Low Mileage Chrysler Sebring 2008 on 2040-cars

Fort Lauderdale, Florida, United States

Body Type:Convertible

Vehicle Title:Clear

Engine:2.7L 2700CC 167Cu. In. V6 FLEX DOHC Naturally Aspirated

Fuel Type:Gasoline

For Sale By:Private Seller

Make: Chrysler

Model: Sebring

Trim: Touring Convertible 2-Door

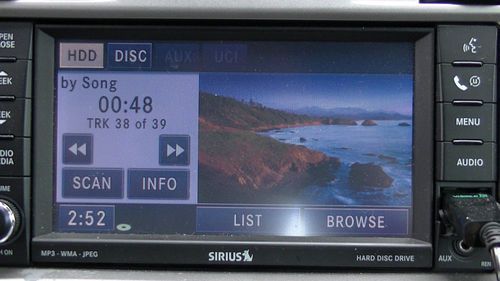

Options: DVD player, Bluetooth, Leather Seats, CD Player, Convertible

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Drive Type: FWD

Power Options: Remote start, USB connection, HDD, Satellite Radio, Touch screen, Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Mileage: 27,669

Exterior Color: Blue

Interior Color: Gray

Disability Equipped: No

Number of Cylinders: 6

Warranty: Vehicle has an existing warranty

Low mileage. In great condition.

Deposit of US $1,000.00 within 24 hours of auction close. Full payment required within 3 days of auction close.

Chrysler Sebring for Sale

2001 silver(US $1,800.00)

2001 silver(US $1,800.00) 2004 chrysler sebring limited convertable low miles(US $9,000.00)

2004 chrysler sebring limited convertable low miles(US $9,000.00) 2008 chrysler sebring touring model,blk & grey/7" dvd player/runs and looks mint(US $5,500.00)

2008 chrysler sebring touring model,blk & grey/7" dvd player/runs and looks mint(US $5,500.00) We finance!! 2011 chrysler 200 limited convertible nav heated leather texas auto(US $22,998.00)

We finance!! 2011 chrysler 200 limited convertible nav heated leather texas auto(US $22,998.00) 2005 chrysler sebring convertible low miles florida car new top(US $5,900.00)

2005 chrysler sebring convertible low miles florida car new top(US $5,900.00) 2004 chrysler sebring gtc convertible (low miles)(US $3,200.00)

2004 chrysler sebring gtc convertible (low miles)(US $3,200.00)

Auto Services in Florida

Workman Service Center ★★★★★

Wolf Towing Corp. ★★★★★

Wilcox & Son Automotive, LLC ★★★★★

Wheaton`s Service Center ★★★★★

Used Car Super Market ★★★★★

USA Auto Glass ★★★★★

Auto blog

FCA earnings improve in first quarter

Thu, Apr 30 2015Following on the recent global financial releases from Ford and from General Motors for the first quarter of 2015, FCA is now putting out its own numbers, and things look quite good for the company. The automaker posted adjusted earnings before taxes and interest of $895 million, a 22-percent jump from Q1 2014, and net profits of $103 million, a $296-million boost from last year. Revenue was also up 19 percent to $30 billion. Despite the favorable figures, actual worldwide shipments fell slightly by 2 percent to 1.1 million vehicles. FCA is giving some credit for these strong Q1 results to the automaker's performance in the NAFTA region. Shipments grew 8 percent to 633,000 vehicles, and net revenue jumped a strong 38 percent to $18.1 billion. Adjusted earnings reached $672 million, compared to $425 million in 2014. The company especially praised the Jeep Renegade, Chrysler 200, and Ram 1500 for helping the bottom line. The numbers could have been even higher, but the corporation admitted that "higher warranty and recall costs" partially drug things down. For the full year in 2015, FCA expects to ship between 4.8 and 5 million vehicles worldwide and post up to $5 billion in adjusted earnings. There should be about $1.3 billion in net profit, as well. FCA CLOSED Q1 WITH NET REVENUES OF ˆ26.4 BILLION, UP 19% AND ADJUSTED EBIT AT ˆ800 MILLION, UP 22% 30/04/15 FCA closed Q1 with net revenues of ˆ26.4 billion, up 19% and adjusted EBIT at ˆ800 million, up 22%. Net industrial debt was ˆ8.6 billion, up ˆ0.9 billion. Full year guidance confirmed. Worldwide shipments were 1.1 million units, 2% lower than Q1 2014, reflecting strong performance in NAFTA and weak market conditions in LATAM. Jeep's positive performance continued with worldwide shipments up 11% and sales up 22%. Net revenues were up 19% to ˆ26.4 billion (+4% at constant exchange rates, or CER). Adjusted EBIT was ˆ800 million, up ˆ145 million from Q1 2014, with all segments except LATAM posting positive results. The positive impact of foreign exchange translation was offset by negative impacts at a transactional level. Net profit was ˆ92 million, up ˆ265 million compared to the net loss of ˆ173 million in Q1 2014. Net industrial debt was ˆ8.6 billion, up ˆ0.9 billion from year-end mainly due to timing of capital expenditures and working capital seasonality. Liquidity remained strong at ˆ25.2 billion. The Group confirms its full-year guidance.

Fiat Chrysler, surprise, had to buy a lot of emissions credits

Sun, Dec 27 2015The world of carbon emissions uses some unusual units of measure. Take, for example, 8.2 million megagrams. Who needs to know how much that is? Someone at Fiat Chrysler Automobiles, that's who. FCA had to buy that many greenhouse-gas emissions credits from greener automakers, Reuters says, citing a report from the US Environmental Protection Agency (EPA). Because its vehicles' collective fuel economy continues to trail the industry average, FCA purchased the emissions credits at of the end of 2014 in order to meet US emissions regulations. About two-thirds of those credits were acquired from Toyota, while the rest were purchased from Tesla and Honda. Daimler and Ferrari, not surprisingly, were among the other automobile companies that had to acquire emissions credits in order to meet US greenhouse gas regulations. Because the price for these credits is set privately by the companies, the EPA didn't disclose how much FCA had to pay to stay on the green side. The reason for the millions FCA likely spent is because the company is making a slow progress building and selling cleaner cars. The company did increase average fuel efficiency by about one mile per gallon to almost 22 mpg for the 2015 model year, but it wasn't enough. Such a performance likely only put the automaker in a last-place tie with General Motors. The emissions credits purchased from Tesla are notable because that California-based maker of electric vehicles has long generated substantial revenue by selling various credits to its less-electrified counterparts. In 2013, Tesla sold more of California's ZEV credits than any other automaker, but Nissan took that title in 2014. While these are not the same as the EPA's GHG credits, they do offer another way to track which automakers are meeting the targets and which need help. Related Video: News Source: ReutersImage Credit: Flickr/Ian YVR Government/Legal Green Chrysler Fiat Fuel Efficiency mpg

Rising aluminum costs cut into Ford's profit

Wed, Jan 24 2018When Ford reports fourth-quarter results on Wednesday afternoon, it is expected to fret that rising metals costs have cut into profits, even as rivals say they have the problem under control. Aluminum prices have risen 20 percent in the last year and nearly 11 percent since Dec. 11. Steel prices have risen just over 9 percent in the last year. Ford uses more aluminum in its vehicles than its rivals. Aluminum is lighter but far more expensive than steel, closing at $2,229 per tonne on Tuesday. U.S. steel futures closed at $677 per ton (0.91 metric tonnes). Republican U.S. President Donald Trump's administration is weighing whether to impose tariffs on imported steel and aluminum, which could push prices even higher. Ford gave a disappointing earnings estimate for 2017 and 2018 last week, saying the higher costs for steel, aluminum and other metals, as well as currency volatility, could cost the company $1.6 billion in 2018. Ford shares took a dive after the announcement. Ford Chief Financial Officer Bob Shanks told analysts at a conference in Detroit last week that while the company benefited from low commodity prices in 2016, rising steel prices were now the main cause of higher costs, followed by aluminum. Shanks said the automaker at times relies on foreign currencies as a "natural hedge" for some commodities but those are now going in the opposite direction, so they are not working. A Ford spokesman added that the automaker also uses a mix of contracts, hedges and indexed buying. Industry analysts point to the spike in aluminum versus steel prices as a plausible reason for Ford's problems, especially since it uses far more of the expensive metal than other major automakers. "When you look at Ford in the context of the other automakers, aluminum drives a lot of their volume and I think that is the cause" of their rising costs, said Jeff Schuster, senior vice president of forecasting at auto consultancy LMC Automotive. Other major automakers say rising commodity costs are not much of a problem. At last week's Detroit auto show, Fiat Chrysler Automobiles NV's Chief Executive Officer Sergio Marchionne reiterated its earnings guidance for 2018 and held forth on a number of topics, but did not mention metals prices. General Motors Co gave a well-received profit outlook last week and did not mention the subject. "We view changes in raw material costs as something that is manageable," a GM spokesman said in an email.