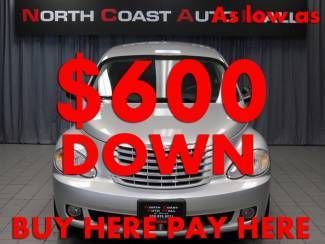

2010 Chrysler Pt Cruiser Automatic Alloy Wheels 3k Mi! Texas Direct Auto on 2040-cars

Stafford, Texas, United States

Engine:See Description

Fuel Type:Gasoline

For Sale By:Dealer

Transmission:Automatic

Body Type:SUV

Warranty: Vehicle has an existing warranty

Make: Chrysler

Model: PT Cruiser

Options: CD Player

Power Options: Power Windows, Power Locks, Cruise Control

Mileage: 3,980

Sub Model: WE FINANCE!!

Exterior Color: Black

Number of Doors: 4

Interior Color: Gray

CALL NOW: 832-947-9946

Number of Cylinders: 4

Inspection: Vehicle has been inspected

Seller Rating: 5 STAR *****

Chrysler PT Cruiser for Sale

2002 chrysler pt cruiser limited edition inferno red

2002 chrysler pt cruiser limited edition inferno red 2007 chrysler pt cruiser convertible - silver with black interior and soft top(US $6,300.00)

2007 chrysler pt cruiser convertible - silver with black interior and soft top(US $6,300.00) 2005 touring 2.4l auto white

2005 touring 2.4l auto white Pink chrysler pt cruiser 6 pax limousine one of kind - like new lqqk no reserve

Pink chrysler pt cruiser 6 pax limousine one of kind - like new lqqk no reserve 2010(10) chrysler pt cruiser classic! heated seats! clean! must see! save big!!!(US $8,795.00)

2010(10) chrysler pt cruiser classic! heated seats! clean! must see! save big!!!(US $8,795.00) 2003 chrysler pt cruiser custom panel all metal well done pt cruiser turbo(US $21,995.00)

2003 chrysler pt cruiser custom panel all metal well done pt cruiser turbo(US $21,995.00)

Auto Services in Texas

Zepco ★★★★★

Z Max Auto ★★★★★

Young`s Trailer Sales ★★★★★

Woodys Auto Repair ★★★★★

Window Magic ★★★★★

Wichita Alignment & Brake ★★★★★

Auto blog

Fiat-Chrysler alliance in jeopardy due to Pentastar's IPO filing?

Thu, 26 Sep 2013The four-year relationship between Fiat and Chrysler has thus far been beneficial for both automakers, but it has also proven to be a complicated battle between Sergio Marchionne and the United Auto Workers - the latter controlling the remaining 41.5 percent of Chrysler. With the recent filing for a US IPO, it looks like Marchionne and the UAW appear to be playing a billion-dollar game of chicken, with both sides far apart on how much the union's shares are worth. If it comes down to Chrysler's remaining stake being publicly traded, it could act to drive a wedge between the two companies.

According to Bloomberg, Fiat's chairman John Elkann says "if the IPO will take place, there will be two companies, and that's different than having a single one." Now, we're not great at math, but this sounds like the complete opposite of the full merger that Marchionne has been pushing for since taking the helm at Chrysler. Bloomberg notes that the UAW's shares should be worth around $5.6 billion, but Fiat could end up paying as little as $4.9 billion for Fiat to gain full control of Chrysler. A story by The Detroit News points out that Marchionne's "alleged low-balling" is just the latest hurdle the Auburn Hills-based automaker must overcome as its ownership is being fought over for the fourth time in 15 years.

Preserving automotive history costs big bucks

Wed, 29 Jan 2014

$1.8 million is spent each year to maintain GM's fleet of 600 production and concept cars.

When at least two of the Detroit Three were on the verge of death a few years back, one of the tough questions that was asked of Ford, General Motors and Chrysler execs - outside of why execs were still taking private planes to meetings - was why each company maintained huge archives of old production and concept vehicles. GM, for example, had an 1,100-vehicle collection when talk of a federal bailout began.

Marchionne recruiting activist investors to prompt GM merger

Tue, Jun 9 2015Sergio Marchionne may have been rebuffed in his previous advances at General Motors, but he's not about to give up that easily. According to The Wall Street Journal, the Fiat Chrysler chief is now turning to activist investors to help coax GM into joining forces. Marchionne has been a staunch and ceaseless advocate of the need for consolidation, arguing that the industry needs to amalgamate into larger groups that will share resources and reduce overhead. Under his leadership, the Fiat group consolidated its own operations, and officially merged with Chrysler last year. But he's also been pursuing additional mergers with the likes of Volkswagen, Peugeot, Ford, and Opel (to name just a few). Now he's pursuing a merger with GM, which has not shown much enthusiasm towards the idea. For one thing, GM is a much larger company, and probably doesn't need FCA as much as FCA needs it. For another, it has a troubled past with Marchionne, who in 2005 dissolved an agreed merger (of sorts) with GM, yet still managed to get the General to pay Fiat some $2 billion in the process. However, Marchionne is evidently hoping that the intervention of activist investors could compel GM CEO Mary Barra and company to proceed with a merger anyway. For precedent, he's looking at the recent negotiation between GM and some of its stakeholders that prompted the company to buy back $5 billion of its own shares, demonstrating Barra's willingness to deal with investors. The more compelling precedent, however, may have been set in 2006, when activist investor Kirk Kerkorian locked arms with Carlos Ghosn to get GM to consider joining the alliance between Renault and Nissan. GM ultimately declined, and Ghosn turned instead of Daimler (which of course has its own history of having merged with Chrysler). Only time will tell if this initiative will prove more successful, but one thing's for sure, and that's that Marchionne isn't about to relent in his pursuit of a major merger partner.