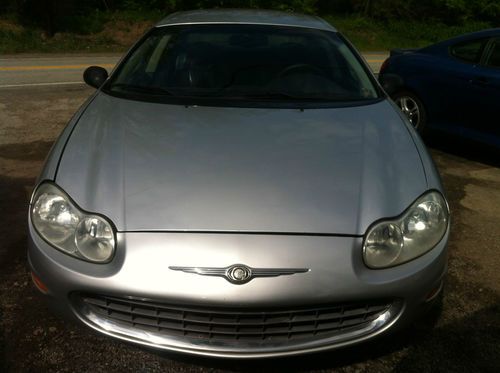

2004 Silver Chrysler Concorde Lxi Sedan 4-door 3.5l Great Condition Sc Or Va on 2040-cars

Conway, South Carolina, United States

Engine:3.5L 3497CC 215Cu. In. V6 GAS SOHC Naturally Aspirated

Vehicle Title:Clear

Body Type:Sedan

Fuel Type:GAS

For Sale By:Private Seller

Sub Model: LXi

Make: Chrysler

Exterior Color: Silver

Model: Concorde

Interior Color: Black

Trim: LXi Sedan 4-Door

Drive Type: FWD

Options: Sunroof, Cassette Player, 4-Wheel Drive, Leather Seats, CD Player

Number of Cylinders: 6

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Mileage: 119,740

Up for sale is a 2004 Chrysler Concorde. It was mostly driven in Southern California and South Carolina and has just under 120,000 miles as of 6/1/13. The car is in great condition with very nice black leather seats with no rips or tears at all in the interior of the car. It also has a brand new aftermarket JVC deck fully equipped with iPhone/iPod playback and charging capability as well as a CD player AUX Input and AM/FM radio. Myrtle Beach, SC and Richmond, VA are two areas where the car can be purchased as well as any states within relative distance (NC). Please feel free to e-mail me any questions.

Chrysler Concorde for Sale

2001 chrysler concorde with no reserve

2001 chrysler concorde with no reserve 2004 chrysler concorde lx sedan 4-door 2.7l(US $3,995.00)

2004 chrysler concorde lx sedan 4-door 2.7l(US $3,995.00) 2001 chrysler concorde lxi sedan 4-door 3.2l **no reserve**

2001 chrysler concorde lxi sedan 4-door 3.2l **no reserve** 2002 chrysler concorde ! no reserve ! no resevre !

2002 chrysler concorde ! no reserve ! no resevre ! 2000 chrysler concorde lxi sedan 4-door 3.2l(US $1,600.00)

2000 chrysler concorde lxi sedan 4-door 3.2l(US $1,600.00) 1999 chrysler concorde lxi auto v6 low miles 71k! clean! no reserve!!

1999 chrysler concorde lxi auto v6 low miles 71k! clean! no reserve!!

Auto Services in South Carolina

Wingard Towing Service ★★★★★

Sumter Tire Plus LLC ★★★★★

Stepp`s Garage & Towing ★★★★★

Stateline Auto Brokers ★★★★★

Patterson`s Towing & Recovery ★★★★★

Parish Automotive ★★★★★

Auto blog

SRT belatedly claims Plymouth Prowler as one of its own

Wed, 19 Dec 2012Before Chrysler had Street and Racing Technology, it had Performance Vehicle Operations. What the two entities have in common, before SRT became its own brand, of course, is that each was created to take Chrysler and Dodge (and Plymouth, before it was unceremoniously killed off) vehicles to the next level of style and performance.

We'll leave the question of whether or not the old Plymouth (and later Chrysler) Prowler was ultimately a stylish, performance-oriented car to you, but the boys and girls currently leading the SRT charge at the Pentastar headquarters are keen to accept the retro-rod into the fold.

According to the automaker, all of SRT's current high-performance models owe a debt of gratitude to the old Prowler, due mostly to that car's use of lightweight bits and pieces and innovative construction techniques. If nothing else, the fact that the Prowler's frame is "the largest machined automotive part in history" is pretty cool. Read all the details here.

Watch these Super Bowl car commercials [UPDATE]

Sat, Feb 2 2019On Sunday, February 3, the New England Patriots take on the Los Angeles Rams in Super Bowl 53 at Mercedes-Benz Stadium in Atlanta, Georgia. Some will watch because of the storyline of the old-school dynasty facing off against the new-school wunderkinds, but a large chunk of people will solely be watching for the commercials. Lucky for those who slot into the latter category, many of the manufacturers release their super bowl ads ahead of time, or have simply opted to release the commercials only online. Scroll down to see what car companies have already shown their cards. Audi Audi goes the comedic route in its clip for the Big Game. It starts with a grandpa showing his grandson a gorgeous Audi e-tron GT tucked away in a garage before he's shaken awake. Turns out he was just choking on a cashew in his cubicle at his boring job. Dodge Dodge does what it knows: create enough smoke to punch more holes in the ozone layer. Set to "The Devil Went Down to Georgia (the Super Bowl is in Atlanta, get it!?), a Challenger SRT Hellcat widebody, Charger SRT Hellcat, and Durango SRT are seen ripping through a city, leaving a trail of rubber crumbs in their wakes. Genesis Genesis has not yet released a commercial prior to the Super Bowl, but it is the official luxury vehicle of the NFL. Because of this, Genesis is hosting a fan experience for 10 days before the game. It will showcase the brand's cars, offer games, and have photos opportunities and autograph days. Hyundai Jason Bateman alert! Hyundai is one of the few companies to hook a major celebrity for its advertisement, and the casting is perfect. Bateman plays a doorman who takes people to various terrible events in life, including root canals, the middle seat, and shopping for a car. The ad centers around Hyundai's Shopper Assurance, which is Hyundai's new method for car shopping. Jeep An old 1963 Jeep Gladiator finds its strength in the crusher and transforms into a a new 2020 Gladiator, with a firm declaration that the nameplate is officially back. Kia Through Kia's commercial, a young boy wonders out loud what it'd be like if the millions spent on Super Bowl commercials were used to help others.

Chrysler appoints new heads of Alfa Romeo and Ram

Mon, 18 Aug 2014Chrysler has announced to two key appointments to its senior leadership, both of them taking immediate effect. First up is Reid Bigland, who has been named head of the Alfa Romeo brand for North America. Bigland has served until now as head of the Ram Truck brand, a portfolio he now hands over to Robert Hegbloom, who had served until now as its director.

As a result of the appointments, both Bigland and Hegbloom will take up seats on Chrysler's NAFTA Leadership Team, and Bigland will also join the Fiat Chrysler Group Executive Council - the highest decision-making body in the Fiat Chrysler Automobiles empire.

As per Sergio Marchionne's leadership style, Bigland will continue to serve in two major capacities, maintaining his role as president and CEO of Chrysler Canada. Other senior executives who hold multiple key portfolios include Harald Wester (who serves as the group's Chief Technology Officer and also overseas Alfa Romeo, Maserati and Abarth), Olivier Francois (group Chief Marketing Officer and head of the Fiat brand) and Michael Manley (head of the Asia-Pacific region and the Jeep brand).