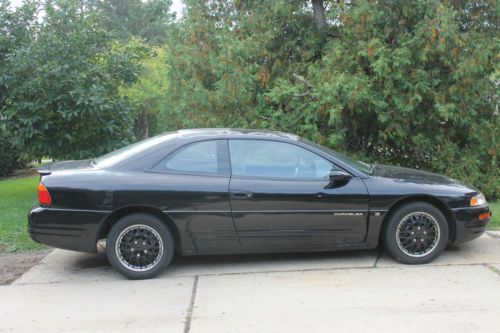

1999 Chrysler Sebring Lxi Coupe 2-door 2.5l on 2040-cars

Gurnee, Illinois, United States

|

1999 Chrysler Sebring LXi 2 Door Coupe Everything works except A/C Blows warm

runs and drives good V6 The clear coat is pealing on roof(PIC) good tires, recent tune up, new speakers, stitching on drivers seat(PIC) Was daughters car but she went off to college don't need anymore good car over all. Was told by daughter when it rains hard the sunroof leaks a little may need new seal |

Chrysler Sebring for Sale

Bentley conversion kit on a sebring convertible

Bentley conversion kit on a sebring convertible 2003 chrysler sebring lxi convertible 2-door 2.7l,leather, no reserve,low miles

2003 chrysler sebring lxi convertible 2-door 2.7l,leather, no reserve,low miles 1996 convertible sebring jx maroon 2.5l nice sound system motor runs great(US $1,500.00)

1996 convertible sebring jx maroon 2.5l nice sound system motor runs great(US $1,500.00) 2005 chrysler sebring base sedan 4-door 2.4l(US $2,400.00)

2005 chrysler sebring base sedan 4-door 2.4l(US $2,400.00) 2004 chrysler sebring convertible - rust free - stored winters - v6 2.7l 30mpg(US $3,000.00)

2004 chrysler sebring convertible - rust free - stored winters - v6 2.7l 30mpg(US $3,000.00) Limited! convertible! fl car! clean carfax! chrome! v6! infinity! leather/suede!

Limited! convertible! fl car! clean carfax! chrome! v6! infinity! leather/suede!

Auto Services in Illinois

Youngbloods RV Center ★★★★★

Village Garage & Tire ★★★★★

Villa Park Auto Clinic ★★★★★

Vfc Engineering ★★★★★

Valvoline Instant Oil Change ★★★★★

USA Muffler & Brake ★★★★★

Auto blog

Fiat Chrysler posts $690M Q1 loss

Mon, 12 May 2014If there is one thing that should be remembered when looking at quarterly and annual earnings, it's that the headline numbers rarely tell the whole story when it comes to an automaker's health. Chrysler's first-quarter earnings are just such an example.

Yes, the Auburn Hills-based manufacturer lost $690 million, which is quite a large sum of money. The reasons for the loss, according to Chrysler, were "Unfavorable infrequent items," which includes a $504 million payment to rid itself of the debts it took on for prepaying the UAW's VEBA healthcare trust. Chrysler was also hit with a $672 million charge to the UAW, which was part of a deal that allowed Fiat to purchase the remaining shares of Chrysler owned by the VEBA.

Ignoring those one-time deals, the first quarter was quite a successful one for Chrysler. It would have made $486 million if you erased the merger costs, which would have been a year-over-year increase of $320 million. Even more promising is the fact that Chrysler snagged the largest increase in market share of any automaker during Q1 at 1.1 percent, bringing its overall share to 12.7 percent of the US market. Chrysler saw a 30-percent improvement in sales of trucks and SUVs, along with an 11-percent increase in year-over-year sales and a 23-percent increase in revenue, to $19 billion.

Dodge not being dropped by Chrysler, CEO reaffirms

Mon, 16 Sep 2013Dodge isn't going anywhere. Despite some rumor and speculation over the future of the crosshair grille and the cars that wear it, Dodge brand boss, Tim Kuniskis, sat down with TheDetroitBureau.com, explaining that the marque isn't going anywhere. His sentiments echo those of SRT boss Ralph Gilles, who told a group of enthusiasts in July that "Dodge is here to stay!"

Dodge's death won't be "a part of a master plan to consolidate brands," Kuniskis told TheDetroitBureau.com. Instead, the brand, which is ultimately under the command of Fiat/Chrysler CEO, Sergio Marchionne, will likely ditch some of its badge-engineered models, like the Dodge Grand Caravan. A more focused Dodge, which was something Gilles has already hinted at, will likely see it exploring areas of the market that haven't been exploited by other Chrysler brands.

Kuniskis, not surprisingly, wasn't willing to delve into any detailed product plans, telling TDB that the size of the brand's lineup "remains to be seen." Regardless of how big the brand actually ends up being (it is presently Chrysler's volume brand - and not by a little), hopefully the statements from Kuniskiss can put the rumors of a Dodge closure to bed.

Fiat and UAW back at negotiating table over Chrysler stake

Mon, 23 Dec 2013We knew there'd be no Chrysler IPO before the end of this year, but Fiat is determined to get the best run going into 2014 and is back at the poker table with the UAW. The delay was said to be Chrysler's desire to clean up a tax issue with the IRS; turns out that also bought the carmaker time to try and close a deal for the UAW's 48.5-percent stake in the company before the IPO happens.

Whereas the price Chrysler was willing to pay was once more than $1 billion under the UAW's asking price, the gap has closed to just $800 million of late. A recent valuation of the company at $10 billion - a valuation the UAW has disputed - means Fiat would be looking to pay about $4.2 billion instead of the $5 billion that the UAW seeks. But the UAW needs to hold out for the highest amount it can get because its pension obligations through the Voluntary Employee Benefit Association (VEBA) are $3.1 billion greater than the VEBA's assets, which include the Chrysler stake.

There's a clause in the agreement that Fiat can buy the VEBA shares for $6 billion, but Fiat CEO Sergio Marchionne has said that the UAW "should buy a ticket for the lottery" if they even want $5 billion. The UAW, though, has more time to wait; it's Fiat that wants access to Chrysler's $11.9-billion war chest and that would like to avoid the risk of paying the full $6 billion for the UAW share if the float really takes off. With other valuations of Chrysler as high as $19 billion, a hot IPO could make that $6 billion look like a bargain.