No Reserve 2005 Chrysler Crossfire Srt6 Convertible Navi Absolute Sale Repo! on 2040-cars

Bloomfield, New Jersey, United States

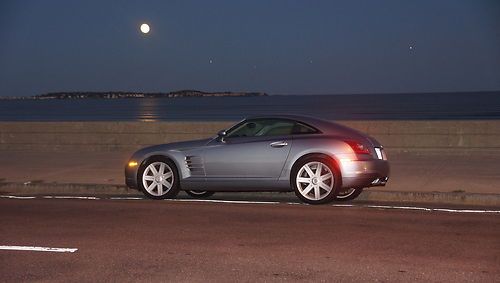

Chrysler Crossfire for Sale

2004 chrysler crossfire limited low price!(US $7,700.00)

2004 chrysler crossfire limited low price!(US $7,700.00) 2004 chrysler crossfire coupe red

2004 chrysler crossfire coupe red Super charged

Super charged 2007 chrysler crossfire base coupe 2-door 3.2l(US $10,900.00)

2007 chrysler crossfire base coupe 2-door 3.2l(US $10,900.00) 2005 chrysler crossfire base convertible 2-door 3.2l(US $9,000.00)

2005 chrysler crossfire base convertible 2-door 3.2l(US $9,000.00) No reserve! clean sporty coupe rare southern no rust! just serviced nice & fun!

No reserve! clean sporty coupe rare southern no rust! just serviced nice & fun!

Auto Services in New Jersey

Woodland Auto Body ★★★★★

Westchester Subaru ★★★★★

Wayne Auto Mall Hyundai ★★★★★

Two Guys Autoplex 2 ★★★★★

Toyota Universe ★★★★★

Total Automotive, Inc. ★★★★★

Auto blog

France tries to dodge blame for blowing up FCA-Renault merger deal

Thu, Jun 6 2019PARIS — France sought to fend off a hail of criticism on Thursday after it was blamed for scuppering a $35 billion-plus merger between carmakers Fiat-Chrysler and Renault only 10 days after it was officially announced. Shares in Italian-American FCA and France's Renault fell sharply in early trading after FCA pulled out of talks, saying "the political conditions in France do not currently exist for such a combination to proceed successfully." French finance minister Bruno Le Maire said the government, which has a 15% stake in Renault, had engaged constructively, but had not been prepared to back a deal without the endorsement of Renault's current alliance partner Nissan. Nissan had said it would abstain at a Renault board meeting to vote on the merger proposal. However, a source close to FCA played down the significance of Nissan's stance in the discussions, believing French President Emmanuel Macron was looking for a way out of the deal after coming under pressure at home. Context The FCA-Renault talks were conducted against the backdrop of a French public outcry over 1,044 layoffs at a General Electric factory. The U.S. company had promised to safeguard jobs there when it acquired France's Alstom in 2015. The collapse of the deal, which would have created the world's third-biggest carmaker behind Japan's Toyota and Germany's Volkswagen, revives questions about how both FCA and Renault will meet the challenges of costly investments in electric and self-driving cars on their own. The merger had aimed to achieve 5 billion euros ($5.6 billion) in annual synergies, with FCA gaining access to Renault's and Nissan's superior electric drive technology and the French firm getting a share of FCA's lucrative Jeep and Ram brands. FCA has long been looking for a merger partner, and some analysts say its search for a deal is becoming more urgent as it is ill-prepared for tougher new regulations on emissions. It previously held unsuccessful talks with Peugeot maker PSA Group, in which the French state also owns a stake. French budget minister Gerald Darmanin said the door should not be closed on the possibility of a deal with Renault, adding Paris would be happy to re-examine any new proposal from FCA. "Talks could resume at some time in the future," he told FranceInfo radio.

FCA earnings improve in first quarter

Thu, Apr 30 2015Following on the recent global financial releases from Ford and from General Motors for the first quarter of 2015, FCA is now putting out its own numbers, and things look quite good for the company. The automaker posted adjusted earnings before taxes and interest of $895 million, a 22-percent jump from Q1 2014, and net profits of $103 million, a $296-million boost from last year. Revenue was also up 19 percent to $30 billion. Despite the favorable figures, actual worldwide shipments fell slightly by 2 percent to 1.1 million vehicles. FCA is giving some credit for these strong Q1 results to the automaker's performance in the NAFTA region. Shipments grew 8 percent to 633,000 vehicles, and net revenue jumped a strong 38 percent to $18.1 billion. Adjusted earnings reached $672 million, compared to $425 million in 2014. The company especially praised the Jeep Renegade, Chrysler 200, and Ram 1500 for helping the bottom line. The numbers could have been even higher, but the corporation admitted that "higher warranty and recall costs" partially drug things down. For the full year in 2015, FCA expects to ship between 4.8 and 5 million vehicles worldwide and post up to $5 billion in adjusted earnings. There should be about $1.3 billion in net profit, as well. FCA CLOSED Q1 WITH NET REVENUES OF ˆ26.4 BILLION, UP 19% AND ADJUSTED EBIT AT ˆ800 MILLION, UP 22% 30/04/15 FCA closed Q1 with net revenues of ˆ26.4 billion, up 19% and adjusted EBIT at ˆ800 million, up 22%. Net industrial debt was ˆ8.6 billion, up ˆ0.9 billion. Full year guidance confirmed. Worldwide shipments were 1.1 million units, 2% lower than Q1 2014, reflecting strong performance in NAFTA and weak market conditions in LATAM. Jeep's positive performance continued with worldwide shipments up 11% and sales up 22%. Net revenues were up 19% to ˆ26.4 billion (+4% at constant exchange rates, or CER). Adjusted EBIT was ˆ800 million, up ˆ145 million from Q1 2014, with all segments except LATAM posting positive results. The positive impact of foreign exchange translation was offset by negative impacts at a transactional level. Net profit was ˆ92 million, up ˆ265 million compared to the net loss of ˆ173 million in Q1 2014. Net industrial debt was ˆ8.6 billion, up ˆ0.9 billion from year-end mainly due to timing of capital expenditures and working capital seasonality. Liquidity remained strong at ˆ25.2 billion. The Group confirms its full-year guidance.

May 2016: FCA wins, Ford and GM stumble on weak car volumes

Wed, Jun 1 2016The May 2016 sales numbers are in, and it looks as though FCA is getting some vindication for boldly cancelling two slow-selling car models. Meanwhile, Ford saw overall sales dip and GM's May volume took a big dive versus the same month in 2015. While Marchionne's decision to axe the Chrysler 200 and Dodge Dart has drawn criticism as being short-sighted, it's working for FCA so far. Although the Dart and 200 aren't out of production yet and no capacity has been shifted to crossover or trucks, May's numbers show that the emphasis on Jeep and Ram models makes sense right now. FCA's US sales rose 1 percent last month compared to May 2015, putting the year-to-date total at 955,186 vehicles, an increase of 6 percent compared to the same period last year. Standouts included the Jeep Renegade, Compass, and Patriot, and the Fiat 500X. Ram pickup sales were down 3 percent. And your fun fact is that Alfa Romeo sales were up precisely 10 percent, for a total of 44 4Cs sold versus 40 in the same month last year. At FoMoCo, the Ford brand took a hit to the tune of 6.4 percent from May 2015 to 2016, registering 226,190 sales last month. Lincoln showed improvement on its modest numbers, going from 9,174 to 9,807, a 6.9 percent increase. Overall, Ford was down 5.9 percent for the month to 235,997; despite the slump, year-to-date total Ford sales are up 4.2 percent to 1,112,939. Strong sellers included Escape, Expedition, F-Series, and Transit - big stuff. Most small and/or efficient models (Fiesta, Focus, Fusion, C-Max) saw sales slides. Fusion sales were also down, likely due to effects of model changeover to the freshened 2017 model. Ford has promised four new crossovers and SUVs by 2020 and if things keep trending this way the company will be able to sell them, but things could change in the next four years. GM saw the worst of it for domestic brands. Retail and fleet sales were down for each of the four divisions, with the May 2016 total dropping 18 percent to 240,450 vehicles. GM's year-to-date sales are down 5.0 percent in 2016 to 1,183,705. Both the Sierra and Silverado were down significantly, and the majority of Chevy, Buick, GMC, and Cadillac nameplates saw sales decreases, with both small cars and larger utilities included. Not even big stuff could help GM this month, it seems. We'll have more on the rest of the industry's May sales as those figures trickle in.