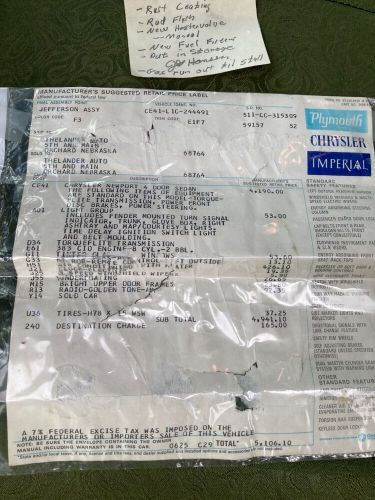

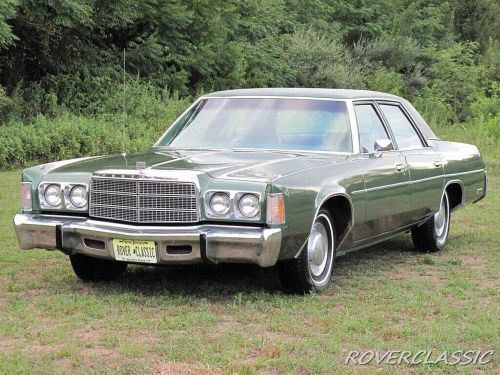

1971 Chrysler Newport on 2040-cars

Winside, Nebraska, United States

Transmission:Automatic

Vehicle Title:Clean

VIN (Vehicle Identification Number): CE41L1C244491

Mileage: 81000

Make: Chrysler

Model: Newport

Chrysler Newport for Sale

1977 chrysler newport(US $7,300.00)

1977 chrysler newport(US $7,300.00) 1962 chrysler newport(US $24,000.00)

1962 chrysler newport(US $24,000.00) 1955 chrysler newport windsor deluxe(US $17,200.00)

1955 chrysler newport windsor deluxe(US $17,200.00) 1977 chrysler newport(US $11,995.00)

1977 chrysler newport(US $11,995.00) 1977 chrysler newport(US $10,995.00)

1977 chrysler newport(US $10,995.00) 1961 chrysler newport(US $42,997.00)

1961 chrysler newport(US $42,997.00)

Auto Services in Nebraska

Siemer Auto Center ★★★★★

Nebraskaland Tire Company ★★★★★

Muths Motors ★★★★★

J A Automotive & Repair ★★★★★

Gary`s Quality Automotive ★★★★★

Gary Gross Auto Sales & Lsng ★★★★★

Auto blog

Huge Canadian sinkhole destroys four-lane road, swallows car

Fri, Jun 10 2016A major thoroughfare in the Canadian capital city of Ottawa was closed after a huge sinkhole opened beneath it. According to the CBC, the sinkhole appeared around mid-morning on Wednesday on Rideau Street near its intersection with Sussex Drive. The sinkhole, which initially formed over an unstable vein of sand, silt, and fractured rock, quickly spread across all four lanes of Rideau Street. A high-pressure natural gas line and a water main were shattered by the road collapse, filling the deep hole with water, gas, and fumes and forcing the evacuation of numerous surrounding buildings. All traffic save for buses and taxis had already been banned from the area due to excavation for a light rail station, but a Chrysler minivan parked along Rideau street fell into the hole as it expanded. Construction workers working in the light rail site evacuated safely once the road began collapsing, and no injuries were reported. Ottawa mayor Jim Watson told The Guardian that there was no sure way to tell how long repairs to Rideau Street would take. "It's a significant sinkhole in the downtown core. It has a major impact on our largest retail shopping center, one of our major hotels as well as one of the busiest intersections and bus routes." This is the second sinkhole to appear in downtown Ottawa in recent years. In 2014, a nearly thirty-foot wide sinkhole caused by excavation for the light rail system opened just a few blocks away from Rideau and Sussex. Watson stated that it is too soon to say whether or not Wednesday's sink hole was related to light rail construction. "We can't confirm whether the tunnel had any impact on the sinkhole or whether it was a water main break or whether it was a leak of some type that destabilized the soil." Watson went on to say that he hoped that city officials would be able to pinpoint the exact cause of the collapse soon. Related Video: News Source: The Guardian, CBC News Auto News Weird Car News Chrysler Minivan/Van sinkhole road

MotorWeek retro review revisits the Chrysler PT Cruiser

Mon, Jun 29 2015I have a long history with the Chrysler PT Cruiser. My mom was working at Automobile magazine when it launched, and she brought home their long-term tester all the time. My buddy Adam's mom bought one in the early 2000s, and I drove it on many an occasion. When I left Winding Road in early 2010 and joined Autoblog, the car I got on Day 1 was... well, I think you can guess. I will never forget driving that 2010 PT Cruiser to a rest stop outside of Toledo, Ohio, to meet then editor-in-chief John Neff and buy his old camera. I will also never forget the look on Neff's face when he pulled into the parking lot in his 1991 Ford Taurus SHO, saw the PT, and started laughing. I have always hated this car. But when it launched around the turn of the millennium, it was a huge deal – not just for Chrysler, but for the industry. Retro styling was all the rage, and the PT had it in spades. On top of that, it was seriously functional – one of the first widely accepted tall hatchbacks in an era where Americans wanted sedans. MotorWeek has now dug up its original PT Cruiser review for its latest retro review offering. Watch the video above to see what the ever-charismatic John Davis and his crew thought of the PT way back when it was actually relevant.

Are you the 2015 Chrysler 300?

Tue, 16 Sep 2014When Chrysler showed us its hand and revealed its five-year product plan to the world, we learned that the updated 300 sedan will bow at the LA Auto Show in November. Now, thanks to Allpar, we might have our first (super grainy) look at the new sedan a full two months ahead of its official debut.

Unlike its Dodge Charger platform mate, the new 300 isn't really all that different from the model currently on sale. That said, we're not sure if the changes shown here really reflect styling that we'd call "better," with the company's logo sort of floating at the top of the grille, and a more simplistic front end that lets the schnoz stick out a bit. Again, nothing drastic to talk about, but the new tweaks are kind of weak. Of course, we'll wait until we see the finished product in the metal before we make up our minds.

Don't expect things to change too much in terms of interior refinement or powertrain offerings, as well, with all the same leather and technology we've enjoyed in the 300 before, and the usual 3.6-liter Pentastar V6 and 5.7-liter Hemi V8 powertrain options. We'll know for sure when the car shows its freshened face in Los Angeles in November.