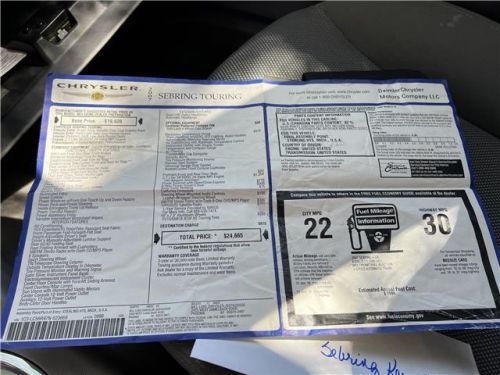

2008 Chrysler Sebring Touring 2dr Convertible on 2040-cars

Engine:2.7L V6

Fuel Type:Gasoline

Body Type:Convertible

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 1C3LC55R28N181386

Mileage: 91000

Make: Chrysler

Trim: Touring 2dr Convertible

Drive Type: --

Features: --

Power Options: --

Exterior Color: Blue

Interior Color: Gray

Warranty: Unspecified

Model: Sebring

Chrysler Sebring for Sale

1998 chrysler sebring jxi(US $6,500.00)

1998 chrysler sebring jxi(US $6,500.00) 2004 chrysler sebring lxi(US $4,500.00)

2004 chrysler sebring lxi(US $4,500.00) 2007 chrysler sebring touring(US $2,495.00)

2007 chrysler sebring touring(US $2,495.00) 2008 chrysler sebring. one owner(C $9,000.00)

2008 chrysler sebring. one owner(C $9,000.00) 2008 chrysler sebring touring(US $2,500.00)

2008 chrysler sebring touring(US $2,500.00) 2005 chrysler sebring(US $500.00)

2005 chrysler sebring(US $500.00)

Auto blog

Stellantis reveals STLA Large platform with EV and ICE support

Fri, Jan 19 2024Hot on the heels of a Jeep Wagoneer S teaser and photos of the prototype next-generation Dodge Charger (or Challenger), comes a reveal and details of what will likely underpin both of them: the STLA Large platform. It's one of multiple Stellantis flexible architectures that will be the basis of its upcoming electric cars, and apparently internal combustion ones, too. Stellantis says the STLA Large platform will be for D- and E-segment cars, crossovers and SUVs. In other words, it will be for midsize and large vehicles. For reference, lengths supported will be from 187.6 to 201.8 inches, and width will range from 74.7 to 79.9 inches. It will be highly flexible, too, with Stellantis claiming significant amounts of adjustability in overhangs, wheelbase, suspension placement and powertrain arrangement. The powertrain flexibility is quite impressive. Front-, rear- and all-wheel-drive layouts will be supported. Single- and dual-motor layouts will be on offer. Internal combustion will be available, too, either on its own or as a hybrid. Apparently engines can be fitted either longitudinally or transversely, too. Battery packs with between 85 and 118 kWh of capacity will be offered, with Stellantis claiming that sedan-style vehicles could have a range of up to 500 miles. The packs will also be available in 400- and 800-volt designs. Stellantis noted also that the platform can "easily accept future energy storage technologies when they reach production readiness." This seems to hint that the company is looking at different battery chemistries and maybe even solid-state batteries that could be added more easily in the future. Furthermore, the platform is designed to handle impressive output. Stellantis says that some models on the platform will have 0-to-62 mph times in the 2-second range. Limited-slip differentials for improved power delivery and wheel-end disconnects for reduced mechanical drag are also on the table for this platform. All of these details fit well with the information previously given for the concept Dodge Charger Daytona Banshee and Jeep Wagoneer S. The former was previewed with both battery voltage architectures and a wide range of electric powertrains with between 456 and 670 horsepower depending on specification and upgrades. And that's just for the 400-volt system; the 800-volt option wasn't detailed. We've also seen photos of the Charger chassis seemingly with provisions for gas engines, likely versions of the Hurricane I6.

Chrysler called out over lackluster Ram Runner by racer who helped develop it

Fri, 11 Apr 2014Fans of off-roading and desert blasting might recall that Chrysler offers an aftermarket conversion that can turn a Ram 1500 into a road-legal desert racer, called the Ram Runner. The kit, sold through Mopar, includes some significant suspension upgrades, body tweaks and a brawnier cat-back exhaust for the truck's 5.7-liter V8.

Considering all of this, comparisons with the almighty Ford F-150 SVT Raptor are common. Among the off-road community, that makes these two a sort of Chevrolet Camaro and Ford Mustang for people that prefer driving on dirt. In the Race-Dezert forum, the discussion as to which truck was better was proceeding as normal - Ram fans said their piece and Ford fans said theirs. Then, a man named Kent Kroeker offered up his two cents.

See, Kroeker is a Baja racer, and the man that helped develop the Ram Runner. Despite his association with the truck, though, he had some less than kind words for Chrysler and the Ram Runner.

Next Chrysler Town & Country will have foot-operated rear doors

Mon, Aug 31 2015Families are still months away from actually seeing the next-gen Chrysler Town & Country debut at the 2016 Detroit Auto Show, but details are continuing to trickle out about the upcoming minivan. Among several features rumored in the latest leak, the sliding doors and rear hatch are reportedly optional with foot activation, according to Automotive News. It should make loading the van easier for owners with their hands full. The T&C's powertrain sees some efficiency improvements, too. Under the hood, expect an upgraded version of the 3.6-liter Pentastar V6 and the already rumored nine-speed automatic, according to Automotive News. For the all-wheel-drive version of the minivan, an electric motor would provide the propulsion at the rear axle. Inside, all of the passengers can arrive with their devices fully charged thanks to USB ports for each of the three rows. Plus, for owners who need to make room to haul, the Stow 'N Go seating is now easier to use, too. Like the latest Honda Odyssey, fastidious buyers might even spec an optional vacuum. Earlier spy shots of the van indicate the switch to a rotary gearshift and upgraded infotainment, as well. Following the Detroit debut, the T&C goes into production in Windsor, Ontario, in late February 2016, Automotive News reports. The plug-in hybrid version would come towards the end of the year possibly capable of 75 mpge.