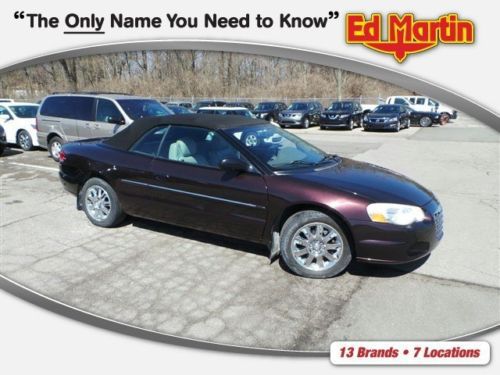

2002 Chrysler Sebring Convertible*limited* Low Miles on 2040-cars

Milford, Connecticut, United States

|

For Sale By Angelo Auto Center Milford Ct. Since 1959 "We are new to ebay but not Auto Sales" SPRING IS HERE GO TOPLESS Up for sale we have a Chrysler Sebring Convertible Limited : It was a New Car Trade-In A Fully Loaded Looks and Runs Great. New Brakes and just had a 108 point inspection and has a New Connecticut emissions good til 2015, Ice Cold A/C and Great Heater.

EXTERIOR

Fog lamps Wide body-color body-side moldings Pwr vinyl convertible top Variable-intermittent windshield wipers w/washer

Dual halogen headlights Black windshield moldings INTERIOR Cruise control Front/rear floor mats Instrumentation-inc: 120 mph speedometer, tachometer Steering wheel-mounted audio controls Trunk dress-up Driver 6-way pwr seat Pwr windows w/driver-side express-down

Dual illuminated visor vanity mirrors Lighting-inc: trunk, rear console courtesy Leather-wrapped steering wheel/shift knob Warning lamps-inc: door & decklid ajar Leather low-back front bucket seats w/manual driver lumbar adjust Tilt steering column Woodgrain instrument panel bezel Rear window defroster Electronic AM/FM stereo w/CD player-inc: (6) speakers, CD changer controls, fixed antenna MECHANICAL Touring suspension Pwr rack & pinion steering P205/60TR16 all-season BSW tires

120-amp alternator Lock-up torque converter 510 CCA maintenance-free battery 4-speed automatic transmission w/OD 16 gallon fuel tank w/tethered cap Front/rear stabilizer bar SAFETY Internal emergency trunk release Single low note horn Brake/park interlock Any Question Please feel Free to Call 203 783 3964- Bobby

*** All Vehicle's carry a $199 doc fee. |

Chrysler Sebring for Sale

Limited coupe 3.0l cd front wheel drive tires - front performance power steering(US $5,488.00)

Limited coupe 3.0l cd front wheel drive tires - front performance power steering(US $5,488.00) 2001 chrysler sebring lxi sedan automatic 6 cylinder no reserve

2001 chrysler sebring lxi sedan automatic 6 cylinder no reserve 2008 chrysler sebring touring convertible 2-door 2.7l(US $9,000.00)

2008 chrysler sebring touring convertible 2-door 2.7l(US $9,000.00) 2002 chrysler sebring lxi convertible v6 coupe 85k orig miles florida/georgia

2002 chrysler sebring lxi convertible v6 coupe 85k orig miles florida/georgia Limited convertible 2.7l cd limited, chrome wheels, leather seats, power seat

Limited convertible 2.7l cd limited, chrome wheels, leather seats, power seat![2006 chrysler sebring touring convertible 2-door 2.7l [santa fe, texas 77510]](/_content/cars/images/41/888341/001.jpg) 2006 chrysler sebring touring convertible 2-door 2.7l [santa fe, texas 77510](US $5,980.00)

2006 chrysler sebring touring convertible 2-door 2.7l [santa fe, texas 77510](US $5,980.00)

Auto Services in Connecticut

West Springfield Auto Parts ★★★★★

Monro Muffler Brake & Service ★★★★★

M K Auto Body Inc ★★★★★

Lia Volkswagen of Enfield ★★★★★

Jensen Tire & Automotive ★★★★★

Goodyear Tire & Service Network ★★★★★

Auto blog

How fracking is causing Chrysler minivans to sit on Detroit's riverfront

Fri, 25 Apr 2014It's fascinating the way that one change to a complex system can have all sorts of unintended consequences. For instance, there are hundreds of new Chrysler Town and County and Dodge Grand Caravan minivans built in Windsor, Ontario, sitting in lots on the Detroit waterfront because of the energy boom in the Bakken oil field in the northern US and parts of Canada.

The huge amount of crude oil coming from these sites mostly use freight trains for transport, and that supply boom has resulted in a shortage of railcars to carry other goods. According to The Windsor Star, North American crude oil transport by train has gone from 9,500 carloads in 2008 to 434,032 carloads in 2013. Making matters worse, some North American rail infrastructure is still damaged because of this year's harsh winter, and that's slowing things down even further.

Chrysler admits to The Star that it has had some delivery delays due to the freight train shortage. In the meantime, it's using more trucks to deliver its vehicles. Trucking is a far less economical solution, partially because a train can carry so many more units at one time, but alternatives are slim. The Windsor plant alone has a deal for 33 trucks to distribute the minivans around Canada and the Midwestern US.

Fiat Chrysler open to mergers, and PSA is looking for one

Fri, Mar 8 2019GENEVA — Fiat Chrysler (FCA) is open to pursuing alliances and merger opportunities if they make sense, but a sale of its luxury brand Maserati is not an option, Chief Executive Mike Manley said on Tuesday. "We have a strong independent future, but if there is a partnership, a relationship or a merger which strengthens that future, I will look at that," Manley told reporters at the Geneva Motor Show. Asked whether he would consider selling Maserati to China's Geely Automobile Holdings, as suggested by recent media reports, Manley said: "Maserati is one of our really beautiful brands and it has an incredibly bright future. ... No." FCA is often cited as a possible merger candidate. Bloomberg said this week that the Italian-American carmaker was attractive to France's PSA Group given its exposure to the U.S. market and its popular Jeep brand. The Detroit News' headline on the situation Friday read, "Fiat Chrysler CEO open to a deal as PSA circles" and stated that Manley's open-to-just-about-anything comments were aimed directly at PSA. Bloomberg said talks between the two were preliminary and said PSA chief Carlos Tavares has also contemplated mergers with General Motors or Jaguar Land Rover, which is losing money for Indian owner Tata. PSA has enjoyed a decade of turnaround and has $10.2 billion in net cash available. The maker of Peugeot, Citroen and DS, acquired Opel and Vauxhall in 2017 and made them almost instantly profitable. Manley, who took over after the death of Sergio Marchionne, said he currently had no news on possible deals. Manley also said the world's seventh-largest carmaker, which is lagging rivals in developing hybrid and electric vehicles, would take the least costly approach to comply with increasingly more stringent European emissions regulations. "There are three options. You can sell enough electrified vehicles to balance your fleet. Two: You can be part of a pooling scheme. Three is to pay the fines," he said. "I don't see a scenario when (carmakers) continue to subsidize technologies ... indefinitely." The carmaker had said last June it would invest 9 billion euros ($10.19 billion) over the next five years to introduce hybrid and electric cars across all regions to be fully compliant with emissions regulations. Asked about a 5-billion-euro investment plan for Italy FCA announced in November but then put under review, Manley said the plan had been confirmed as originally presented.

Carmakers ask Trump to revisit fuel efficiency rules

Mon, Feb 13 2017Car companies operating in the US are required to meet stringent fuel efficiency standards (a fleet average of 54.5MPG) through 2025, but they're hoping to loosen things now that President Trump is in town. Leaders from Fiat Chrysler, Ford, GM, Honda, Hyundai, Nissan, Toyota and VW have sent a letter to Trump asking him to rethink the Obama administration's choice to lock in efficiency guidelines for the next several years. The car makers want to revisit the midterm review for the 2025 commitment in hopes of loosening the demands. They claim that the tougher requirements raise costs, don't match public buying habits and will supposedly put "as many a million" jobs up in the air. The Trump administration hasn't specifically responded to the letter, although Environmental Protection Agency nominee Scott Pruitt had said he would return to the Obama-era decision. The automakers' argument doesn't entirely hold up. While the EPA did estimate that the US would fall short of efficiency goals due to a shift toward SUVs and trucks, the job claims are questionable. Why would making more fuel efficient vehicles necessarily cost jobs instead of pushing companies to do better? As it is, even a successful attempt to loosen guidelines may only have a limited effect. All of the brands mentioned here are pushing for greater mainstream adoption of electric vehicles within the next few years -- they may meet the Obama administration's expectations just by shifting more drivers away from gas power. This article by Jon Fingas originally appeared on Engadget, your guide to this connected life. Related Video: News Source: ReutersImage Credit: Daniel Acker/Bloomberg via Getty Images Government/Legal Green Chrysler Fiat GM Honda Hyundai Nissan Toyota Volkswagen Fuel Efficiency CAFE standards Trump