One Owner Like New Cold A/c Front And Rear Stow And Go Seating All Power Service on 2040-cars

Fort Myers, Florida, United States

Chrysler Town & Country for Sale

2005 chrysler town and country stow and go touring

2005 chrysler town and country stow and go touring 2005 chrysler town & country handicap wheelchair accessible van(US $8,500.00)

2005 chrysler town & country handicap wheelchair accessible van(US $8,500.00) 2001 chrysler town & country lxi 80+photos see description wow must see!!

2001 chrysler town & country lxi 80+photos see description wow must see!! 2003 chrysler town & country leather 3rd row video system 1 owner & clean carfax

2003 chrysler town & country leather 3rd row video system 1 owner & clean carfax 2011 chrysler town & country touring l~htd leather~immaculate luxury minivan!!(US $17,988.00)

2011 chrysler town & country touring l~htd leather~immaculate luxury minivan!!(US $17,988.00) 2000 chrysler town & country lx (f9659a) ~ absolute sale ~ no reserve ~

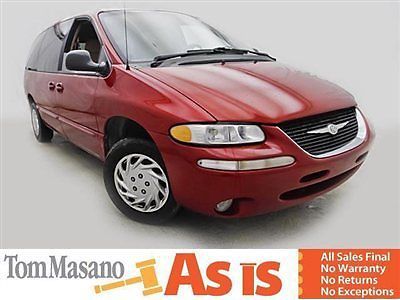

2000 chrysler town & country lx (f9659a) ~ absolute sale ~ no reserve ~

Auto Services in Florida

Xtreme Car Installation ★★★★★

White Ford Company Inc ★★★★★

Wheel Innovations & Wheel Repair ★★★★★

West Orange Automotive ★★★★★

Wally`s Garage ★★★★★

VIP Car Wash ★★★★★

Auto blog

Bob Lutz, UAW rep commend Chrysler for not bowing to NHTSA recall pressure [w/poll]

Mon, 10 Jun 2013Bob Lutz, the well-known executive with a range of automakers including both General Motors and Chrysler, says he supports Chrysler for not caving under federal pressure to issue a recall on 2.7 million Jeep vehicles. The National Highway Traffic Safety Administration is arguing that the plastic fuel tanks positioned behind the axles of certain 1993-2004 Grand Cherokee models and 2002-2007 Liberty models may become punctured in a collision and potentially catch fire, so it has called upon Chrysler to recall the vehicles. 15 deaths and 46 injuries have been attributed to the issue. For its part, Chrysler has maintained that its models "met and exceeded" all safety applicable mandates when they were manufactured, and furthermore, they argue that the government agency's own data proves that the vehicles are no more dangerous than similar SUVs produced by other automakers at the time. As a result, it is taking the unusual step of refusing to recall the vehicles.

According to The Detroit News, Lutz says Chrysler is right to push back when the government is out of line. Lutz also said that he wished he could have done the same when NHTSA urged Chrysler to issue a recall on certain minivans back when he was with the automaker 25 years ago.

Meanwhile, United Auto Workers Vice President General Holiefield also defended Chrysler by saying, "Our legendary Jeeps are crafted with pride by our dedicated UAW American workforce who work tirelessly to ensure the utmost quality of each Jeep that is produced for customers."

5 reasons why GM is cutting jobs, closing plants in a healthy economy

Tue, Nov 27 2018DETROIT — Even though unemployment is low, the economy is growing and U.S. auto sales are near historic highs, General Motors is cutting thousands of jobs in a major restructuring aimed at generating cash to spend on innovation. It's the new reality for automakers that are faced with the present cost of designing gas-powered cars and trucks that appeal to buyers now while at the same time preparing for a future world of electric and autonomous vehicles. GM announced Monday that it will cut as many as 14,000 workers in North America and put five plants up for possible closure as it abandons many of its car models and restructures to focus more on autonomous and electric vehicles. The reductions could amount to as much as 8 percent of GM's global workforce of 180,000 employees. The cuts mark GM's first major downsizing since shedding thousands of jobs in the Great Recession. The company also said it will stop operating two additional factories outside North America by the end of next year. The move to make GM get leaner before the next downturn likely will be followed by Ford Motor Co., which also has struggled to keep one foot in the present and another in an ambiguous future of new mobility. Ford has been slower to react, but says it will lay off an unspecified number of white-collar workers as it exits much of the car market in favor of trucks and SUVs, some of them powered by batteries. Here's a rundown of the reasons behind the cuts: Coding, not combustion CEO Mary Barra said as cars and trucks become more complex, GM will need more computer coders but fewer engineers who work on internal combustion engines. "The vehicle has become much more software-oriented" with millions of lines of code, she said. "We still need many technical resources in the company." Shedding sedans The restructuring also reflects changing North American auto markets as manufacturers continue to shift away from cars toward SUVs and trucks. In October, almost 65 percent of new vehicles sold in the U.S. were trucks or SUVs. That figure was about 50 percent cars just five years ago. GM is shedding cars largely because it doesn't make money on them, Citi analyst Itay Michaeli wrote in a note to investors. "We estimate sedans operate at a significant loss, hence the need for classic restructuring," he wrote. The reduction includes about 8,000 white-collar employees, or 15 percent of GM's North American white-collar workforce. Some will take buyouts while others will be laid off.

For his last act, Marchionne will outline an EV/hybrid roadmap this week

Wed, May 30 2018MILAN/LONDON — Fiat Chrysler (FCA) boss Sergio Marchionne is expected to outline new plans for electric and hybrid cars in a strategy presentation on Friday, aiming to ensure the world's seventh-largest carmaker remains in the race in the absence of a merger. The 65-year-old will present FCA's strategy to 2022, his final contribution to the company he turned around and multiplied in value through 14 years of canny dealmaking. After failing to secure a tie-up he said was necessary to manage the costs of producing cleaner vehicles, Marchionne needs to show the group can keep churning out profits on its own, even as emissions rules tighten, SUV competition intensifies and worries around his succession abound. Marchionne had long refused to jump on the electrification bandwagon, saying he would only do so if selling battery-powered cars could be done at a profit. He even urged customers not to buy FCA's Fiat 500e, its only battery-powered model, because he was losing money on each sold. But Tesla's success and the need to comply with tougher emissions rules have forced Marchionne to commit to what he calls "most painful" spending. "FCA is way behind rivals in terms of hybrid and electric vehicles and they need to hit the accelerator to convince investors they can close that gap," said Andrea Pastorelli, a fund manager at 8a+ Investimenti. Germany's Volkswagen, Daimler, BMW and U.S. rivals GM and Ford have committed to spending billions of euros each in coming years to try produce profitable cars powered by cleaner fuels. FCA needs to present a clear roadmap, just like Volvo Cars, which ditched diesel from its best-selling XC60 SUV, launched a new electric brand and pledged to shift all brands to hybrid by 2019, a banking source close to FCA said, noting: "The tech divide determines winners and losers in the industry." Marchionne has already said half of the wider FCA fleet will incorporate some elements of electrification by 2022, while luxury marque Maserati will spearhead FCA's electrification drive by making all new models due after 2019 electric. But its plans remain vaguer and less advanced than most big rivals and some investors wonder about the capital required to make vehicles compliant, and what share of spending can go to electrification given FCA's numerous demands.