1964 Chrysler Newport Wagon No Post 413 V8 100% Original California Survivor on 2040-cars

San Diego, California, United States

|

~TERMS OF SALE - non refundable $1,000 deposit due 24 hours after auction ends. Car needs to be paid for in full within 3 days. I will do everything I can to make this a pleasant buying experience. Shipping is buyer's responsibility but I will be happy to assist if you like. Usually $300-$1200 door to door C.O.D. anywhere in the US. International buyers welcome. I can have the car transported to Los Angeles for overseas buyers. I encourage anybody who is interested to come look for themselves or send somebody. I live in San Diego and would be more than happy to pick you up at the airport to view the car in person. I do my best to represent and describe things honestly, accurately and to the best of my knowledge but at the end of the day this is still a classic car. This vehicle is being sold as-is, where is, with no warranty expressed written, or implied. The seller has described this vehicle to the best of his/her knowledge and shall not be responsible for possible missed items or description discrepancies, and makes no warranty in connection therewith. Any and all descriptions or representations are for identification purposes only and are not to be construed as a warranty of any type. It is the responsibility of interested parties to arrange for and pay to have this vehicle thoroughly inspected to their satisfaction within 24 hours prior to the bid ending. Seller assumes no responsibility for any repairs or liability. |

Chrysler Newport for Sale

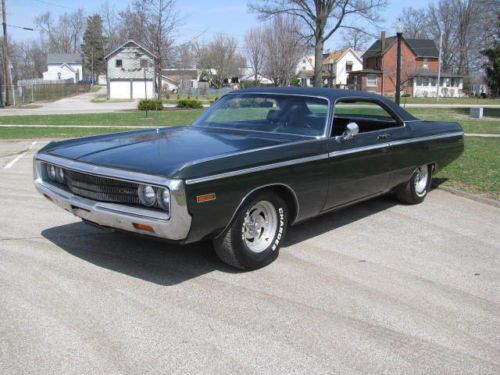

1970 chrysler newport custom coupe

1970 chrysler newport custom coupe 1974 chrysler newport custom hardtop 2-door 6.6l(US $4,995.00)

1974 chrysler newport custom hardtop 2-door 6.6l(US $4,995.00) Daily driver, blue, 4 door, good condition, 383, 6.3l, built in 1969 september

Daily driver, blue, 4 door, good condition, 383, 6.3l, built in 1969 september 1970 newport custom drive + show no reserve

1970 newport custom drive + show no reserve 1965 chrysler newport base hardtop 2-door 6.3l

1965 chrysler newport base hardtop 2-door 6.3l 1967 chrysler newport 300 convertible barn find !!!!(US $10,000.00)

1967 chrysler newport 300 convertible barn find !!!!(US $10,000.00)

Auto Services in California

Zoe Design Inc ★★★★★

Zee`s Smog Test Only Station ★★★★★

World Class Collision Ctr ★★★★★

WOOPY`S Auto Parts ★★★★★

William Michael Automotive ★★★★★

Will Tiesiera Ford Inc ★★★★★

Auto blog

2015 Chrysler 200 gets 36 mpg with Tigershark four-cylinder

Thu, 27 Mar 2014Chrysler has come out with the official fuel economy information on the new 200 following the info that was leaked from the EPA earlier this week. It turns out that our initial report of 18 miles per gallon in the city and 29 mpg on the highway for the all-wheel-drive V6 was correct.

What we didn't know at the time, though, was what sort of economy the 200's other powertrain options managed. Outfitted with the 2.4-liter four-pot, Chrysler is promising 23 mpg in the city and 36 mpg on the highway, with a combined rating of 28 mpg. Those figures are fairly impressive; besting figures of the 2.5-liter Ford Fusion and tying the 1.5-liter, EcoBoost, non-start-stop model. It's also beats the four-cylinder Toyota Camry's 35-mpg highway figure while tying its combined efficiency.

Stepping up to the 295-horsepower Pentastar V6 pushes the economy down to 19 mpg in the city, while the highway figure is a respectable 32 mpg for the front-driver. The combined rating for the FWD V6 is 23 mpg. Those figures can't quite match the 270-horsepower 2.0-liter, EcoBoost four of the Fusion, which nets 22 city and 33 highway. In fact, the V6 200 has trouble besting even the 3.5-liter V6 of the Camry, which returns 21 mpg city and 31 mpg highway. Again, though, the 200 is noticeably more powerful.

How to update and secure a vulnerable Chrysler Uconnect system

Sat, Jul 25 2015If you own one of the 1.4 million vehicles affected by the recent Chrysler software recall, you may want to watch this video. In it, we explain how to get the latest infotainment software loaded onto the 8.4-inch Uconnect system. The recall was a response to the findings of researchers who were able to hack into and remotely control a 2014 Jeep Cherokee through its cellular connection. Although Fiat Chrysler has worked with Sprint to plug most of the holes on the carrier side, there are still some vulnerabilities that only this latest software version can patch. Owners have three options to get the update: download it now, wait for a USB stick in the mail, or take the vehicle to an FCA dealer. Chrysler will be sending USB sticks loaded with the software update to customers. Anyone with an internet connection and a USB stick of their own with at least 4 GB capacity can speed things up by downloading the patch from the Uconnect website. We cover that process from start to finish in the video, with the final portion still applicable to those using the FCA-supplied USB stick. If after watching this you still don't want to tackle the patch yourself, you can take your vehicle to the dealer to have it done. Also note that this process is the same for all Uconnect updates, not just the one patching the exploits. Our demonstrator vehicle is a 2015 Ram 1500 pickup. The procedure should be very similar on other products with the 8.4-inch Uconnect system, with only the location of the USB port varying. Once you have the USB stick with the software on it – either after having downloaded it yourself or receiving it in the mail from Chrysler – the installation process is relatively simple. It takes about 15 minutes to perform the update; we edited out the wait in the video. To check whether or not your car's 8.4-inch Uconnect system is running the latest software, go to System Information on the touch screen's Settings page and look at Software Version. The update related to the recall is version 15.17.5. Related Video: Recalls Chrysler Dodge Jeep RAM Safety Technology Infotainment Videos Original Video hacking

Fiat-Chrysler shows its SEMA lineup

Fri, 24 Oct 2014Fiat Chrysler Automobiles already previewed its 2014 SEMA show lineup with some slick renders. Now, the automaker has finally showed us the actual cars, and among the group there are definitely some that stand out more than others.

Dodge is really showing off its muscle at this year's show with four concepts that all pump up the power of the brand's models. Perhaps most interesting among them is the Challenger T/A Concept (pictured above) in striking Sublime Green and matte black. It's meant to resemble the classic Trans Am racer from the '70s. Under the hood is a 6.4-liter V8, and to fit the vintage style there's a pistol-grip gearshift inside.

The Charger R/T also gets some attention with the Mopar concept that shows off what FCA's aftermarket performance arm can do. Mods include an updated body kit, cold-air intake for the 5.7-liter V8 and a coil-over suspension kit. Beyond that, the Dart R/T Concept looks a lot meaner with a black hood with duct work that leads straight to the air intake. The rest of the compact sedan is dolled up in O-So-Orange paint and is fitted with upgrades to improve handling like a coil-over suspension and big brake kit from the Mopar catalog.