2014 Chrysler Town & Country Touring-l on 2040-cars

701 S Main St, High Point, North Carolina, United States

Engine:3.6L V6 24V MPFI DOHC

Transmission:Automatic

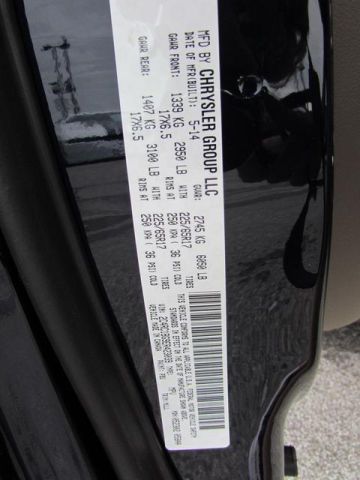

VIN (Vehicle Identification Number): 2C4RC1CG5ER374288

Stock Num: 3009

Make: Chrysler

Model: Town & Country Touring-L

Year: 2014

Exterior Color: Deep Cherry Red Crystal Pearlcoat

Interior Color: Black / Light Graystone

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 1

Thank you for visiting another one of Ilderton Dodge's online listings! Please continue for more information on this 2014 Chrysler Town & Country Touring-L with 0 miles. There are many vehicles on the market but if you are looking for a vehicle that will perform as good as it looks then this Town & Country Touring-L is the one! A truly breathtaking example of pure vehicle design achievement...this is the vehicle of your dreams! Equipped with, Leather-Trimmed Bucket Seats with Alcantara Acce, Heated Front Seats, Heated Second-Row Seats, Heated Steering Wheel, Remote Start System, All Power Features, Power Rear Sliding Doors, Power Liftgate, ParkView Rear Back-up Camera, Blind Spot and Cross Path Detection, ParkSense Rear Park Assist System, 2nd/3rd-Row Stow 'n Go w/3rd-Row Tailgate Seats, Single DVD Entertainment, Second-Row Overhead 9-Inch VGA Video Screen, Uconnect 430N CD/DVD/MP3/HDD/NAV, Dual DVD / Blu-Ray Entertainment , 30th Anniversary Package Badge, 30th Anniversary Key Fob, 17-Inch x 6.5-Inch Polished/Painted Aluminum Wheels, and a 3.6-Liter V6 24-Valve VVT Engine! Family owned and operated for 87 years. Visit our store today, you will see that we deliver the best dealership experience you have ever had. New vehicle prices include Factory incentives and rebates for SEBC (VA, NC, SC, GA, FL), RAM Trucks and Chrysler 200s (except convertibles) include $500 Chrysler Capital Financing. On approved credit

Chrysler Town & Country for Sale

2014 chrysler town & country touring-l(US $36,450.00)

2014 chrysler town & country touring-l(US $36,450.00) 2014 chrysler town & country s(US $34,950.00)

2014 chrysler town & country s(US $34,950.00) 2014 chrysler town & country touring(US $33,050.00)

2014 chrysler town & country touring(US $33,050.00) 2014 chrysler town & country touring(US $33,285.00)

2014 chrysler town & country touring(US $33,285.00) 2014 chrysler town & country s(US $34,950.00)

2014 chrysler town & country s(US $34,950.00) 2014 chrysler town & country touring-l(US $36,455.00)

2014 chrysler town & country touring-l(US $36,455.00)

Auto Services in North Carolina

Young`s Auto Center & Salvage ★★★★★

Wright`s Transmission ★★★★★

Wilson Off Road ★★★★★

Whitman Speed & Automotive ★★★★★

Webster`s Import Service ★★★★★

Vester Nissan ★★★★★

Auto blog

GM, FCA retain financial advisors amid merger rumors

Thu, Jun 18 2015Well, here we go again. Despite allegedly shutting down the idea of a merger, General Motors has retained financial advisors to, well, advise it on Fiat Chrysler Automobiles' advances. GM brought in New York-based Goldman Sachs, while FCA is currently working with Switzerland's UBS. Another source told Reuters that GM was working with Morgan Stanley, as well. But what does all this mean? Well, as we know, FCA boss Sergio Marchionne still has his eyes set very much on merging his automaker to combat what he claims are the prohibitive costs that come from developing today's vehicles. And while GM has said "no thanks," to a merger, the FCA boss is still looking to shareholders of the world's third-largest automaker to force the issue. Rather than a sign of an impending merger, voluntary or otherwise, between the two automotive powers – analysts called a hostile move by FCA "beyond ambitious," after all – retaining financial advisors on both sides could be viewed as just good business. News Source: ReutersImage Credit: Paul Sancya / AP Chrysler Fiat GM Sergio Marchionne FCA

Interested, then not: Marchionne not 'chasing' a VW merger

Tue, Mar 14 2017Update (March 15, 2017) : Automotive News reports that FCA CEO Sergio Marchionne, regarding the suggested VW and FCA merger, said in a press conference "I have no interest." He also said that he "will not call Matthias," the CEO of VW. He did add that he would be willing to entertain anything VW brings up, but he has "no intention of chasing him." Despite this, Marchionne still took a moment to reinforce his favorable stance concerning mergers and consolidation. Last week, Volkswagen's CEO Matthias Mueller effectively shut down Fiat Chrysler CEO Sergio Marchionne's idea of the two automakers merging. However, it seems Mueller has softened, if only just, to the idea. According to Reuters, the CEO said in a press conference he is "not ruling out a conversation." However, he did say that he would like Marchionne to discuss with him directly the possibility rather than to the media. Though this statement certainly doesn't mean such a merger is happening, it's far more open than when he said outright the company isn't in any talks with anyone at the moment. His new stance also indicates that there may be people (lawyers, accountants, etc.) behind the scenes working out possible ways a merger could work. And even though this new development makes the prospect of a merger between the two companies a bit less bleak, it's still a long way from the "will they, won't they" relationship between GM and FCA. FCA's pursuit of GM involved emailing CEO Mary Barra and the threats of a hostile takeover, the latter of which resulted in some awkward statements about hugs. Only time will tell if VW becomes open enough for Marchionne to talk about hugs again. Related Video:

Fiat Chrysler global HQ lands in London's ultra-posh West End

Thu, 18 Sep 2014It seems Fiat is bent on bolstering its image as a global automaker, as word has leaked out that the Italian/American conglomerate has chosen to locate its global headquarters in a rather swanky neighborhood in London. According to Bloomberg, the rental location on St. James Street in London's West End is a 10-minute walk from Buckingham Palace, and Fiat Chrysler Automobiles will fill up three complete floors of an office building that also houses The Economist magazine.

As a neutral location between Italy and the United States, the London-based headquarters makes sense, though, at $277 per square foot, this area is said to be the most expensive office space in the world. There's no mention of what FCA has actually agreed to pay for renting the space, but we're certain it isn't coming cheap.

Not surprisingly, Bloomberg also cites research indicating that the largest number of immigrants moving into London from January through August of this year hail from Italy, which makes sense considering the number of Italian executives and workers we'd expect would have to relocate to the UK in order to work at Fiat's new home. The company reportedly plans to be in place in London by the time it holds its next round of board meetings in October.