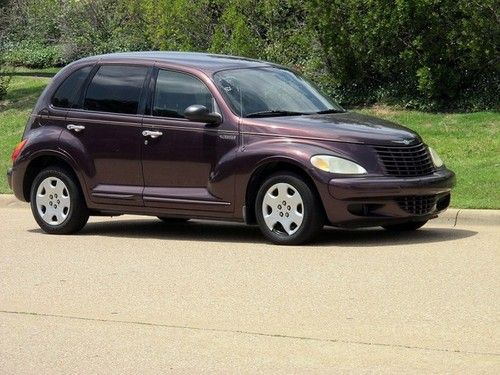

2004 Chrysler Pt Cruiser Touring 5spd. Power Windows Cold A/c! on 2040-cars

Carrollton, Texas, United States

Vehicle Title:Clear

For Sale By:Dealer

Engine:2.4L 2429CC 148Cu. In. l4 GAS DOHC Naturally Aspirated

Body Type:Wagon

Fuel Type:GAS

Make: Chrysler

Model: PT Cruiser

Trim: Base Wagon 4-Door

Disability Equipped: No

Doors: 4

Drive Type: FWD

Drive Train: Front Wheel Drive

Mileage: 92,107

Exterior Color: Purple

Number of Cylinders: 4

Interior Color: Black

Chrysler PT Cruiser for Sale

Cool white 4 door, stick shift, base

Cool white 4 door, stick shift, base 2005 "woody" chrysler pt cruiser gt convertible 2-door 2.4l(US $6,800.00)

2005 "woody" chrysler pt cruiser gt convertible 2-door 2.4l(US $6,800.00) 2002 pt cruiser limited edition wagon no reserve(US $1,500.00)

2002 pt cruiser limited edition wagon no reserve(US $1,500.00) We finance 04 limited edition auto low miles heated leather seats cd changer 82k(US $6,000.00)

We finance 04 limited edition auto low miles heated leather seats cd changer 82k(US $6,000.00) 2007 chrysler pt cruiser touring wagon(US $6,250.00)

2007 chrysler pt cruiser touring wagon(US $6,250.00) 2009 chrysler pt cruiser touring wagon 4-door 2.4l(US $8,400.00)

2009 chrysler pt cruiser touring wagon 4-door 2.4l(US $8,400.00)

Auto Services in Texas

Whatley Motors ★★★★★

Westside Chevrolet ★★★★★

Westpark Auto ★★★★★

WE BUY CARS ★★★★★

Waco Hyundai ★★★★★

Victorymotorcars ★★★★★

Auto blog

PSA shares rise following FCA's breakup with Renault

Thu, Jun 6 2019Shares in Groupe PSA, parent company of automakers Peugeot, Citroen and the DS brand, rose on Thursday as analysts considered the possibility that Fiat Chrysler could turn back to PSA after withdrawing its $35 billion merger offer for Renault. "Both parties have acknowledged the need for scale or [mergers and acquisitions] and may pursue other opportunities. If Nissan was an obstacle (to an FCA-Renault deal) PSA-FCA discussions could resume," wrote brokerage Jefferies. Back in March at the Geneva Motor Show, rumors started swirling that PSA was interested in a potential merger with FCA. Mike Manley, who took over at the helm of Fiat Chrysler following the death of Sergio Marchionne, had indicated a willingness to look into potential partnership options. Of course, that was all before FCA proposed a merger with Renault — with that deal now off the table, attention naturally turns back to PSA, which is also based in France. "We expect both shares to react negatively but see FCA having wider strategic options and Renault shares more downside risk near-term," said Jefferies. According to Reuters, PSA shares were up 1.5% at the time this was published, making it the top-performing stock on France's benchmark CAC-40 Index. Renault saw its shares slump 7%. Shares for FCA fell 3% in early trading on the Milan Stock Exchange. Considering that FCA said in its statement confirming the withdraw of its merger offer with Renault that "political conditions in France do not currently exist for such a combination to proceed successfully," we have to wonder how keen the company is to begin negotiations with another French automaker like PSA. Those thoughts were similarly voiced by Bernstein Research analyst Max Warburton, who said (via Forbes), "Expect PSA to rise on unrealistic hopes it may be FCA's next date." Earnings/Financials Chrysler Fiat Mitsubishi Nissan Citroen Peugeot Renault FCA renault-nissan

Fiat Chrysler chief still says EVs can't make money

Sun, Jun 12 2016Add Sergio Marchionne's insistence that it's impossible to make money on electric vehicle production to death and taxes among things we can all count on. The Fiat Chrysler Automobiles CEO, speaking in an interview with UK's Car Magazine, implied that Tesla Motors was "the iPhone of cars." The metaphor may have been mixed, as iPhones make plenty of cash for Apple, whereas Tesla has never made an annual profit from its electric vehicles. But the implication was that automakers should stick to what they know, and they don't know smartphones. Forget any upcoming presidential debates, we're waiting for one between Marchionne and Tesla chief Elon Musk. As for the development of autonomous-driving features? Those are another story, says Marchionne, and an area where he's far more in line with Musk. That's because the technology required to make a car safely accelerate, brake, and steer on its own is far cheaper than making a car with an electric drivetrain that offers similar range and performance to a car with an internal combustion engine, he says. As opposed to electrification, Fiat Chrysler has been going the route of modifying conventional powertrains via wringing out more power out of progressively smaller engines, and mating them with eight- and nine-speed transmissions. As for EVs, credit Marchionne for his consistency. Fiat Chrysler has been selling the Fiat 500e since 2013. That year, Wards Auto named the 500e motor to its 10 Best Engines list, while the 500e won Road & Track's 2013 award for best electric car. Still, Marchionne has long said that Fiat only makes the vehicle for to satisfy zero-emissions vehicle mandates in California, and that the company loses as much as $10,000 for every 500e that it sells. Related Video: Featured Gallery 2014 Fiat 500e News Source: Car Magazine via Hybrid VehiclesImage Credit: Andrew Harrer/Bloomberg via Getty Images Green Chrysler Fiat Electric Sergio Marchionne

The next steps automakers could take after sales drop again in April

Tue, May 2 2017DETROIT (Reuters) - Major automakers on Tuesday posted declines in U.S. new vehicle sales for April in a sign the long boom cycle that lifted the American auto industry to record sales last year is losing steam, sending carmaker stocks down. The drop in sales versus April 2016 came on the heels of a disappointing March, which automakers had shrugged off as just a bad month. But two straight weak months has heightened Wall Street worries the cyclical industry is on a downward swing after a nearly uninterrupted boom since the Great Recession's end in 2010. Auto sales were a drag on U.S. first-quarter gross domestic product, with the economy growing at an annual rate of just 0.7 percent according to an advance estimate published by the Commerce Department last Friday. Excluding the auto sector the GDP growth rate would have been 1.2 percent. Industry consultant Autodata put the industry's seasonally adjusted annualized rate of sales at 16.88 million units for April, below the average of 17.2 million units predicted by analysts polled by Reuters. General Motors Co shares fell 2.9 percent while Ford Motor Co slid 4.3 percent and Fiat Chrysler Automobiles NV's U.S.-traded shares tumbled 4.2 percent. The U.S. auto industry faces multiple challenges. Sales are slipping and vehicle inventory levels have risen even as carmakers have hiked discounts to lure customers. A flood of used vehicles from the boom cycle are increasingly competing with new cars. The question for automakers: How much and for how long to curtail production this summer, which will result in worker layoffs? To bring down stocks of unsold vehicles, the Detroit automakers need to cut production, and offer more discounts without creating "an incentives war," said Mark Wakefield, head of the North American automotive practice for AlixPartners in Southfield, Michigan. "We see multiple weeks (of production) being taken out on the car side," he said, "and some softness on the truck side." Rival automakers will be watching each other to see if one is cutting prices to gain market share from another, he said, instead of just clearing inventory. INVESTORS DIGEST BAD NEWS Just last week GM reported a record first-quarter profit, but that had almost zero impact on the automaker's stock. The iconic carmaker, whose own interest was once conflated with that of America's, has slipped behind luxury carmaker Tesla Inc in terms of valuation.