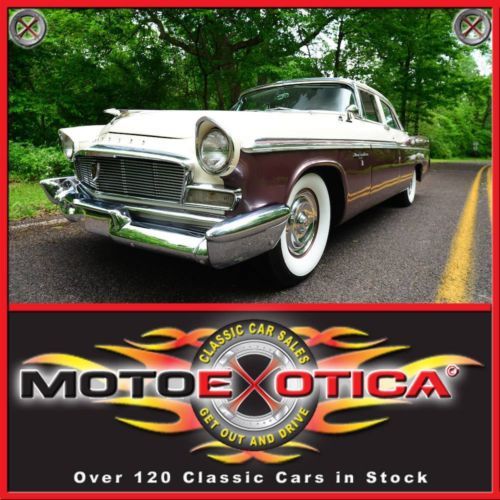

1956 Chrysler New Yorker-fresh Chrome And Paint-rebuilt 354 Cid Hemi-awesome! on 2040-cars

Saint Louis, Missouri, United States

Engine:354 CID V8 HEMI

For Sale By:Dealer

Year: 1956

Drive Type: RWD

Make: Chrysler

Mileage: 91,183

Model: New Yorker

Warranty: Vehicle does NOT have an existing warranty

Trim: NEW YORKER

Chrysler New Yorker for Sale

1977 chrysler new yorker brougham hardtop 4-door 7.2l

1977 chrysler new yorker brougham hardtop 4-door 7.2l 1979 chrysler new yorker(US $7,500.00)

1979 chrysler new yorker(US $7,500.00) Beautiful vintage 1964 chrysler new yorker "salon"(US $7,999.00)

Beautiful vintage 1964 chrysler new yorker "salon"(US $7,999.00) 1953 chrysler new yorker with real deal hemi and fluid drive automatic

1953 chrysler new yorker with real deal hemi and fluid drive automatic 1961 chrysler new yorker wagon

1961 chrysler new yorker wagon 1939 chrysler new yorker with rare double spare tire fenders !(US $15,000.00)

1939 chrysler new yorker with rare double spare tire fenders !(US $15,000.00)

Auto Services in Missouri

Wyatt`s Garage ★★★★★

Woodlawn Tire & Auto Center ★★★★★

West County Auto Body Repair ★★★★★

Tiger Towing ★★★★★

Straatmann Toyota ★★★★★

Scott`s Auto Repair ★★★★★

Auto blog

2015 Chrysler 200 caught looking good after leaking out

Tue, 07 Jan 2014We can't yet share all the details on the 2015 Chrysler 200 sedan, but we can direct your attention to the image above, which was published by the boys at Jalopnik after Chrysler reportedly let it out by accident. As you can see, the new 200 will be a nicely styled piece of machinery.

According to leaked documentation, the 2015 Chrysler 200 will come with the buyer's choice of a 2.4-liter Tiger Shark four-cylinder engine with 184 horsepower and 173 pound-feet of torque or a 3.6-liter Pentastar V6 boasting 295 horses and 262 lb-ft. Those ponies will be routed through a nine-speed automatic with a rotary gear selector, sending power to the front wheels. Alternatively, a high-tech all-wheel-drive system will be available that can electronically disconnect the rear axle, saving fuel.

Speaking of fuel efficiency, the 2015 200 will be able to achieve up to 35 miles per gallon on the highway, which is an impressive figure for this class. An on-sale date has yet to be announced, but the next 200 will start at $21,700 (plus $995 for destination) when it does finally hit dealerships.

For his last act, Marchionne will outline an EV/hybrid roadmap this week

Wed, May 30 2018MILAN/LONDON — Fiat Chrysler (FCA) boss Sergio Marchionne is expected to outline new plans for electric and hybrid cars in a strategy presentation on Friday, aiming to ensure the world's seventh-largest carmaker remains in the race in the absence of a merger. The 65-year-old will present FCA's strategy to 2022, his final contribution to the company he turned around and multiplied in value through 14 years of canny dealmaking. After failing to secure a tie-up he said was necessary to manage the costs of producing cleaner vehicles, Marchionne needs to show the group can keep churning out profits on its own, even as emissions rules tighten, SUV competition intensifies and worries around his succession abound. Marchionne had long refused to jump on the electrification bandwagon, saying he would only do so if selling battery-powered cars could be done at a profit. He even urged customers not to buy FCA's Fiat 500e, its only battery-powered model, because he was losing money on each sold. But Tesla's success and the need to comply with tougher emissions rules have forced Marchionne to commit to what he calls "most painful" spending. "FCA is way behind rivals in terms of hybrid and electric vehicles and they need to hit the accelerator to convince investors they can close that gap," said Andrea Pastorelli, a fund manager at 8a+ Investimenti. Germany's Volkswagen, Daimler, BMW and U.S. rivals GM and Ford have committed to spending billions of euros each in coming years to try produce profitable cars powered by cleaner fuels. FCA needs to present a clear roadmap, just like Volvo Cars, which ditched diesel from its best-selling XC60 SUV, launched a new electric brand and pledged to shift all brands to hybrid by 2019, a banking source close to FCA said, noting: "The tech divide determines winners and losers in the industry." Marchionne has already said half of the wider FCA fleet will incorporate some elements of electrification by 2022, while luxury marque Maserati will spearhead FCA's electrification drive by making all new models due after 2019 electric. But its plans remain vaguer and less advanced than most big rivals and some investors wonder about the capital required to make vehicles compliant, and what share of spending can go to electrification given FCA's numerous demands.

Weekly Recap: Chrysler forges ahead with new name, same mission

Sat, Dec 20 2014Chrysler is history. Sort of. The 89-year-old automaker was absorbed into the Fiat Chrysler Automobiles conglomerate that officially launched this fall, and now the local operations will no longer use the Chrysler Group name. Instead, it's FCA US LLC. Catchy, eh? Here's what it means: The sign outside Chrysler's Auburn Hills, MI, headquarters says FCA (which it already did) and obviously, all official documents use the new name, rather than Chrysler. That's about it. The executives, brands and location of the headquarters aren't changing. You'll still be able to buy a Chrysler 200. It's just made by FCA US LLC. This reinforces that FCA is one company going forward – the seventh largest automaker in the world – not a Fiat-Chrysler dual kingdom. While the move is symbolic, it is a conflicting moment for Detroiters, though nothing is really changing. Chrysler has been owned by someone else (Daimler, Cerberus) for the better part of two decades, but it still seemed like it was Chrysler in the traditional sense: A Big 3 automaker in Detroit. Now, it's clearly the US division of a multinational industrial empire; that's good thing for its future stability, but bittersweet nonetheless. Undoubtedly, it's an emotion that's also being felt at Fiat's Turin, Italy, headquarters as the company will no longer officially be called Fiat there. Digest that for a moment. What began in 1899 as the Societa Anonima Fabbrica Italiana di Automobili Torino – or FIAT – is now FCA Italy SpA. In a statement, FCA said the move "is intended to emphasize the fact that all group companies worldwide are part of a single organization." The new names are the latest changes orchestrated by CEO Sergio Marchionne, who continues to makeover FCA as an international automaker that has ties to its heritage – but isn't tied down by it. Everything from the planned spinoff of Ferrari, a new FCA headquarters in London and the pending demise of the Dodge Grand Caravan in 2016 has shown that the company is willing to move quickly, even if it's controversial. While renaming the United States and Italian divisions were the moves most likely to spur controversy, FCA said other regions across the globe will undergo similar name changes this year. Despite the mixed emotions, it's worth noting: The name of the merged company that oversees all of these far-flung units is Fiat Chrysler Automobiles. Obviously the Chrysler corporate name isn't completely history.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.077 s, 7830 u