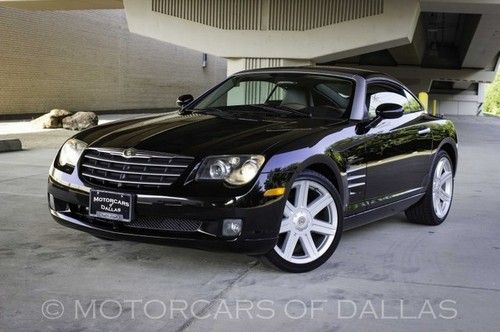

2004 Chrysler Crossfire Limited Coupe 2-door 3.2l Sapphire Blue 6 Spd Low Miles! on 2040-cars

Jupiter, Florida, United States

Vehicle Title:Clear

Engine:3.2L 3200CC 195Cu. In. V6 GAS SOHC Naturally Aspirated

Fuel Type:GAS

For Sale By:Private Seller

Transmission:Manual

Make: Chrysler

Model: Crossfire

Options: Heated Seats, Factory Premium Sound, Staggered Wheels, Non-Factory Option Wheels, 6-Speaker Sound System, Telescoping Wheel, Leather Seats, CD Player

Trim: Limited Coupe 2-Door

Safety Features: Stability Control, Brake Assist System, 4 Disc Brakes, Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Power Options: Heated Seats, Power Steering, Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Drive Type: Rear Wheel Drive

Mileage: 81,018

Exterior Color: Silver Sapphire Blue Metallic

Disability Equipped: No

Interior Color: Gray

Warranty: Vehicle does NOT have an existing warranty

Number of Cylinders: 6

Number of Doors: 2

Chrysler Crossfire for Sale

2007 chrysler crossfire limited manual heated seats homelink active spoiler

2007 chrysler crossfire limited manual heated seats homelink active spoiler 2004 chrysler crossfire base coupe 2-door 3.2l(US $15,000.00)

2004 chrysler crossfire base coupe 2-door 3.2l(US $15,000.00)

3.2l v6 rare 6-speed low miles

3.2l v6 rare 6-speed low miles 2005 chrysler crossfire coupe, low miles, fun and sporty !!!(US $12,900.00)

2005 chrysler crossfire coupe, low miles, fun and sporty !!!(US $12,900.00) 2005 chrysler crossfire limited roadster convertible 2-door 3.2l

2005 chrysler crossfire limited roadster convertible 2-door 3.2l

Auto Services in Florida

Zephyrhills Auto Repair ★★★★★

Yimmy`s Body Shop & Auto Repair ★★★★★

WRD Auto Tints ★★★★★

Wray`s Auto Service Inc ★★★★★

Wheaton`s Service Center ★★★★★

Waltronics Auto Care ★★★★★

Auto blog

Chrysler called out over lackluster Ram Runner by racer who helped develop it

Fri, 11 Apr 2014Fans of off-roading and desert blasting might recall that Chrysler offers an aftermarket conversion that can turn a Ram 1500 into a road-legal desert racer, called the Ram Runner. The kit, sold through Mopar, includes some significant suspension upgrades, body tweaks and a brawnier cat-back exhaust for the truck's 5.7-liter V8.

Considering all of this, comparisons with the almighty Ford F-150 SVT Raptor are common. Among the off-road community, that makes these two a sort of Chevrolet Camaro and Ford Mustang for people that prefer driving on dirt. In the Race-Dezert forum, the discussion as to which truck was better was proceeding as normal - Ram fans said their piece and Ford fans said theirs. Then, a man named Kent Kroeker offered up his two cents.

See, Kroeker is a Baja racer, and the man that helped develop the Ram Runner. Despite his association with the truck, though, he had some less than kind words for Chrysler and the Ram Runner.

Pontiac Aztek enjoys rebirth thanks to Millennials

Fri, Sep 11 2015Apparently, Millennials – those between 18 and 34 – aren't afraid to look different on the road, and they like performance, too. A new study by Edmunds is discovering some surprising vehicle choices by this group. Among them, the long-derided Pontiac Aztek is getting a new day in the sun with 25.5 percent its buyers coming from this generation in the first half of 2015. For comparison, Millennials represent an average of 16.8 percent of used car purchases. The Aztek is slowly shaking its reputation as a styling abomination, which seems tied to its appearance on Breaking Bad. The show premiered in 2008, and the Pontiac has been on this list for four of the past five years, according to Edmunds. It even led the pack in 2010. A recent Retro Review from MotorWeek also showed that the crossover wasn't always so hated. While it's still a shock to see the Aztek on any popularity list, the awkward-looking crossover only ranks sixth among Millennials. The vehicle with the biggest portion of buyers from the generation is the Dodge Magnum with 27.6 percent. According to Edmunds, the bluntly styled wagon is especially popular in Detroit and Chicago. The Chrysler Pacifica comes in a close second at 27.3 percent. When it comes to used cars, value and utility appear to trump just about anything else for many Millennial buyers," Edmunds analyst Jeremy Acevedo said in the report. Young buyers aren't afraid of sporty rides, either. The Subaru WRX has 26.4 percent Millennial buyers to rank third place on the list, and the Volkswagen R32 takes fifth at 25.7 percent. Just a few points lower in seventh place is the Nissan GT-R at 25.4 percent, and the final performance machine in 10th place is the Lexus IS-F with 24.7 percent. Related Video:

NHTSA looking into non-Takata airbag shrapnel case

Tue, Jul 14 2015The global airbag inflator recall from Takata has been one of the biggest topics in auto safety for months. Now, the National Highway Traffic Safety Administration is opening a preliminary evaluation into the components from Arc Automotive to investigate whether two reported ruptures and two injuries signal a wider problem. So far, only the 2002 Chrysler Town & Country and 2004 Kia Optima are believed to be affected. If a safety campaign is deemed necessary, it could cover an estimated 420,000 of the minivans and 70,000 of the Korean sedans. NHTSA first noticed these ruptures in December 2014. The agency received a complaint of a 2009 case in Ohio about the bursting of the driver's side inflator in a 2002 Town & Country. According to the report, the incident broke the woman's jaw and sent shrapnel into her chest. The government investigated the case, and this was found to be the only known occurrence in these vehicles. The analysis indicated the part's gases were possibly blocked somehow and caused the component to explode. FCA US spokesperson Eric Mayne told Autoblog that the company is "cooperating fully" with NHTSA. "Also, we no longer use that inflator," he said. A second incident came to NHTSA's attention in June 2015 with the driver's side rupture in a 2004 Optima in New Mexico. The agency lists fewer details about the case, and a root cause isn't known. This is also the only currently known example in a Kia vehicle. According to a statement from Kia to Autoblog, "We are taking this matter very seriously and support NHTSA's action and will continue working cooperatively with the agency and suppliers throughout the process." Arc's components are sealed within a steel housing that's meant to protect them from "external atmospheric conditions," according to NHTSA. Multiple suppliers also use them. In the Chrysler, the airbag module came from Key Safety Systems and from Delphi in the Kia. In a statement to Autoblog the company said, "We have received NHTSA's notification and are cooperating fully with its Preliminary Evaluation." At this time, NHTSA admits that it doesn't know for certain whether these two cases are linked. The agency is conducting this preliminary evaluation to learn more.