2007 Chrysler Sebring Limited, 38k Miles, 1-owner, Fully Loaded, Fantastic Cond. on 2040-cars

Mooresville, North Carolina, United States

|

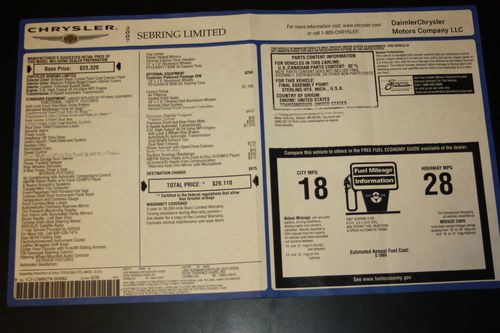

This is a fantastic fully loaded vehicle. This is a one-owner car and had been garage kept. It is a very clean car inside and out. Be sure to take a look at all the photos to get a feel for the fantastic condition of this car.

|

Chrysler Sebring for Sale

Only $1895.00, very clean for age and miles, top working, drives good, see pics

Only $1895.00, very clean for age and miles, top working, drives good, see pics Amazing convertible~nice one~40k certified~gold package~new tires~00 01 02 03(US $5,449.00)

Amazing convertible~nice one~40k certified~gold package~new tires~00 01 02 03(US $5,449.00) 2005 chrysler sebring base sedan 4-door 2.4l one owner

2005 chrysler sebring base sedan 4-door 2.4l one owner 2004 chrysler sebring coupe 2-door 2.4l(US $3,300.00)

2004 chrysler sebring coupe 2-door 2.4l(US $3,300.00) 2004 lxi used 2.7l v6 24v automatic fwd sedan

2004 lxi used 2.7l v6 24v automatic fwd sedan Limited edition

Limited edition

Auto Services in North Carolina

Ward`s Automotive Ctr ★★★★★

Usa Auto Body ★★★★★

Unique Auto Sales ★★★★★

True2Form Collision Repair Centers ★★★★★

Triple A Automotive Towing & Recovery Services Inc. ★★★★★

Triangle Automotive Repair, Inc ★★★★★

Auto blog

Dodge recalling 2k SRT Hellcat Challengers and Chargers for fuel leak

Tue, Mar 3 2015Bad news for fans of the obscene output of the Dodge Hellcat twins, as FCA has announced a voluntary recall of both 707-horsepower variants of the 2015-model-year Charger sedan and Challenger coupe. According to FCA, a total of 2,211 cars are being recalled after a dealer discovered a "possible fuel leak" during a pre-delivery inspection. Despite getting cleared by suppliers, FCA claims its engineers found "improperly installed" hose seals. Owners of affected vehicles will receive notification and be asked to report in for repairs. Of the vehicles affected, the overwhelming majority, 2,012, were sold in the US market. The remainder were sold in Canada (148), Mexico (30) and just 21 outside of North America. Scroll down for the official release from FCA. Related Video: Statement: Hose Seals March 1, 2015 , Auburn Hills, Mich. - FCA US LLC is voluntarily recalling an estimated 2,211 cars globally to replace fuel-delivery components that may leak. An FCA US dealer alerted the Company to a possible fuel leak following a pre-delivery vehicle inspection. These components had passed the supplier's leak-testing, but FCA US engineers launched an investigation and discovered certain hose seals may have been improperly installed. The Company is unaware of any related injuries, accidents or customer complaints. Affected are model-year 2015 Dodge Challenger SRT coupes and Dodge Charger SRT sedans equipped with 6.2-liter V-8 engines. There are an estimated 2,012 in the U.S.; 148 in Canada; 30 in Mexico and 21 outside the NAFTA region. Affected customers will be notified and advised when they may schedule service. Customers with questions or concerns may call the FCA US Customer Information Center at 1-800-853-1403.

Mopar-modified Chrysler 200 reappears in Chicago

Fri, 07 Feb 2014Chrysler made what was one of the biggest debuts of the 2014 North American International Auto Show last month when it debuted the heavily redesigned 200. While impressive on its own, the sleek sedan's Mopar counterpart, which was tucked away in a corner during the Detroit show, adds even more visual flair.

Based on the Chrysler 200S, the showcar had already benefitted from Lunar White Tricoat paint and meaty, 19-inch wheels (now in Satin Lite Bronze finish). White leather seats with bronze stitching accented the cabin treatment.

For Chicago, Chrysler added a Mopar body kit and new upper and lower grilles, both of which give the four-door a considerably more menacing look. The rear fascia is set off by a new bumper and a revised set of exhaust tips. The cabin is unchanged from the Detroit car.

Marchionne ready to get tough with GM over merger

Mon, Aug 31 2015FCA CEO Sergio Marchionne absolutely refuses to let go of his dream of a merger with General Motors. With official discussions not happening, Marchionne now hints that a hostile takeover attempt of The General could be under consideration as a future strategy. In a massive interview with Automotive News, the boss explains why a tie-up with GM might be such a windfall for both automakers. By Marchionne's numbers, a merged GM-FCA would produce $30 billion a year in global earnings and 17 million vehicles annually. He claims these huge figures are based on analyzing plants around the world to find growth opportunities. So far, GM is refusing to sit down and look at the numbers, let alone even begin to negotiate. For now, Marchionne just wants to talk, but he's not against aggressive action, if necessary. He uses a bizarre metaphor in the interview to explain his feelings. "There are varying degrees of hugs. I can hug you nicely, I can hug you tightly, I can hug you like a bear, I can really hug you. Everything starts with physical contact," he said to Automotive News. "An attack on GM, properly structured, properly financed, it cannot be refused," he said in the interview. Marchionne is looking for partners, too. The UAW's significant stake in GM could be a strong ally, and he's reportedly recruiting activist investors for more help. Selling Magneti Marelli and spinning off Ferrari would put even more cash in the war chest. Both sides also have banks at their aid. While Marchionne received positive replies from some of his "Plan B" partners, he apparently lost interest in working with them. "Are they the people I wanted to get the response from? The answer is probably not. There are people who are interested in doing deals," he said in the interview. News Source: Automotive News - sub. req.Image Credit: Paul Sancya / AP Photo Earnings/Financials Chrysler Fiat GM Sergio Marchionne FCA merger