2017 Chrysler Pacifica Touring-l Mobility Handicap Van Handicap on 2040-cars

Denver, Colorado, United States

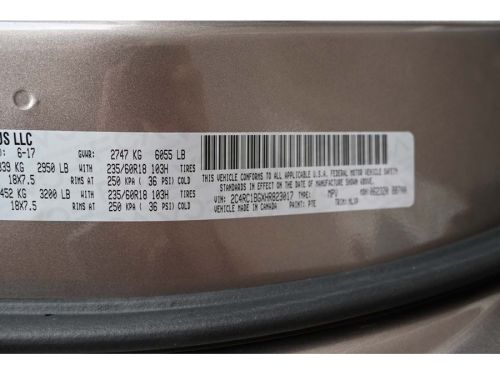

Engine:Pentastar 3.6L V6 287hp 262ft. lbs.

Fuel Type:Gasoline

Body Type:PV

Transmission:Automatic

For Sale By:Dealer

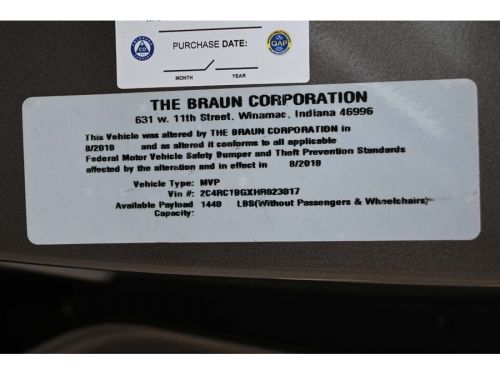

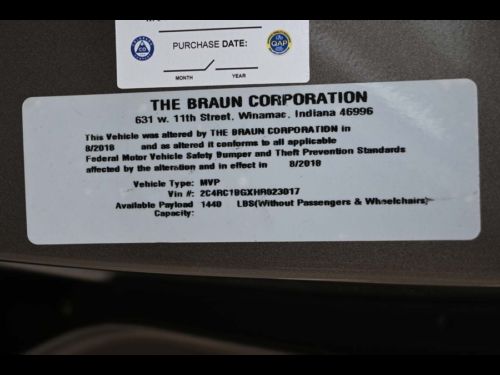

VIN (Vehicle Identification Number): 2C4RC1BGXHR823017

Mileage: 52388

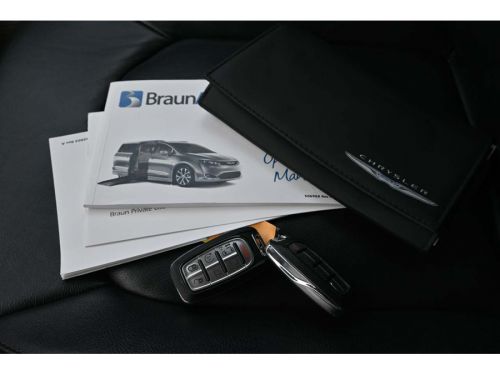

Make: Chrysler

Trim: Touring-L Mobility Handicap Van Handicap

Features: --

Power Options: --

Exterior Color: Gold

Interior Color: Tan

Warranty: Vehicle does NOT have an existing warranty

Model: Pacifica

Chrysler Pacifica for Sale

2021 chrysler pacifica touring l(US $17,076.50)

2021 chrysler pacifica touring l(US $17,076.50) 2021 chrysler pacifica touring l(US $14,831.60)

2021 chrysler pacifica touring l(US $14,831.60) 2022 chrysler pacifica touring l(US $23,900.00)

2022 chrysler pacifica touring l(US $23,900.00) 2022 chrysler pacifica limited(US $31,950.00)

2022 chrysler pacifica limited(US $31,950.00) 2022 chrysler pacifica limited(US $24,481.10)

2022 chrysler pacifica limited(US $24,481.10) 2020 chrysler pacifica touring l 4dr mini van(US $100.00)

2020 chrysler pacifica touring l 4dr mini van(US $100.00)

Auto Services in Colorado

Yoda Man Jim ★★★★★

Tsgauto.Com ★★★★★

Tsg Auto ★★★★★

Tilden Car Care ★★★★★

South Denver Automotive ★★★★★

Royal Automotive ★★★★★

Auto blog

Chrysler recalling 700k minivans and Dodge Journey for ignition switch woes

Tue, 01 Jul 2014General Motors isn't the only automaker with ignition switch problems. Chrysler is fighting it too and is now announcing a recall of 695,957 examples worldwide of the Chrysler Town & Country and Dodge Grand Caravan minivans from the 2008-2010 model years, plus the 2009-2010 Dodge Journey.

According to a statement from Chrysler, the models have a bad wireless ignition node detent ring in the ignition switch, making it possible for drivers to appear to have the key in the "Run" position but for the spring not to fully engage. It can then slip back to the "Accessory" position and shut the car off. If this happens, the vehicle loses power steering, brake boost and the airbags.

There is some disparity about the number of vehicles affected under this recall. In its statement, Chrysler claims that it covers 525,206 vehicles in the US, 102,892 in Canada, 25,591 in Mexico and 42,268 elsewhere. However, the recall announcement posted by The National Highway Traffic Safety Administration lists an estimated 438,109 vehicles in the US. Chrysler spokesperson Nick Cappa told Autoblog via email that the reasoning for the different figures "will become clear at a later date."

Fiat Chrysler, Peugeot owner PSA reportedly in merger talks

Tue, Oct 29 2019Fiat Chrysler and Peugeot owner PSA are in talks to combine in a deal that could create a $50 billion automaker, the Wall Street Journal reported on Tuesday, citing sources. The deal could be in the form of an all-stock deal, the report said. Fiat Chrysler shares rose sharply after the report and were up more than 7% in late afternoon trading. Fiat Chrysler and Peugeot had no comment. Investors have speculated for several years that Fiat Chrysler was hunting for a merger partner, encouraged by the rhetoric of the company's late chief executive, Sergio Marchionne. In 2015, Marchionne outlined the case for consolidation of the auto industry, and tried unsuccessfully to interest General Motors in a deal. Peugeot and Fiat Chrysler had discussed a combination earlier this year, before Fiat Chrysler proposed a $35 billion merger with French automaker Renault SA. Fiat Chrysler Chairman John Elkann broke off talks with Renault in June after French government officials intervened, and pushed for Renault to first resolve tensions with its Japanese alliance partner, Nissan. Following the collapse of the Renault merger plan, Fiat Chrysler CEO Mike Manley left the door open for talks with would-be partners, but said the Italian-American automaker could go it alone despite mounting costs to develop electric vehicles and comply with tougher emissions rules in Europe, the United States and China. Peugeot CEO Carlos Tavares dismissed the idea of a combination with Fiat Chrysler during a discussion with reporters at the Frankfurt auto show last month. "We don't need it," Tavares said when asked whether he was still interested in a deal with Fiat Chrysler. Fiat Chrysler has a commercial vehicle partnership with Peugeot.

Stellantis reports $15B profit in first year of merger

Wed, Feb 23 2022FRANKFURT, Germany — Automaker Stellantis said Wednesday that it made 13.4 billion euros ($15.2 billion) in its first year after it was formed from the merger of Fiat Chrysler Automobiles and PSA Group. The earnings nearly tripled profits compared with its pre-merger existence as two separate companies, as the maker of Jeep, Opel and Peugeot vehicles exploited cost efficiencies from combining the businesses. The result compared to a combined 4.79 billion euros for the separate companies in 2020 before the merger, which took effect on Jan. 17, 2021. Revenue for the combined business rose 14%, to 152 billion euros. CEO Carlos Tavares said the results “prove that Stellantis is well positioned to deliver strong performance" and had overcome “intense headwinds” during the year. Automakers have struggled with shortages of key parts such as semiconductor electronic components and rising costs for raw materials as the global rebound from the worst of the coronavirus pandemic brings more demand. The company said the benefits of the merger were worth some 3.2 billion euros during the year. Mergers can lead to streamlined costs as companies combine functions and spread fixed costs over a larger revenue base. The company accelerated its rollout of battery-powered vehicles, with sales of low-emission vehicles reaching 388,000 — an increase of 160%. Stricter environmental regulations in Europe and China are pushing automakers to roll out more electric vehicles with longer range. Stellantis started production of a hydrogen fuel cell commercial van under its Opel brand in December. Stellantis' other brands include Chrysler, Citroen, DS, Fiat, Maserati, Ram and Vauxhall. Related video: Earnings/Financials Chrysler Dodge Ferrari Fiat Jeep RAM Citroen Opel Peugeot Vauxhall