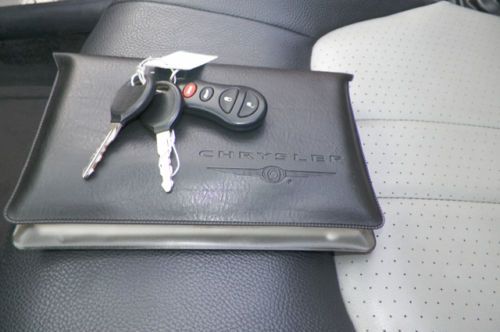

2004 Chrysler Sebring Gtc Convertible Leather Seats Sporty Must See No Reserve on 2040-cars

Marietta, Georgia, United States

Engine:2.7L 2700CC 167Cu. In. V6 GAS DOHC Naturally Aspirated

For Sale By:Dealer

Body Type:Convertible

Transmission:Automatic

Fuel Type:GAS

Year: 2004

Warranty: Vehicle does NOT have an existing warranty

Make: Chrysler

Model: Sebring

Options: Convertible

Trim: GTC Convertible 2-Door

Safety Features: Anti-Lock Brakes

Power Options: Power Windows

Drive Type: FWD

Mileage: 145,837

Vehicle Inspection: Inspected (include details in your description)

Sub Model: 2004 2dr Con

Number of Doors: 2

Exterior Color: White

Interior Color: Other

Number of Cylinders: 6

Chrysler Sebring for Sale

02 4 door domestic automatic power cloth silver sedan as-is - no reserve

02 4 door domestic automatic power cloth silver sedan as-is - no reserve A-nice-limited-jxi-georgia-leather-convertible-v6-cold-ac-cd-chrome-fact-wheels(US $5,990.00)

A-nice-limited-jxi-georgia-leather-convertible-v6-cold-ac-cd-chrome-fact-wheels(US $5,990.00) 2006 chrysler sebring(US $6,965.00)

2006 chrysler sebring(US $6,965.00) 2005 chrysler sebring touring sedan 4-door 2.7l

2005 chrysler sebring touring sedan 4-door 2.7l 2008 limited used 2.4l i4 16v automatic fwd sedan

2008 limited used 2.4l i4 16v automatic fwd sedan Lx convertible 2.4l cd 6 speakers am/fm 6 disc/dvd/mp3 w/sirius satellite

Lx convertible 2.4l cd 6 speakers am/fm 6 disc/dvd/mp3 w/sirius satellite

Auto Services in Georgia

Wright`s Professional Window ★★★★★

Vick`s Auto ★★★★★

V-Pro Vinyl & Leather Repair ★★★★★

Trailers & Hitches ★★★★★

Tire Town ★★★★★

Thornton Auto Care ★★★★★

Auto blog

Five automakers now being investigated by NHTSA for airbag woes

Thu, 12 Jun 2014It appears that Toyota's renotification to owners of recalled vehicles from last year is just the tip of the iceberg for what could potentially be a much larger industry-wide recall. The National Highway Traffic Safety Administration is opening a preliminary evaluation investigation into roughly 1.1 million vehicles from Chrysler, Honda, Mazda, Nissan, Toyota and parts supplier Takata regarding faulty airbag inflators in several models.

NHTSA has received six reports - three directly, two from Takata and one from Toyota - of vehicles with ruptured airbag inflators from 2002-2006, which resulted in three injuries. So far, all six incidents have occurred in high humidity areas like Florida and Puerto Rico. According to Toyota's latest recall announcement, the inflators may have an improper propellant that could cause it to rupture in a crash and the bag to deploy abnormally.

This new investigation follows a previous recall from April 2013 of about 3.4 million vehicles worldwide for the airbag inflators from Takata. As Autoblog reported, Toyota jumpstarted the new situation when it found that the original list of serial numbers for the faulty part was incomplete and discovered more cars in need of replacement. Honda and Nissan told us that they were investigating whether further models would need called in again as well. Mazda told Autoblog: "Regarding the current Takata situation, we're working closely with NHTSA and investigating the situation, but nothing else to report at this time." Chrysler Group responded to us with the statement: "Chrysler Group engineers are conducting the appropriate analysis. The Company will cooperate fully with the National Highway Traffic Administration."

The next steps automakers could take after sales drop again in April

Tue, May 2 2017DETROIT (Reuters) - Major automakers on Tuesday posted declines in U.S. new vehicle sales for April in a sign the long boom cycle that lifted the American auto industry to record sales last year is losing steam, sending carmaker stocks down. The drop in sales versus April 2016 came on the heels of a disappointing March, which automakers had shrugged off as just a bad month. But two straight weak months has heightened Wall Street worries the cyclical industry is on a downward swing after a nearly uninterrupted boom since the Great Recession's end in 2010. Auto sales were a drag on U.S. first-quarter gross domestic product, with the economy growing at an annual rate of just 0.7 percent according to an advance estimate published by the Commerce Department last Friday. Excluding the auto sector the GDP growth rate would have been 1.2 percent. Industry consultant Autodata put the industry's seasonally adjusted annualized rate of sales at 16.88 million units for April, below the average of 17.2 million units predicted by analysts polled by Reuters. General Motors Co shares fell 2.9 percent while Ford Motor Co slid 4.3 percent and Fiat Chrysler Automobiles NV's U.S.-traded shares tumbled 4.2 percent. The U.S. auto industry faces multiple challenges. Sales are slipping and vehicle inventory levels have risen even as carmakers have hiked discounts to lure customers. A flood of used vehicles from the boom cycle are increasingly competing with new cars. The question for automakers: How much and for how long to curtail production this summer, which will result in worker layoffs? To bring down stocks of unsold vehicles, the Detroit automakers need to cut production, and offer more discounts without creating "an incentives war," said Mark Wakefield, head of the North American automotive practice for AlixPartners in Southfield, Michigan. "We see multiple weeks (of production) being taken out on the car side," he said, "and some softness on the truck side." Rival automakers will be watching each other to see if one is cutting prices to gain market share from another, he said, instead of just clearing inventory. INVESTORS DIGEST BAD NEWS Just last week GM reported a record first-quarter profit, but that had almost zero impact on the automaker's stock. The iconic carmaker, whose own interest was once conflated with that of America's, has slipped behind luxury carmaker Tesla Inc in terms of valuation.

Stellantis and LG launch joint venture for North American battery plant

Mon, Oct 18 2021Stellantis has struck a preliminary deal with battery maker LG Energy Solution (LGES) to produce battery cells and modules for North America, as the world's No. 4 automaker rolls out its 30 billion euro ($35 billion) electrification plan. Global automakers are investing billions of euros to accelerate a transition to low-emission mobility and prepare for a progressive phase-out of internal combustion engines. Stellantis and LGES's joint venture will produce battery cells and modules at a new facility with an annual capacity of 40 gigawatt hours (GWh), the two firms said on Monday. No financial details of the deal were provided. The plant is scheduled to start production by the first quarter of 2024, with groundbreaking expected in the second quarter of 2022, the companies said in their statement. Its location is under review and will be announced later. Stellantis, formed in January from the merger of Italian-American automaker Fiat Chrysler and France's PSA, has said it wants to secure more than 130 GWh of global battery capacity by 2025 and more than 260 GWh by 2030. The batteries produced under the deal will supply Stellantis' U.S., Canadian and Mexican assembly plants for installation in hybrid and fully electric vehicles, supporting its goal of e-vehicles making up more than 40% of its U.S. sales by 2030. The company, whose brands include Peugeot, Fiat, Opel and U.S. best-sellers Jeep and Ram, earlier this year announced it would invest more than 30 billion euros through 2025 on electrifying its vehicle lineup. Stellantis has said it would build three battery plants in Europe and two in North America, including at least one in the United States. Intesa Sanpaolo analyst Monica Bosio said the deal was positive, and a further step ahead in Stellantis' electrification process. It comes weeks after Stellantis and its partner TotalEnergies agreed to open up their battery cell joint venture ACC to Daimler, to expand their European sourcing of battery cells. Stellantis is also targeting more than 70% of sales in Europe to be of low-emission vehicles by 2030, and aims to make the total cost of owning an EV equal to that of a gasoline-powered model by 2026. Related video: Green Plants/Manufacturing Alfa Romeo Chrysler Dodge Ferrari Fiat Jeep Maserati RAM Citroen Lancia Opel Peugeot Vauxhall Electric Hybrid EV batteries LG

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.151 s, 7891 u