1999 Chrysler Town & Country Limited Minivan 7 Passenger Van on 2040-cars

Nixa, Missouri, United States

Body Type:Minivan, Van

Vehicle Title:Clear

Engine:3.8L 6 Cyl.

Fuel Type:Gasoline

For Sale By:Private Seller

Make: Chrysler

Model: Town & Country

Trim: Limited

Options: Leather Seats

Safety Features: Anti-Lock Brakes

Drive Type: FWD

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Mileage: 121,924

Sub Model: Limited

Exterior Color: White

Disability Equipped: No

Interior Color: Tan

Number of Doors: 4

Number of Cylinders: 6

Warranty: Vehicle does NOT have an existing warranty

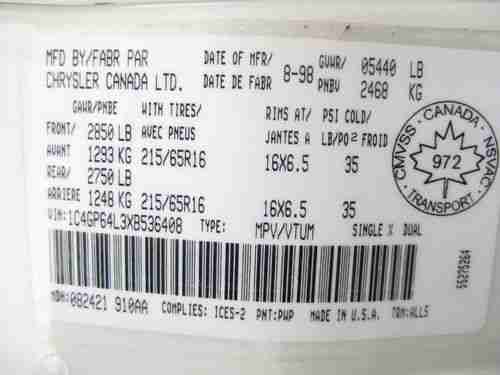

Always maintained and in excellent condition. Limited Edition includes Leather, memory seats, roof rack, dual zone heat & air conditioning and 16" chrome wheels. Convenient rear sliding door on both sides. No dents or scrapes. While the van has always been garage kept, there is a slight bit of rust above the left rear wheel and some rust o front left shock tower near battery (see photo).

Chrysler Town & Country for Sale

Auto Services in Missouri

Westport Service Center ★★★★★

Sterling Ave Auto Service ★★★★★

Santa Fe Glass Co Inc ★★★★★

Osage Auto Body ★★★★★

North West Auto Body & Service ★★★★★

Napa Auto Parts - Horn`S Auto Supply ★★★★★

Auto blog

Chrysler teases upcoming outlay of SEMA cars

Wed, 15 Oct 2014Fiat Chrysler Automobiles is hauling a multitude of modified models to the annual SEMA show in Las Vegas this November, and the company is releasing the first teasing sketches of many of them.

Unfortunately, FCA isn't giving many solid details on any of the concepts other than saying the vehicles from Chrysler, Jeep, Dodge, Ram and Fiat all benefit from tuning from its Mopar performance brand. The teaser photos include a sinister-looking Chrysler 200S, Fiat 500 Abarth with two-tone paint and a scorpion on the hood, a red and black 500L, seemingly two different takes on the Jeep Renegade, a green Dodge Challenger wearing the T/A badge, an orange and black Dart, a very neon Charger, just the outline of a red and black Viper, a Ram ProMaster in Mopar livery and a Ram pickup called the Outdoorsman.

Take a look through the gallery to see what you think of the sketches for these concepts, and scroll down for the full announcement from FCA.

Stellantis reports surprising 2020 results, is 'off to a flying start'

Wed, Mar 3 2021MILAN — Low global car inventories and cost cuts should boost Stellantis's profit margins this year, though a shortage of semiconductors and investments in electric vehicles could weigh on results, the newly-formed automaker said on Wednesday. The forecast came as Stellantis, created by the January merger of Peugeot-maker PSA and Fiat Chrysler (FCA), reported better-than-expected results for 2020 that sent its shares up around 3% in morning trading. "Stellantis gets off to a flying start and is fully focused on achieving the full promised synergies (from the merger)," Chief Executive Carlos Tavares said in a statement. Stellantis is the world's fourth largest carmaker, with 14 brands including Fiat, Peugeot, Opel, Jeep, Ram and Maserati. It said 2021 results should be helped by three new high-margin Jeep vehicles in North America and a strong pricing environment there. The U.S. market has driven profits for years at FCA and starts off as the strongest part of Stellantis. The group's guidance assumes no more significant lockdowns caused by the global COVID-19 pandemic, which shuttered auto plants around the world last spring. Stellantis should also get a lift as its starts to implement a plan aimed at delivering over 5 billion euros a year in savings, without closing any plants. Tavares has also pledged not to cut jobs. But a pandemic-related global shortage of semiconductors, used for everything from maximizing engine fuel economy to driver-assistance features, could hurt business. Auto industry executives have said the shortage should ease by the second half of 2021. Stellantis said its "electrification offensive" could also weigh on results this year. Automakers are racing to develop electric vehicles to meet tighter CO2 emissions targets in Europe and this week Volvo joined a growing number of carmakers aiming for a fully-electric line-up by 2030. Stellantis plans to have fully-electric or hybrid versions of all of its vehicles available in Europe by 2025, broadly in line with plans at top rivals such as Volkswagen and Renault-Nissan, although Stellantis has further to go to meet that goal. The carmaker is targeting an adjusted operating profit margin of 5.5%-7.5% this year. That compares with a 5.3% aggregated margin last year: 4.3% at FCA and 7.1% at PSA excluding a controlling stake in parts maker Faurecia, which is set to be spun-off from Stellantis shortly.

Chrysler Group moves around execs in wake of recent departure

Tue, 16 Apr 2013Chrysler is busy shuffling executives around in the wake of Ram head Fred Diaz's departure. The automaker has named Reid Bigland (pictured, right) as Diaz's successor in the role of president and CEO of Ram, though Bigland will continue his duties as the head of US sales and the president and CEO of Chrysler Canada. Bigland first came to Chrysler in 2006 from Freightliner Custom Chassis Corporation, so the guy knows a thing or two about trucks.

Meanwhile, Timothy Kuniskis will take over as president and CEO of Dodge. Previously, he served as the head of Fiat in North America and has been with Chrysler in one capacity or another since 1992. His old title now falls to Jason Stoicevich, who will also continue to work as the director of the automaker's California Business Center. Finally, Bruno Cattori will take over as the president and CEO of Chrysler Mexico.

Diaz left his position to take over as a divisional vice president of sales and marketing with Nissan. You can read the full press release on the Chrysler personnel changes below for more information.

2012 chrysler town & country touring dvd rear cam 28k! texas direct auto

2012 chrysler town & country touring dvd rear cam 28k! texas direct auto 2005 town & country

2005 town & country 2012 chrysler town & country touring dvd power sliding doors

2012 chrysler town & country touring dvd power sliding doors 1996 chrysler town and countery like new

1996 chrysler town and countery like new 2008 touring 3.8l auto modern blue pearlcoat

2008 touring 3.8l auto modern blue pearlcoat Chrysler - town & country lx minivan

Chrysler - town & country lx minivan