2010 Chrysler Town And Country Wheelchair, Mobility, Handicap Wheelchair Van on 2040-cars

Wichita, Kansas, United States

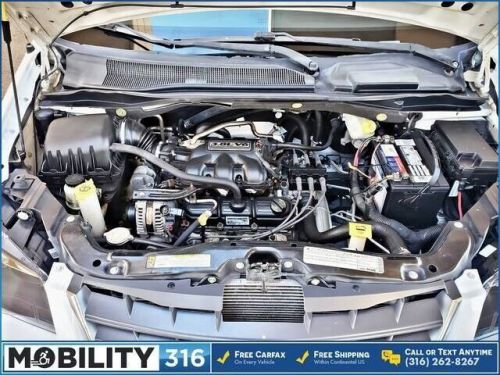

Engine:3.8L V6

Fuel Type:Gasoline

Body Type:Mini-van, Passenger

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 2A4RR5D14AR352206

Mileage: 61852

Make: Chrysler

Model: Town and Country

Trim: Wheelchair, Mobility, Handicap Wheelchair Van

Drive Type: 4dr Wgn Touring

Number of Cylinders: 3.8L V6

Features: 3.8L OHV SMPI V6 ENGINE

Power Options: --

Exterior Color: White

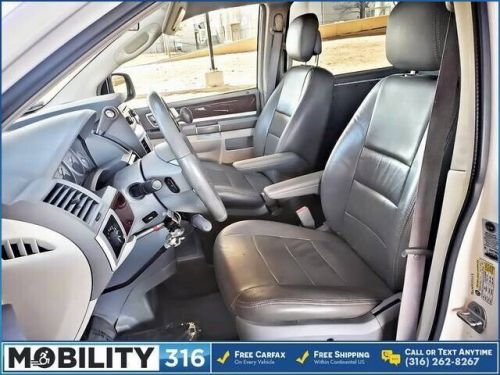

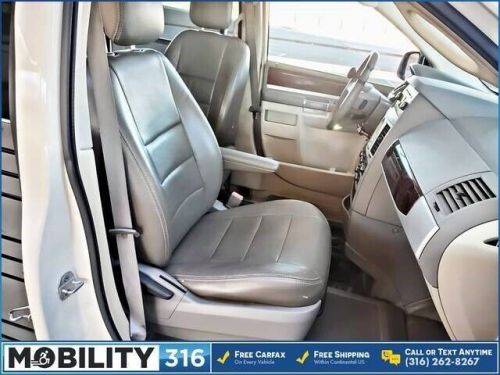

Interior Color: Gray

Warranty: Unspecified

Disability Equipped: Yes

Chrysler Town and Country for Sale

2010 chrysler town and country wheelchair, mobility, handicap wheelchair van(US $19,995.00)

2010 chrysler town and country wheelchair, mobility, handicap wheelchair van(US $19,995.00) 2015 chrysler town and country limited platinum 4dr mini van(US $152.50)

2015 chrysler town and country limited platinum 4dr mini van(US $152.50) 2016 chrysler town and country touring 4dr mini van(US $100.00)

2016 chrysler town and country touring 4dr mini van(US $100.00) 2015 chrysler town and country touring 4dr mini van(US $100.00)

2015 chrysler town and country touring 4dr mini van(US $100.00) 2007 chrysler town and country limited handicap wheelchair side entry(US $13,900.00)

2007 chrysler town and country limited handicap wheelchair side entry(US $13,900.00)

Auto Services in Kansas

Wininger Towing ★★★★★

The Shop ★★★★★

The Auto Clinic ★★★★★

Talley`s Collision Repair Service ★★★★★

Smith Specialty Automotive ★★★★★

Rusty`s Auto Sales ★★★★★

Auto blog

FCA shifts Ram Heavy Duty trucks from Mexico to U.S., creating 2,500 jobs

Fri, Jan 12 2018DETROIT — Fiat Chrysler Automobiles said on Thursday it will shift production of Ram Heavy Duty pickup trucks from Mexico to Michigan in 2020, a move that lowers the risk to the automaker's profit should President Donald Trump pull the United States out of the North American Free Trade Agreement. Fiat Chrysler said it would create 2,500 jobs at a factory in Warren, Michigan, near Detroit, where the Ram 1500 is currently built, and FCA will invest $1 billion in the facility. The Mexican plant will be "repurposed to produce future commercial vehicles" for sale global markets. Mexico has free trade agreements with numerous countries. Fiat Chrysler Chief Executive Sergio Marchionne a year ago raised the possibility that the automaker would move production of its heavy-duty pickups to the United States, saying U.S. tax and trade policy would influence the decision.If the United States exits NAFTA, it could mean that automakers would pay a 25 percent duty on pickup trucks assembled in Mexico and shipped to the United States. About 90 percent of the Ram pickups made at Fiat Chrysler's Saltillo plant in Mexico are sold in the United States or Canada, company officials said. Negotiators for the United States, Mexico and Canada are scheduled to meet later this month for another round of talks on revising NAFTA. Canadian government officials earlier this week said they are convinced that Trump intends to announce his intention to quit the agreement. Trump has threatened to force the rollback of NAFTA, which enables the free flow of goods made in the United States, Canada and Mexico across the borders of those countries. He also has criticized automakers for moving jobs and investment in new manufacturing facilities to Mexico and prodded them to add more auto production in the United States. View 31 Photos On Wednesday, Toyota and Mazda announced they would build a new $1.6 billion auto assembly plant in Alabama, drawing praise from Trump. Vice President Mike Pence praised Fiat Chrysler's announcement. "Manufacturing is back. Great announcement. Proof that this admin's AMERICA FIRST policies are WORKING!" Pence said in a Twitter posting. Chrysler raised its output in Mexico by 39 percent in 2017 to 639,000 vehicles, according to Mexican government data. That made Fiat Chrysler the third-largest producer of vehicles in Mexico in 2017, after Nissan and General Motors.

Total auto recalls already on record pace in 2014

Tue, 08 Apr 2014If you've noticed that there have been more recalls than usual this year, you may be on to something. According to a report from the National Highway Traffic Safety Administration, the US market is on pace to break a record for recalls. In 2013, 22 million cars were recalled. We're only a third of the way through 2014, though, and we've already halved that figure, with 11 million units recalled. That's wild.

Considering the past few months, it shouldn't be a surprise that General Motors is leading the charge, with six million of the 11 million units recalled coming from one of the General's four brands. Between truck recalls, CUV recalls and the ignition switch recall, 2014 hasn't been a great year for GM.

Other recall leaders include Nissan (one million Sentra and Altima sedans), Honda (900,000 Odyssey minivans), Toyota (over one million units in a few recalls), Volkswagen (150,000 Passat sedans), Chrysler (644,000 Dodge Durango and Jeep Grand Cherokee SUVs) and most recently, Ford (434,000 units, the bulk of which were early Ford Escape CUVs). So while it's been a bad year for GM so far, its competitors aren't doing too well, either.

Ferrari borrows $2.6 billion to finance FCA spinoff

Tue, Dec 1 2015Ferrari announced Monday that it is borrowing about $2.6 billion to finance its spinoff from Fiat Chrysler Automobiles. Here's how it breaks down: Ferrari NV, the automaker's parent company based in the Netherlands, is taking out loans totaling 2.5 billion euros. That's equivalent to $2.64 billion at current exchange rates, and is divided between a term loan of $2.12 billion and a revolving credit facility of $529 million. The larger term loan "will be used to refinance indebtedness owing to Fiat Chrysler Automobiles," among other purposes. That ought to constitute the lion's share of the $2.38 billion which the Prancing Horse marque was, according to reports last year, slated to pay its current parent company in order to help FCA fund its ambitious growth plans. The separate line of credit is earmarked "to be used from time to time for general corporate and working capital purposes of the Ferrari group." Though Ferrari is not expected to take any other Fiat Chrysler properties with it, the "group" in this case would include its various financial services and distribution arms around the world that may have been separately incorporated. As noted in the statement below, the financial arrangement "represents a further step towards the separation of Ferrari from the FCA Group," following the separate stock issues from both companies as independent from each other. FERRARI N.V. SIGNS ˆ2.5 BILLION SYNDICATED CREDIT FACILITY Ferrari N.V. (NYSE: RACE) ("Ferrari") announced today that it has entered into a ˆ2.5 billion syndicated loan facility with a group of ten bookrunner banks. The facility comprises a bridge loan (the "Bridge Loan") and a term loan (the "Term Loan") of ˆ2 billion in aggregate and a revolving credit facility of ˆ500 million (the "RCF"). Proceeds of the Bridge Loan and Term Loan will be used to refinance indebtedness owing to Fiat Chrysler AutomobilesN.V. (NYSE: FCAU) ("FCA") and other indebtedness and for other general corporate purposes. Proceeds of the RCF may be used from time to time for general corporate and working capital purposes of the Ferrari group. The Bridge Loan has a 12 month maturity with an option for Ferrari to extend once for a six-month period. Ferrari intends to refinance the Bridge Loan prior to its maturity with longer term debt, including through capital markets or other financing transactions. The Term Loan, which comprises a majority of the total facility, and the RCF each have a maturity of five years.