2004 Chrysler Sebring Convertible Limited on 2040-cars

Bath, New York, United States

Body Type:Convertible

Vehicle Title:Clear

Engine:2.7L 2700CC 167Cu. In. V6 GAS DOHC Naturally Aspirated

Fuel Type:Gasoline

For Sale By:Private Seller

Number of Cylinders: 6

Make: Chrysler

Model: Sebring

Trim: Limited Convertible 2-Door

Options: Leather Seats, CD Player, Convertible

Drive Type: FWD

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Mileage: 143,000

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Sub Model: Limited

Exterior Color: White

Interior Color: Tan

2004 Chrysler Sebring Convertible Limited in good used condition. 143,000 miles on car overall but only 72,000 on replacement engine. New front suspension, tires, new brakes all around, new exhaust, new transmission seals, new thermostat in the last 2 years. Car is my daily commuter (80mi round trip) and I trust it to get me anywhere I need to go. Paint has a few bubbles, chips, and touch-ups but the car is still sharp looking.

Chrysler Sebring for Sale

1997 chrysler sebring jx convertible 2-door 2.5l(US $1,100.00)

1997 chrysler sebring jx convertible 2-door 2.5l(US $1,100.00) 2001 chrysler sebring lxi sedan 4-door 2.7l(US $4,000.00)

2001 chrysler sebring lxi sedan 4-door 2.7l(US $4,000.00) Touring convertible 2.7l cd front wheel drive power steering abs aluminum wheels

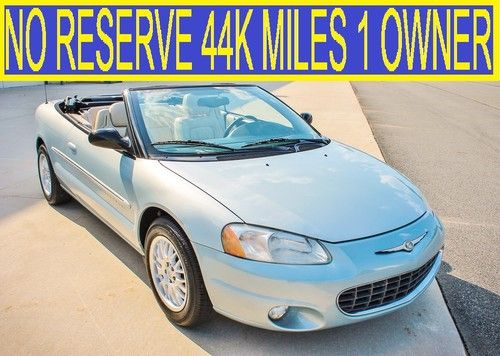

Touring convertible 2.7l cd front wheel drive power steering abs aluminum wheels No reserve 44k miles 1 owner limited convertible leather 02 03 04 05 06 07 dodge

No reserve 44k miles 1 owner limited convertible leather 02 03 04 05 06 07 dodge 2005 chrysler sebring convertible touring(US $7,195.00)

2005 chrysler sebring convertible touring(US $7,195.00) 2000 chrysler sebring jx convertible 2-door 2.5l silver(US $2,900.00)

2000 chrysler sebring jx convertible 2-door 2.5l silver(US $2,900.00)

Auto Services in New York

Wheel Fix It Corp ★★★★★

Warner`s Auto Body ★★★★★

Vision Kia of Canandaigua ★★★★★

Vision Ford New Wholesale Parts Body Shop ★★★★★

Vince Marinaro Automotive Inc ★★★★★

Valu Muffler & Brake ★★★★★

Auto blog

Chrysler recalls small number of 2013-2014 cars and trucks over engine debris

Thu, 12 Dec 2013Chrysler is recalling a small number cars over issues with their 2.4-liter four-cylinder engines. The recall, which affects 522 examples of its 2013 Dodge Avenger and Chrysler 200 models, as well as 2014 Jeep Compass and Patriot CUVs has to do with potential debris in the balance shaft bearings.

The abrasive stuff can cause the oil pressure to drop, which could lead to the engine stalling or outright failure. This situation could at best leave drivers stranded and at worst lead to a crash.

Chrysler will begin notifying owners, who will need to report in to have the balance shaft module replaced. All repairs are naturally free of charge. Scroll down for the bulletin from NHTSA.

Fiat Chrysler CEO says final merger talks with Peugeot going well

Thu, Jan 23 2020BRUSSELS — Fiat Chrysler's chief executive Michael Manley said on Wednesday that merger talks with Peugeot owner PSA to create the world's No. 4 carmaker are progressing well and he hopes to have a deal within 12-14 months. Speaking to Reuters on the sidelines of an industry meeting, he said he doesn't expect any major obstacles that could delay a final agreement. "Talks are progressing really well," Manley said about negotiations with the French carmaker ahead of a briefing by the European automotive association (ACEA), of which he is president. His comments come a month after the two carmakers agreed to a binding deal worth about $50 billion to combine forces in response to a slowdown in global demand and mounting costs of making cleaner vehicles amid tighter emissions regulations. Manley's timeline for completing the deal by early 2021 is in line with a forecast made by the companies in December. Fiat and Peugeot are now getting into the details of how the merger will work, including choosing which vehicle platforms — the technological underpinnings of a vehicle — will fit which products in a combined company. Because customers in different locations still prefer vastly different cars, there is room for multiple platforms in a combined group, Manley said. "That global platform is an elusive beast," he added. "This concept of a massive global platform in my mind is almost a myth, but that doesnÂ’t mean to say weÂ’re not going to recruit significant volume." Related Video:  Â

FCA facing class-action lawsuit over Grand Cherokee shifters

Fri, Jun 24 2016Fiat Chrysler Automobiles is now facing a multi-million-dollar class-action lawsuit over the recalled shifter design in the 2014 and 2015 Jeep Grand Cherokee, and the 2012 to 2014 Dodge Charger and Chrysler 300. Grand Cherokee owners, galvanized by Star Trek actor Anton Yelchin's fatal accident, filed the suit. According to The Wall Street Journal, the owners allege that FCA concealed the shifter's problems. On top of restitution, the class action suit is demanding a court order force FCA to issue a do-not-drive warning to owners of affected vehicles until it fixes the problem. FCA started distributing a software fix to dealers last week – according to the WSJ, the update will add more warnings about the shifter's position and will automatically kick the vehicle into park if the driver steps out. FCA's shifter problems have been bubbling under the surface as part of the company's recall issues. The US government dinged FCA with a $105 million fine last year for its recall practices (or lack thereof) last year, but things have exploded this week after Yelchin's death. The 27-year-old, best known for playing Ensign Pavel Chekov in the rebooted Star Trek film series, was killed after his 2015 Grand Cherokee rolled down his driveway and pinned the actor against a security gate. According to Jeep CEO Mike Manley, the company will dispatch engineers to analyze Yelchin's vehicle. Related Video: