptom hardtop sedan Chrysler imperial crown convertible 1959

Chrysler imperial crown convertible 1959 1957 chrysler imperial sedan - hemi powered! great driver!

1957 chrysler imperial sedan - hemi powered! great driver!