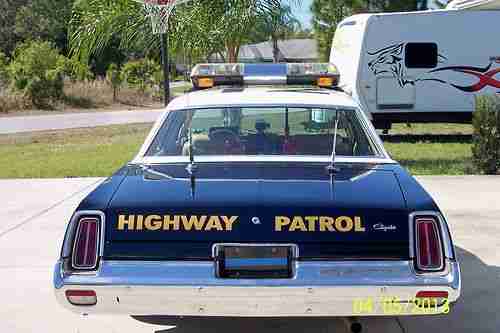

1976 Chrysler Newport Police Car Package on 2040-cars

North Port, Florida, United States

Body Type:Sedan

Engine:V-8

Vehicle Title:Clear

For Sale By:Private Seller

Interior Color: Tan

Make: Chrysler

Number of Cylinders: 8

Model: Newport

Trim: 4 DOOR

Warranty: Vehicle does NOT have an existing warranty

Drive Type: AUTOMATIC

Mileage: 63,000

Exterior Color: Black

Chrysler Newport for Sale

Classic red white big body convertible with good run and drive(US $6,750.00)

Classic red white big body convertible with good run and drive(US $6,750.00) 1965 chrysler newport - 2door h/t

1965 chrysler newport - 2door h/t 1963 chrysler newport convertible coupe(US $15,000.00)

1963 chrysler newport convertible coupe(US $15,000.00) 1963 chrysler newport beautiful with air conditioning

1963 chrysler newport beautiful with air conditioning !968 chrysler newport two tone teal and white(US $9,500.00)

!968 chrysler newport two tone teal and white(US $9,500.00) 1969 chrysler newport 4 door

1969 chrysler newport 4 door

Auto Services in Florida

Zych Certified Auto Repair ★★★★★

Xtreme Automotive Repairs Inc ★★★★★

World Auto Spot Inc ★★★★★

Winter Haven Honda ★★★★★

Wing Motors Inc ★★★★★

Walton`s Auto Repair Inc ★★★★★

Auto blog

PSA unions vote in favor of merger with Fiat Chrysler

Tue, Nov 19 2019PARIS — The majority of unions representing workers at Peugeot maker PSA are in favor of a planned $50 billion merger with Fiat Chrysler, PSA executives and union representatives said. However, the unions said that once the merger deal was signed, they would be seeking detailed information about the plans for the combined company. At a PSA works council meeting, all trade union representatives on the council voted to give a favorable opinion on the merger. "We will remain vigilant about the social impact and await a clearer and more detailed picture of the plan's implications for plants, volume, and how much work will be given to the foundries," said Franck Don, representative of the CFTC union. "But the project in the form it's been presented makes sense because the two groups complement each other, are in good financial health, and thanks to the new format will attain a critical size which is vital in the auto business today." The merger would help the firms pool resources to meet tough new emissions rules and investments in electric and self-driving vehicles, as well as counter a broader downturn in car markets. Securing support from Europe's powerful trade unions will be critical for the merged company, which will employ more than 400,000 staff and operate hundreds of factories worldwide. The deal has stirred concerns in Germany and Britain where plants making Opel and Vauxhall cars have seen jobs cut in recent year as part of a cost-cutting drive. UAW/Unions Chrysler Fiat Citroen Peugeot PSA

2015 Chrysler 200 sheds its frumpy past, V6 comes with AWD standard

Mon, 13 Jan 2014

The 2015 200 is the automotive equivalent of an ugly duckling turning into a swan.

In 2004, Chrysler's fullsize offerings were the lamentable Concorde and 300M - a pair of bloated, plasticky barges that hadn't received significant attention since before the dawn of the new millennium. Then, seemingly out of nowhere, Chrysler unveiled its new 300, which rode on the bones of a Mercedes-Benz E-Class and had the look of a Rolls-Royce with a thug-life upbringing. It was cool.

DoJ fines Japanese parts firms $740M in massive automotive price-fixing scandal

Fri, 27 Sep 2013Nine Japanese suppliers have pleaded guilty in US court over charges of price fixing in the automotive parts industry, resulting in the Department of Justice doling out a total of $740 million of fines, according to a report from Bloomberg. The scandal, which has resulted in General Motors, Ford, Toyota and Chrysler spending up to $5 billion on inflated parts and driving up prices on 25 million vehicles has sent the DoJ hustling into investigations. "The conduct this investigation uncovered involved more than a dozen separate conspiracies aimed at the U.S. economy," Attorney General Eric Holder (pictured above) said during yesterday's press conference.

As the investigation stands, the DoJ has issued $1.6 billion in fines against 20 companies and 21 individual executives, with 17 of the execs headed to prison. Deputy Assistant Attorney General Scott Hammond said, "The breadth of the conspiracies brought to light today are as egregious as they are pervasive. They involve more than a dozen separate conspiracies operating independently but all sharing in common that they targeted US automotive manufacturers."

Big-name suppliers indicted in the investigation include Mitsubishi Electric, Mitsubishi Heavy Industries, Hitachi Automotive and Mitsuba Corporation. A list of fines and other corporations named in the investigation is available at Bloomberg.