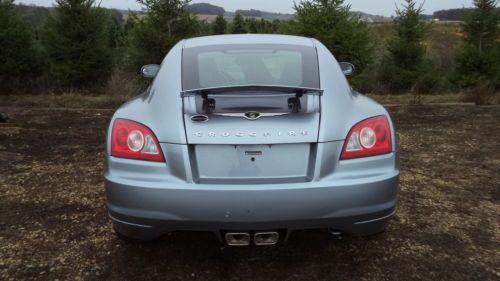

2005 Chrysler Crossfire Limited Coupe 2-door 3.2l No Reserve on 2040-cars

Eleva, Wisconsin, United States

|

Previously Salvage,was inspected.Was a flood car, however I needed the parts to finish my Crossfire Roadster, Can be repaired but would make a great parts car.RUNS GOOD.Car is also listed locally and I reserve the right to end listing early if sold locally. maybe able to help with delivery with in 150 miles

|

Chrysler Crossfire for Sale

2004 chrysler crossfire coupe 2-door(US $11,500.00)

2004 chrysler crossfire coupe 2-door(US $11,500.00) 2dr roadster convertible 3.2l 4-wheel abs 4-wheel disc brakes 6-speed m/t a/c

2dr roadster convertible 3.2l 4-wheel abs 4-wheel disc brakes 6-speed m/t a/c No reserve! clean sporty coupe rare southern no rust! just serviced nice & fun!

No reserve! clean sporty coupe rare southern no rust! just serviced nice & fun! 2004 chrysler crossfire

2004 chrysler crossfire 2008 crysler crossfire coupe 30k miles cd/gps nav 3.2l v6 excellent condition

2008 crysler crossfire coupe 30k miles cd/gps nav 3.2l v6 excellent condition 3.2l v6 rare 6-speed low miles clean leather heated seats clean power spoiler

3.2l v6 rare 6-speed low miles clean leather heated seats clean power spoiler

Auto Services in Wisconsin

Welk`s Automotive Service ★★★★★

Waukegan Gurnee Glass Company ★★★★★

Vern`s Body Shop ★★★★★

Tire Warehouse ★★★★★

The Real C&M Automotive & Truck Repair ★★★★★

Steve`s Body Shop ★★★★★

Auto blog

DoJ fines Japanese parts firms $740M in massive automotive price-fixing scandal

Fri, 27 Sep 2013Nine Japanese suppliers have pleaded guilty in US court over charges of price fixing in the automotive parts industry, resulting in the Department of Justice doling out a total of $740 million of fines, according to a report from Bloomberg. The scandal, which has resulted in General Motors, Ford, Toyota and Chrysler spending up to $5 billion on inflated parts and driving up prices on 25 million vehicles has sent the DoJ hustling into investigations. "The conduct this investigation uncovered involved more than a dozen separate conspiracies aimed at the U.S. economy," Attorney General Eric Holder (pictured above) said during yesterday's press conference.

As the investigation stands, the DoJ has issued $1.6 billion in fines against 20 companies and 21 individual executives, with 17 of the execs headed to prison. Deputy Assistant Attorney General Scott Hammond said, "The breadth of the conspiracies brought to light today are as egregious as they are pervasive. They involve more than a dozen separate conspiracies operating independently but all sharing in common that they targeted US automotive manufacturers."

Big-name suppliers indicted in the investigation include Mitsubishi Electric, Mitsubishi Heavy Industries, Hitachi Automotive and Mitsuba Corporation. A list of fines and other corporations named in the investigation is available at Bloomberg.

FCA fibbed on sales according to internal report

Mon, Jul 25 2016Following last week's news that Fiat Chrysler Automobiles (FCA) is under investigation by the Department of Justice and Securities and Exchange Commission for allegedly fudging sales figures, a new report in Automotive News says an internal investigation at FCA uncovered misreported sales. According to the AN story, 5,000 to 6,000 vehicles from various FCA brands were reported sold by dealers, but no customers existed for those cars. FCA sales chief Reid Bigland has already put a stop to the practice. One potential reason for the practice was to maintain the company's month-to-month sales increase streak, currently at 75 months. In April, FCA added a lengthy disclaimer to its sales announcements: "FCA US reported vehicle sales represent sales of its vehicles to retail and fleet customers, as well as limited deliveries of vehicles to its officers, directors, employees and retirees. Sales from dealers to customers are reported to FCA US by dealers as sales are made on an ongoing basis through a new vehicle delivery reporting system that then compiles the reported data as of the end of each month. "Sales through dealers do not necessarily correspond to reported revenues, which are based on the sale and delivery of vehicles to the dealers. In certain limited circumstances where sales are made directly by FCA US, such sales are reported through its management reporting system." FCA did not provide comment to Automotive News. Click through for the full story and more details. Related Video: Earnings/Financials Government/Legal Chrysler Dodge Fiat Jeep RAM sales Sergio Marchionne FCA USDOJ reid bigland

Interested, then not: Marchionne not 'chasing' a VW merger

Tue, Mar 14 2017Update (March 15, 2017) : Automotive News reports that FCA CEO Sergio Marchionne, regarding the suggested VW and FCA merger, said in a press conference "I have no interest." He also said that he "will not call Matthias," the CEO of VW. He did add that he would be willing to entertain anything VW brings up, but he has "no intention of chasing him." Despite this, Marchionne still took a moment to reinforce his favorable stance concerning mergers and consolidation. Last week, Volkswagen's CEO Matthias Mueller effectively shut down Fiat Chrysler CEO Sergio Marchionne's idea of the two automakers merging. However, it seems Mueller has softened, if only just, to the idea. According to Reuters, the CEO said in a press conference he is "not ruling out a conversation." However, he did say that he would like Marchionne to discuss with him directly the possibility rather than to the media. Though this statement certainly doesn't mean such a merger is happening, it's far more open than when he said outright the company isn't in any talks with anyone at the moment. His new stance also indicates that there may be people (lawyers, accountants, etc.) behind the scenes working out possible ways a merger could work. And even though this new development makes the prospect of a merger between the two companies a bit less bleak, it's still a long way from the "will they, won't they" relationship between GM and FCA. FCA's pursuit of GM involved emailing CEO Mary Barra and the threats of a hostile takeover, the latter of which resulted in some awkward statements about hugs. Only time will tell if VW becomes open enough for Marchionne to talk about hugs again. Related Video: