2006 Chrysler Sebring Gtc Convertible Hot Nice Super Low Miles No Reserve!! on 2040-cars

Plymouth Meeting, Pennsylvania, United States

Vehicle Title:Clear

Engine:2.7L 2700CC 167Cu. In. V6 GAS DOHC Naturally Aspirated

For Sale By:Dealer

Body Type:Convertible

Fuel Type:GAS

Make: Chrysler

Warranty: Vehicle does NOT have an existing warranty

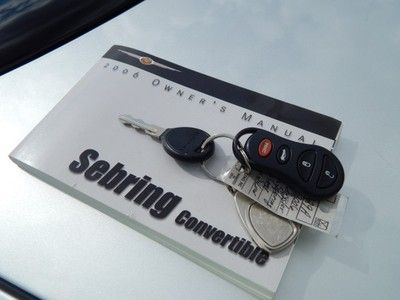

Model: Sebring

Trim: GTC Convertible 2-Door

Options: Convertible

Power Options: Power Windows

Drive Type: FWD

Mileage: 56,314

Number of Doors: 2

Sub Model: 2dr GTC

Exterior Color: Gray

Number of Cylinders: 6

Interior Color: Gray

Chrysler Sebring for Sale

04 sebring limited florida car 1-owner only 47k miles carfax certified must sell(US $6,750.00)

04 sebring limited florida car 1-owner only 47k miles carfax certified must sell(US $6,750.00) 2002 chrysler sebring convertable in great condition.

2002 chrysler sebring convertable in great condition. 2000 chrysler sebring jxi convertible

2000 chrysler sebring jxi convertible 2001 chrysler sebring convertible pick up only in grand ledge, mi 48837

2001 chrysler sebring convertible pick up only in grand ledge, mi 48837 2005 sebring touring convertible, power top, alloys, only 49k miles!! low price!(US $6,975.00)

2005 sebring touring convertible, power top, alloys, only 49k miles!! low price!(US $6,975.00) Chrysler sebring convertible lx automatic free autocheck no reserve

Chrysler sebring convertible lx automatic free autocheck no reserve

Auto Services in Pennsylvania

Zuk Service Station ★★★★★

york transmissions & auto center ★★★★★

Wyoming Valley Motors Volkswagen ★★★★★

Workman Auto Inc ★★★★★

Wells Auto Wreckers ★★★★★

Weeping Willow Garage ★★★★★

Auto blog

Autoblog sell-it-yourself highlight: 2004 Chrysler Crossfire

Wed, Apr 19 2017Chrysler's Crossfire was the most fortuitous product of the Chrysler and Daimler-Benz merger when it launched, but also the most tormented. Clothed in Chrysler sheetmetal, the Crossfire sat atop a Mercedes platform and was propelled by an M-B drivetrain. The upscale vibe was obvious, while its outlier status on a Chrysler showroom dominated by minivans, was preordained. As Autoblog reported in May 2006, "production of the Crossfire [fell] from a peak of 35,700 in 2003 to just 12,500 last year. Introduced in 2003, the Crossfire managed about 28,000 sales in 2004, but less than 10,000 in 2005. Chrysler was so desperate to move Crossfires in late 2005 that it even engaged in a marketing stunt when it attempted to sell units on Overstock.com." Most specialized two-seaters (or 2+2 coupes) invariably run into marketing reality; once the novelty wears off, there is little sustained support for a small, impractical vehicle in modern America. Conversely, if looking for a recreational vehicle with a possible upside as an investment, you'll be hard pressed to find a more accessible example than the Crossfire. Our for-sale example, located in Randleman, NC, looks to be well maintained and has the preferred manual transmission. There are few credible guides for evaluating the price, but the $3,750 ask falls in line with a decent Miata of the same vintage and mileage. A buyer should remember that the Mercedes-sourced drivetrain of this era can be a financial swamp, but with a clean Carfax and pre-purchase inspection, Chrysler's Crossfire can provide real driving enjoyment. Related Video: Chrysler Car Buying Used Car Buying Ownership Coupe Luxury Performance chrysler crossfire

FCA is setting a five-year strategy: Here's how the last one played out

Thu, May 31 2018We're slightly more than four years removed from Sergio Marchionne last five-year plan for FCA, a tell-all where the Italian-American automaker divulged its plans for the 2014 through 2018 model years. It was a grand affair, where Sergio told FCA investors that all was right in Auburn Hills, Alfa Romeo and Maserati were making comebacks, and the fifth-gen Dodge Viper received a mid-cycle refresh. You can read every last one of those past predictions right here. We're on our way to Europe to see Sergio's sequel, coming out Friday straight from FCA's Italian headquarters. (Bloomberg reports a plan to expand Jeep and Ram globally, combine Alfa Romeo and Maserati into a single division for an eventual spinoff, and downsizing Fiat and Chrysler. Also, EVs.) But before we arrive in Italy and find out exactly what Marchionne has planned for 2019 through 2023 as his last act as CEO, let's take a minute to tally up the results of his last term based on the same scoresheet we used in 2014. Now, we're only five months into 2018, so much of this — including vehicles like the Ram HD and Jeep Grand Wagoneer — could still debut this year. For those, we'll mark things TBD. We're not going to draw any conclusions or make any objectionable remarks. We're simply going to let the stats speak for themselves.

Detroit Three autoworkers could get huge bonuses

Mon, 06 Jan 2014For a long time, being a line worker for one of the Detroit Three has meant living with an uncertain future. With the health of American automakers on the rise, though, things are also starting to look up for the men and women building the cars. The latest sign that things aren't bad? Big profit-sharing checks.

According to The Detroit News, Ford, General Motors and Chrysler could end up paying over $800 million to 130,000 workers as part of a profit-sharing plan. According to The News, the economic impact of these profits in Michigan alone could exceed $400 million, besting the NFL's Super Bowl, MLB's All-Star Game and the NHL's Winter Classic for their economic impact.

This is the third straight year the Detroit Three have issued profit-sharing checks to UAW employees, and for many workers, the checks are as close as they'll get to a raise, due to the most recent contract between the union and the manufacturers. On average, employees at GM and Ford receive $1 for every $1 million in North American (not just the US) pre-tax profits. Chrysler, meanwhile, gets a similar deal, although the Auburn Hills-based company calculates profit sharing using 85 percent of the brand's global profits.