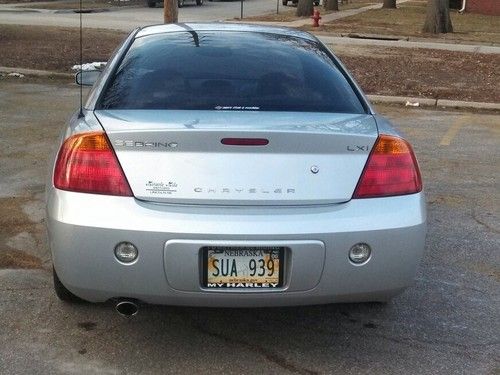

2002 Chrysler Sebring on 2040-cars

Whitefield, New Hampshire, United States

Body Type:Convertible

Engine:V6

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Private Seller

Number of Cylinders: 6

Make: Chrysler

Model: Sebring

Trim: 2 DOOR

Warranty: Vehicle does NOT have an existing warranty

Drive Type: FWD

Mileage: 157,997

Exterior Color: Black

Number of Doors: 2

Interior Color: Tan

Chrysler Sebring for Sale

Amazing 2002 chrysler sebring lxi with 58,000 miles!!!!

Amazing 2002 chrysler sebring lxi with 58,000 miles!!!! Chrysler sebring jxi convertible georgia owned leather seats no reserve

Chrysler sebring jxi convertible georgia owned leather seats no reserve 1998 chrysler sebring limited convertible - awesome!! no reserve!!

1998 chrysler sebring limited convertible - awesome!! no reserve!! 1998 chrysler sebring jxi convertible 2-door 2.5l

1998 chrysler sebring jxi convertible 2-door 2.5l 2004 chrysler sebring limited convertible 2-door 2.7l great car, mpg, and clean!

2004 chrysler sebring limited convertible 2-door 2.7l great car, mpg, and clean! 1999 chrysler sebring limited convertible with no reserve

1999 chrysler sebring limited convertible with no reserve

Auto Services in New Hampshire

Tisdell Transmission ★★★★★

Precision Towing & Recovery ★★★★★

Mike`s Mast Rd Auto Inc ★★★★★

Karstoks Automotive ★★★★★

Jim`s Alignment Service ★★★★★

Greater Lowell Buick ★★★★★

Auto blog

Stellantis invests more than $100 million in California lithium project

Thu, Aug 17 2023Stellantis said it would invest more than $100 million in California's Controlled Thermal Resources, its latest bet on the direct lithium extraction (DLE) sector amid the global hunt for new sources of the electric vehicle battery metal. The investment by the Chrysler and Jeep parent announced on Thursday comes as the green energy transition and U.S. Inflation Reduction Act have fueled concerns that supplies of lithium and other materials may fall short of strong demand forecasts. DLE technologies vary, but each aims to mechanically filter lithium from salty brine deposits and thus avoid the need for open pit mines or large evaporation ponds, the two most common but environmentally challenging ways to extract the battery metal. Stellantis, which has said half of its fleet will be electric by 2030, also agreed to nearly triple the amount of lithium it will buy from Controlled Thermal, boosting a previous order to 65,000 metric tons annually for at least 10 years, starting in 2027. "This is a significant investment and goes a long way toward developing this key project," Controlled Thermal CEO Rod Colwell said in an interview. The company plans to spend more than $1 billion to separate lithium from superhot geothermal brines extracted from beneath California's Salton Sea after flashing steam off those brines to spin turbines that will produce electricity starting next year. That renewable power is expected to cut the amount of carbon emitted during lithium production. Rival Berkshire Hathaway has struggled to produce lithium from the same area given large concentrations of silica in the brine that can form glass when cooled, clogging pipes. Colwell said a $65 million facility recently installed by Controlled Thermal can remove that silica and other unwanted metals. DLE equipment licensed from Koch Industries would then remove the lithium. "We're very happy with the equipment," he said. "We're going to deliver. There's just no doubt about it." Stellantis CEO Carlos Tavares called the Controlled Thermal partnership "an important step in our care for our customers and our planet as we work to provide clean, safe and affordable mobility." Both companies declined to provide the specific investment amount. Controlled Thermal aims to obtain final permits by October and start construction of a commercial lithium plant soon thereafter, Colwell said. Goldman Sachs is leading the search for additional debt and equity financing, he added.

Chrysler files for IPO

Tue, 24 Sep 2013Chrysler has had a lot of owners over the past few years alone, from Daimler to Cerberus to Fiat and the federal government. But it could be poised to gain some more before long. Like, a lot more.

The automaker has just announced that it has filed with the US Securities and Exchange Commission to issue an Initial Public Offering of common stocks. Chrysler hasn't revealed how many shares will be offered and at what price, however the shares in question will not come out of Fiat's approximate 60% majority shareholding but instead out of the 40% minority stock held by the UAW's VEBA retiree healthcare trust. Reports suggest that the IPO, which is being handled by JP Morgan, could encompass approximately 16% of Chrysler stock, initially valued at approximately $100 million.

Lest you think this is all part of Sergio Marchionne's grand plan to consolidate Chrysler and Fiat, the two auto groups over which he presides, think again. The filing, which still needs to be approved by the SEC, comes at the insistence of the UAW. Negotiations between Marchionne's management team and the union over Fiat's acquisition of the VEBA shares have stalled. If they manage to come to an agreement, however, the IPO would likely be taken off the table. So don't go calling your broker just yet, but you can analyze the official announcement below.

2013.5 Chrysler 200 S Special Edition is a Sebring swan song

Wed, 27 Mar 2013

The world is set to get an all-new Chrysler 200 next year, thereby finally putting the bones of the long-serving Sebring to rest. To tide us all over until then, the automaker has released the 2013.5 200 S Special Edition. As a collaboration between Chrysler and the Imported from Detroit clothing line, the sedan features plenty of aesthetic tweaks to give it a bit more attitude. Those include tinted headlamp and taillamp housings, body-color door sills and 18-inch gloss black wheels. There's also a revised front fascia with a black mesh grille, while the tail end gets a decklid spoiler and a revised valance.

Indoors, the seats are clad in black, water-resistant fabric courtesy of Carhartt. Expect to see the 2013.5 200 S Special Edition in dealers soon with a price tag of $28,870. While there are plenty of questions to be asked here, one is more nagging than the others. Why bother buying the special edition when an all-new model is mere months away? It's an age-old question, but it still bears asking. Check out the full press release below for more information.