2010 Chrysler Town & Country Wheelchair Van With Stow Away Rear Ramp System on 2040-cars

Huntingdon Valley, Pennsylvania, United States

Body Type:Minivan, Van

Vehicle Title:Clear

Engine:3.3L V-6

Fuel Type:Flex

For Sale By:Dealer

Year: 2010

Make: Chrysler

Model: Town & Country

Trim: WHEELCHAIR HANDICAP MOBILITY VAN

Options: CD Player

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Drive Type: Front Wheel Drive

Power Options: Power Drivers Seat, Rear Air Conditioning & Heat, Remote Entry, Air Conditioning, Cruise Control, Power Locks, Power Windows

Mileage: 80,300

Sub Model: REAR LOADING RAMP WHEELCHAIR VAN

Exterior Color: White

Disability Equipped: Yes

Interior Color: Beige

Warranty: Balance of Factory Power Train Warranty

Number of Cylinders: 6

|

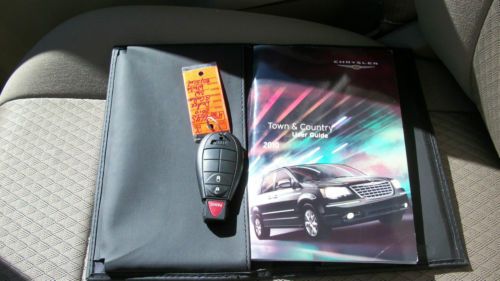

Offered by Kenny's Auto Sales is a 2010 Chrysler Town & Country Rear Loading Wheelchair Mobility Van. It was converted by "AMT " American Mobility Transport in April, 2013 as a demonstrator unit for commercial use customers and features a new State of the Art "STOW AWAY" ramp system that folds to the floor to allowing open access converting the Wheelchair Bay to a rear cargo area so that it can be used to hold cargo or luggage if a wheelchair passenger is not aboard. This is a New Conversion built on an off lease vehicle chassis and the rear wheelchair passenger area has never been used. This design is ideal for Taxi and Car Service operators and families that have occassional use for a Wheel Chair Vehicle and can keep this vehicle in use for everyday service when not needed for a Wheelchair passenger. It is very nice Bright White exterior Color with a Beige Cloth Interior with middle row Bench Seats. It has 80300 miles and Runs and Drives 100%. All on-board systems have been checked and are in good operating Condition. It features a smooth running 3.3 V-6, Automatic Transmission, front and Rear Air Conditioning and Heat, Power Drivers Seat, Power Windows and Locks with Remote Entry with a Key Fob Clicker, Am Fm Cd player, Tilt Wheel, Tire Pressure Monitoring System and Cruise Control. The Tires are in good condition and all have 7/32 or better Tread left and The Front brakes and Rear Brakes have been checked and are in good condition. The Van has just been serviced and is ready to travel. We have many other rear loading wheelchair Vans in stock so please call Kenny at 215-938-9333 for more information. All AMT Vans are ADA compliant are designed for commercial use. AMT Mobility Vans are built stronger and rust proofed better than any other competing product. It is built for the long haul and is an excellent value. I believe it is the best on the market today! We have experience with all types of vehicle shipping and have shipped these Vans worldwide! Kenny's Auto Sales, 820 Welsh Road, Huntingdon Valley, Pa. 19006 215-938-9333

|

Chrysler Town & Country for Sale

Silver town and country touring(US $9,000.00)

Silver town and country touring(US $9,000.00) 2013 chrysler town country leather 8100 miles rear camera dvd stow n go seats(US $21,800.00)

2013 chrysler town country leather 8100 miles rear camera dvd stow n go seats(US $21,800.00) 2010 chrysler town and country touring stow n' go(US $15,950.00)

2010 chrysler town and country touring stow n' go(US $15,950.00) 2007 chryler town&country touring power sliding doors and power lift gate(US $7,200.00)

2007 chryler town&country touring power sliding doors and power lift gate(US $7,200.00) 2014 touring-l new 3.6l v6 24v automatic fwd

2014 touring-l new 3.6l v6 24v automatic fwd 08 town & country limited gps navi tv dvd leather power doors warranty finance(US $13,995.00)

08 town & country limited gps navi tv dvd leather power doors warranty finance(US $13,995.00)

Auto Services in Pennsylvania

Wayne Carl Garage ★★★★★

Union Fuel Co ★★★★★

Tint It Is Incorporated ★★★★★

Terry`s Auto Glass ★★★★★

Terry`s Auto Glass ★★★★★

Syrena International Ltd ★★★★★

Auto blog

Marchionne urges industry consolidation, again

Fri, May 29 2015Sergio Marchionne isn't just an instigator of mergers – he's also a staunch advocate for their need in the industry. And he seems convinced another big one will happen in the next few years. "I am absolutely certain that before 2018 there will be a merger," said Marchionne. "It's my personal opinion, based on a gut feeling." Though the terms "absolutely certain" and "gut feeling" would seem to convey vastly different degrees of certainty, his chief's statement would seem to suggest some inside knowledge of an impending deal. Marchionne, of course, brokered the consolidation of the Fiat Chrysler Automobiles empire over which he now presides, and has been actively seeking another merger to help reduce redundancy and overhead between major automakers in the industry. With which automaker he might be seeking such a merger, however, remains a big question. He was recently reported to have approached Mary Barra regarding a potential merger with General Motors, but was said to have been rebuffed. The Italian-Canadian executive may not be alone in his advocacy for industry consolidation, though. Opel chief Karl-Thomas Neumann said that "In principle, Marchionne is right – the auto industry develops the same things ten times over." Bringing major automakers together would ostensibly reduce that redundancy. Marchionne had been linked to a potential takeover of Opel when GM was shedding brands post-bankruptcy, but in the end the Detroit giant opted to keep its European division in-house.

Weekly Recap: Marchionne's Manifesto again calls for industry consolidation

Sat, May 2 2015Sergio Marchionne isn't taking no for an answer. Despite public rebuffs from General Motors and Ford, the leader of Fiat Chrysler Automobiles continues to push for consolidation within the auto industry. His latest assertion came Wednesday when he said a combination of FCA with another automaker could net savings of $5 billion or more annually. No, this isn't about selling his company, he claimed, it's about cutting costs. Put simply, the auto industry wastes money, Marchionne said during FCA's earnings conference call. Companies invest billions to develop basic components that all cars use, but many consumers don't care how they work or recognize the differences. "About half of this is really relevant in terms of positioning the car in the marketplace," he said. "The other half, in our view, is stuff which is neither visible to the consumer nor is it relevant to the consumer." In 2014, top automakers spent more than $100 million on product development, FCA estimated. Marchionne said consolidation could save up to $1 billion on powertrains alone, noting that almost every automaker offers four- and six-cylinder engines. Not everyone has to make their own, he contended. "The consumer could not give a flying leap whose engines we are using because they are irrelevant to the buying decision." That's pretty provocative for enthusiasts, but less so for average consumers. Still, there are major differences in power and efficiency ratings, even among similar engines. Skeptics could argue consolidation would also weaken competition and reduce choices for car buyers. Marchionne stressed his presentation, curiously entitled Confessions of a Capital Junkie, wouldn't require closing factories or dealerships. It's not his final "big deal" as CEO, intent to sell FCA, or a way to elevate his company up the automotive food chain. He claims he wants to fundamentally change the industry and its habit for burning cash. "The horrible part about this, and the thing that I find most offensive, is that the capital consumption rate is duplicative," he said. "It doesn't deliver real value to the consumer and it is in its purest form, economic waste." Other News & Notes Ford Profits dip in first quarter Ford profits fell $65 million to $924 million in the first quarter, hampered by slight dips in revenue and sales.

Fiat to list on New York Stock Exchange?

Mon, 06 Jan 2014Citing the ever-nebulous "two sources close to Fiat," Reuters is reporting that the Italian automaker and owner of the Chrysler brand is likely to list itself on the New York Stock Exchange. The move could reportedly happen as soon as 2015, marking the end, at least in the minds of investors, of Fiat's 115-year base in Turin, Italy.

The Italian government is not likely to react favorably to Fiat's potential move from Italy to the United States, despite initially positive reactions to Fiat's landmark final purchase of Chrysler, the third-largest automaker in the US. Fiat spent $3.65 billion to buy out the 41.46-percent stake in Chrysler that had been owned by the United Auto Workers' VEBA trust fund.

With little sign of a swift European recovery, Fiat has little choice but to focus on markets outside its traditional home, and a listing in New York could potentially be a boon for investors. According to International Strategy and Investment analyst George Galliers, speaking to Reuters, "People [would be] more likely to think of the entity in the same context as they do Ford and GM" if it were listed on the NYSE.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.051 s, 7821 u