2022 Chrysler Pacifica Hybrid Touring L on 2040-cars

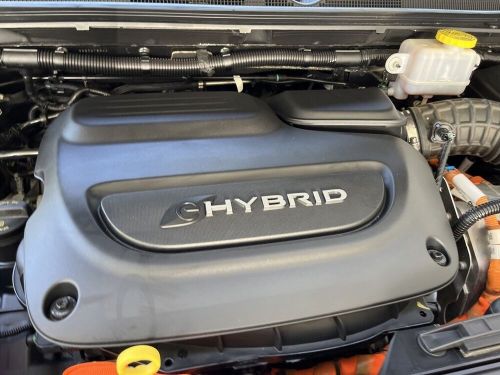

Engine:3.6L V6

Fuel Type:Hybrid-Electric

Body Type:4D Passenger Van

Transmission:CVT

For Sale By:Dealer

VIN (Vehicle Identification Number): 2C4RC1L7XNR137019

Mileage: 40995

Make: Chrysler

Trim: Hybrid Touring L

Features: --

Power Options: --

Exterior Color: Black

Interior Color: Black

Warranty: Unspecified

Model: Pacifica

Chrysler Pacifica for Sale

2020 chrysler pacifica touring l(US $17,384.00)

2020 chrysler pacifica touring l(US $17,384.00) 2022 pacifica touring l 4dr mini-van camera(US $22,995.00)

2022 pacifica touring l 4dr mini-van camera(US $22,995.00) 2024 chrysler pacifica pinnacle(US $50,335.00)

2024 chrysler pacifica pinnacle(US $50,335.00) 2022 chrysler pacifica touring l(US $28,499.00)

2022 chrysler pacifica touring l(US $28,499.00) 2019 chrysler pacifica limited(US $25,967.00)

2019 chrysler pacifica limited(US $25,967.00) 2022 chrysler pacifica touring l(US $26,750.00)

2022 chrysler pacifica touring l(US $26,750.00)

Auto blog

Henrik Fisker interview, and driving the Polestar 2 | Autoblog Podcast #643

Thu, Sep 3 2020In this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Senior Editor, Green, John Beltz Snyder. They've been driving the updated 2021 Honda Odyssey, the 2020 Mercedes-AMG GLC 43 and the new Polestar 2 electric sedan. After reviewing those, they talk about how the Chrysler 300 appears to be withering on the vine. Next, they take time to talk to legendary automotive designer and eponymous Chairman & CEO of Fisker Inc., Mr. Henrik Fisker himself, about jeans, horses and, of course, electric cars. Finally, they help a listener pick a $100,000 supercar in the "Spend My Money" segment. Autoblog Podcast #643 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Cars we're driving 2021 Honda Odyssey 2020 Mercedes-AMG GLC 43 2020 Polestar 2 Chrysler 300 soldiers on for 2021 with pared-down range, higher price Henrik Fisker interview Spend My Money Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video:

Ferrari to be spun off from Fiat Chrysler

Wed, 29 Oct 2014The recently merged Fiat Chrysler Automobiles empire has ambitious plans for growth, and it's going to need some big bucks in its coffers in order to enact them. Part of that cash injection is coming from the floating of its IPO on the New York Stock Exchange, but now FCA has announced a further capital campaign to be based on the enormous asset that is Ferrari.

FCA's board of directors has just approved the separation of Ferrari from the rest of the group as a separate entity. Once that separation is complete, Ferrari will put 10 percent of its shares on the stock market "in the United States and possibly a European exchange" as well.

This isn't the first time that the idea of a Ferrari IPO has been raised. Sergio Marchionne, chief executive of Chrysler, Fiat and Ferrari (pictured above), first raised the idea four years ago. Former Ferrari chairman Luca di Montezemolo nixed the idea, but now that he's been discharged, it appears there's nothing to get in the way of Marchionne's desires.

Marchionne says the Chrysler 200 and Dodge Dart were terrible investments for FCA

Mon, Jan 9 2017In a press conference during the Detroit Auto Show, Sergio Marchionne was quite candid about why the Chrysler 200 and Dodge Dart were discontinued altogether without replacement. He essentially said they weren't worth the trouble. "I can tell you right now that both the Chrysler 200 and the Dodge Dart, as great products as they were, were the least financially rewarding enterprises that we've carried out inside FCA in the last eight years," Marchionne said. "I don't know one investment that was as bad as these two were." Marchionne was responding to a question about whether he felt the company's shift toward trucks and SUVs and sacrifice in sedan development was shortsighted. Marchionne said he felt that the market would likely continue to be strong for trucks and SUVs, and that the sedan market requires enormous investment that might not pay off. He used the 200 and Dart as examples. When we tried out the 200 and the Dart, we had mixed feelings. We enjoyed the 200's potent V6, pleasant interior, and solid handling. However, it was lacking in space (especially in the rear seat area), and doesn't drive any better than the top vehicles in the midsize sedan class. As for the Dart, it was fairly roomy, and had great infotainment thanks to Uconnect, but lackluster handling and a surprising amount of weight left it only average. With that in mind, it's probably not a bad idea to get rid of the 200 and Dart. The sedan segment is shrinking, and FCA can only afford to invest in areas where it can be a class-leader. Related Video: