4 Door Brougham Hardtop on 2040-cars

Addison, Illinois, United States

Body Type:Sedan

Engine:V8 440 CID 4BBL

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Private Seller

Interior Color: White

Make: Chrysler

Number of Cylinders: 8

Model: New Yorker

Trim: 4 Door Hardtop

Drive Type: RWD

Power Options: Air Conditioning, Cruise Control, Power Windows, Power Seats

Mileage: 53,158

Exterior Color: Regal Blue Metallic Body White Top

For your consideration is a gorgeous 1973 Chrysler New Yorker Brougham. This a one owner car, purchased new by me in 1973. This car has undergone elaborate maintenance and is therefore in pristine condition. This car has never been in an accident, which accounts for the straight lines of the fit and finish. I would suggest you will never find another hard top in this amazing condition for such a little amount of money.

Mechanically this car is in excellent condition right down to its five (5) matching white wall tires. The lucky buyer would need to put forth NO effort to show this car.

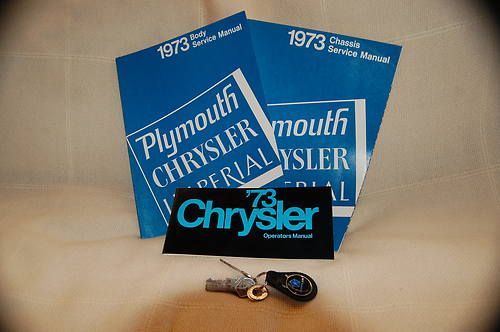

Comes with original books and manuals as if new.

Chrysler New Yorker for Sale

Chrysler 5th avenue fifth ave. new yorker 1989 42k original miles leather 5.2l(US $2,995.00)

Chrysler 5th avenue fifth ave. new yorker 1989 42k original miles leather 5.2l(US $2,995.00) 1973 chrysler new yorker brougham hardtop 4-door 440 engine

1973 chrysler new yorker brougham hardtop 4-door 440 engine 1973 chrysler new yorker 2 door v-8 automatic(US $2,500.00)

1973 chrysler new yorker 2 door v-8 automatic(US $2,500.00) 1978 chrysler new yorker brougham hardtop 4-door 7.2l 440 v8 727 auto 82k miles

1978 chrysler new yorker brougham hardtop 4-door 7.2l 440 v8 727 auto 82k miles Classic chrysler new yorker landau roof v-6 leather loaded runs great no reserve

Classic chrysler new yorker landau roof v-6 leather loaded runs great no reserve 1966 chrysler new yorker rare 2 door(US $11,800.00)

1966 chrysler new yorker rare 2 door(US $11,800.00)

Auto Services in Illinois

X Way Auto Sales ★★★★★

Twins Auto Body Shop ★★★★★

Trevino`s Transmission & Auto ★★★★★

Thompson Auto Supply ★★★★★

Sigler`s Auto Ctr ★★★★★

Schob`s Auto Repair ★★★★★

Auto blog

Dodge shows can-do attitude with grand Can'avan sculpture

Fri, 01 Nov 2013There are lots of ways to celebrate an important birthday, and all of them are well deserved. You can throw a big party, buy yourself something nice, or - if you're the altruistic type - do something for others in need. The latter is how Chrysler has opted to mark the 30th anniversary of its Dodge Grand Caravan and Chrysler Town & Country.

Together with hunger-advocacy organization Canstruction, the Chrysler Foundation has built a full-scale replica of the Grand Caravan out of 30,000 food cans in the square at the corner of Yonge and Dundas in Toronto, a ways down the highway from where the real vans are built in Windsor. The sculpture was built over the course of 10 hours by 30 volunteers and was displayed earlier this week.

Now the installation is being taken down, and the cans of food are being donated to the Daily Bread Food Bank, which will assemble them into 2,000 food baskets to be distributed to those in need through its network of 200 food banks across the Canadian metropolis. Check out a neat time-lapse video of the build and the press release below.

Henrik Fisker interview, and driving the Polestar 2 | Autoblog Podcast #643

Thu, Sep 3 2020In this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Senior Editor, Green, John Beltz Snyder. They've been driving the updated 2021 Honda Odyssey, the 2020 Mercedes-AMG GLC 43 and the new Polestar 2 electric sedan. After reviewing those, they talk about how the Chrysler 300 appears to be withering on the vine. Next, they take time to talk to legendary automotive designer and eponymous Chairman & CEO of Fisker Inc., Mr. Henrik Fisker himself, about jeans, horses and, of course, electric cars. Finally, they help a listener pick a $100,000 supercar in the "Spend My Money" segment. Autoblog Podcast #643 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Cars we're driving 2021 Honda Odyssey 2020 Mercedes-AMG GLC 43 2020 Polestar 2 Chrysler 300 soldiers on for 2021 with pared-down range, higher price Henrik Fisker interview Spend My Money Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video:

Stellantis reports $15B profit in first year of merger

Wed, Feb 23 2022FRANKFURT, Germany — Automaker Stellantis said Wednesday that it made 13.4 billion euros ($15.2 billion) in its first year after it was formed from the merger of Fiat Chrysler Automobiles and PSA Group. The earnings nearly tripled profits compared with its pre-merger existence as two separate companies, as the maker of Jeep, Opel and Peugeot vehicles exploited cost efficiencies from combining the businesses. The result compared to a combined 4.79 billion euros for the separate companies in 2020 before the merger, which took effect on Jan. 17, 2021. Revenue for the combined business rose 14%, to 152 billion euros. CEO Carlos Tavares said the results “prove that Stellantis is well positioned to deliver strong performance" and had overcome “intense headwinds” during the year. Automakers have struggled with shortages of key parts such as semiconductor electronic components and rising costs for raw materials as the global rebound from the worst of the coronavirus pandemic brings more demand. The company said the benefits of the merger were worth some 3.2 billion euros during the year. Mergers can lead to streamlined costs as companies combine functions and spread fixed costs over a larger revenue base. The company accelerated its rollout of battery-powered vehicles, with sales of low-emission vehicles reaching 388,000 — an increase of 160%. Stricter environmental regulations in Europe and China are pushing automakers to roll out more electric vehicles with longer range. Stellantis started production of a hydrogen fuel cell commercial van under its Opel brand in December. Stellantis' other brands include Chrysler, Citroen, DS, Fiat, Maserati, Ram and Vauxhall. Related video: Earnings/Financials Chrysler Dodge Ferrari Fiat Jeep RAM Citroen Opel Peugeot Vauxhall