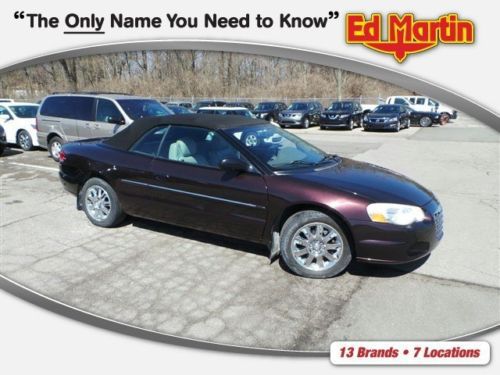

2002 Chrysler Sebring Lxi Convertible V6 Coupe 85k Orig Miles Florida/georgia on 2040-cars

Miami, Florida, United States

|

This car was my wife's daily driver until two years ago when her sister and husband came to the USA from Cuba. They needed a car so we gave this one to drive until they got on their feet. They are now doing well and recently purchased a brand new car. The car has a new roof as of two years ago. The front and back bumpers are in need of new paint. the interior needs a little sprucing up but other than that is is in good condition for a car its age. The car has issues. The first thing you need to know is that the transmission slips after it heats up (not sure what the problem is) , the second is the engine takes a few tries sometimes to get started (not sure if it needs a new ecu or a tune up) This car is located in Hialeah Florida. It has been only in Florida and Georgia its entire life ,so there is no rust . The car is available for personal inspection and test drive by appointment only . You will have to provide your own source of transportation out of Miami I do not recommend trying to drive this car long distance until you have made repairs.. Please note that we are selling this car as is no repairs prior to sale ,and no guarantees , no warrantees . . very simple you buy the car , take it away .and that is all there is . If you need to ask any questions feel free to call me at 404-451-2133 . I will be in Miami for two weeks only . this is CASH only no checks paypal can be used for deposit only .

must have made $500.00 deposit at time of purchase. |

Chrysler Sebring for Sale

Limited convertible 2.7l cd limited, chrome wheels, leather seats, power seat

Limited convertible 2.7l cd limited, chrome wheels, leather seats, power seat![2006 chrysler sebring touring convertible 2-door 2.7l [santa fe, texas 77510]](/_content/cars/images/41/888341/001.jpg) 2006 chrysler sebring touring convertible 2-door 2.7l [santa fe, texas 77510](US $5,980.00)

2006 chrysler sebring touring convertible 2-door 2.7l [santa fe, texas 77510](US $5,980.00) 1998 chrysler sebring jxi 2.5l v6 auto low mileage loaded no accidents 2 owners(US $6,900.00)

1998 chrysler sebring jxi 2.5l v6 auto low mileage loaded no accidents 2 owners(US $6,900.00) 2004 chrysler sebring touring convertible automatic 4 cylinder no reserve

2004 chrysler sebring touring convertible automatic 4 cylinder no reserve 2002 chrysler sebring lxi convertible blue no reserve

2002 chrysler sebring lxi convertible blue no reserve Convertible chrysler sebring low miles automatic transmission power equipped

Convertible chrysler sebring low miles automatic transmission power equipped

Auto Services in Florida

Yogi`s Tire Shop Inc ★★★★★

Window Graphics ★★★★★

West Palm Beach Kia ★★★★★

Wekiva Auto Body ★★★★★

Value Tire Royal Palm Beach ★★★★★

Valu Auto Care Center ★★★★★

Auto blog

Editors' Picks March 2021 | Ford Mustang Mach-E, Polestar 2, Land Rover Defender and more

Thu, Apr 8 2021The month of March was unofficial minivan month here at Autoblog. We drove all of them but the Kia Carnival, but don’t worry, you wonÂ’t have to wait much longer to read that review. Among all the family-toting machines, we drove some more exciting vehicles including the Land Rover Defender and a pair of up-and-coming EVs. It was a month of excellent cars, meaning that this monthÂ’s litter of EditorsÂ’ Picks is stacked. In case you missed FebruaryÂ’s picks, hereÂ’s a quick refresher on whatÂ’s going on here. We rate all the new cars we drive with a 1-10 score. Cars that are exemplary or stand out in their respective segments get EditorsÂ’ Pick status. Those are the ones weÂ’d recommend to our friends, family and anybody whoÂ’s curious and asks the question. The list that youÂ’ll find below consists of every car we rated in March that earned the honor of being an EditorsÂ’ Pick. 2021 Ford Bronco Sport 2021 Ford Bronco Sport First Edition View 32 Photos Quick take: Ford's baby Bronco is an authentic foil to the big Bronco 2-Door and 4-Door. It brings rugged styling, better-than-average off-road capability and thoughtful utility features to a generic segment of cars. Score: 8 What it competes with: Jeep Compass, Jeep Cherokee, Mazda CX-30, Subaru Crosstrek, Kia Seltos, Chevrolet Trailblazer Pros: Stellar design, excellent off-road, clever interior details throughout Cons: Pricier than most, average transmission, underwhelming interior quality and ambiance in lowest trims From the editors: Road Test Editor Zac Palmer — “I genuinely enjoy driving this cute crossover. It feels like a mini truck on the road, and Ford admirably translated the design from its big Bronco over to this Escape-based crossover. News Editor Joel Stocksdale — "The Bronco Sport isn't perfect, the transmission could use some work, and it's a little bumpy, but it's a characterful little thing with loads of style, great visibility and space, and impressive capabilities on and off road in the powerful Badlands form." In-depth analysis: 2021 Ford Bronco Sport Review | Bronco for the masses  2021 Land Rover Defender 2021 Land Rover Defender 110 View 64 Photos Quick take: The Land Rover Defender provides everything you'd hope for in a modern Land Rover: superlative off-road capability, surprisingly plush on-road demeanor, abundant interior space and abundant character. The base four-cylinder is likely all you'll need and lower trim levels provide more than enough equipment.

Chrysler's Woodward Dream Cruise festivities include Ram concept truck debut

Tue, 13 Aug 2013The streets will be crowded next weekend along Woodward Avenue in Royal Oak, Michigan for the 19th Annual Woodward Dream Cruise. As part of the run-up to the festivities, Chrysler has announced that all of its brands - Chrysler, Jeep, Dodge, Ram, Fiat, SRT and Mopar - will bring along their latest vehicles. Also included will be a collection of classic American cars and various activities for attendees at the official Chrysler location on the corner of Woodward and 13 Mile Road.

Special to this year, Ram brand director Bob Hegbloom and head of design John Dehner will unveil a Ram concept truck on Saturday. Chrysler will also bring Ryan Friedlinghaus of West Coast Customs fame along to show off a few custom Chrysler-made vehicles of his own. Fans of the brand on Facebook will get the chance to virtually customize a vehicle from the automaker's portfolio, with the winner getting their dream car built for them by Chrysler. Pretty cool stuff, no?

As in past years, Ford and General Motors will have an official presence at the event as well, and you can expect to see plenty of cars of all makes and models from all parts of the globe. The madness starts this Friday, August 16, from 4:30 PM to 10 PM, with the main event taking place on Saturday, from 9 AM to 9 PM. For more details on the show, including events and their times, check out the press release below.

Pontiac Aztek enjoys rebirth thanks to Millennials

Fri, Sep 11 2015Apparently, Millennials – those between 18 and 34 – aren't afraid to look different on the road, and they like performance, too. A new study by Edmunds is discovering some surprising vehicle choices by this group. Among them, the long-derided Pontiac Aztek is getting a new day in the sun with 25.5 percent its buyers coming from this generation in the first half of 2015. For comparison, Millennials represent an average of 16.8 percent of used car purchases. The Aztek is slowly shaking its reputation as a styling abomination, which seems tied to its appearance on Breaking Bad. The show premiered in 2008, and the Pontiac has been on this list for four of the past five years, according to Edmunds. It even led the pack in 2010. A recent Retro Review from MotorWeek also showed that the crossover wasn't always so hated. While it's still a shock to see the Aztek on any popularity list, the awkward-looking crossover only ranks sixth among Millennials. The vehicle with the biggest portion of buyers from the generation is the Dodge Magnum with 27.6 percent. According to Edmunds, the bluntly styled wagon is especially popular in Detroit and Chicago. The Chrysler Pacifica comes in a close second at 27.3 percent. When it comes to used cars, value and utility appear to trump just about anything else for many Millennial buyers," Edmunds analyst Jeremy Acevedo said in the report. Young buyers aren't afraid of sporty rides, either. The Subaru WRX has 26.4 percent Millennial buyers to rank third place on the list, and the Volkswagen R32 takes fifth at 25.7 percent. Just a few points lower in seventh place is the Nissan GT-R at 25.4 percent, and the final performance machine in 10th place is the Lexus IS-F with 24.7 percent. Related Video: