1947 Chrysler New Yorker on 2040-cars

Lebanon, Pennsylvania, United States

Engine:FLATHEAD 8

Body Type:Sedan

Vehicle Title:Clear

Exterior Color: Black

Model: New Yorker

Number of Cylinders: 8

Trim: NEW YORKER

Drive Type: REAR

Mileage: 76,234

EXTREMELY CLEAN 1947 CHRYSLER NEW YORKER

LOW MILES

BLUE VELVET INTERIOR

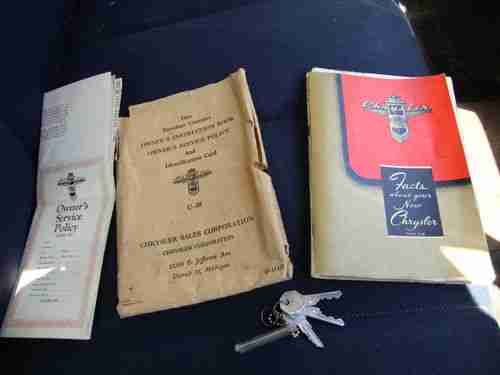

3 OWNERS

RUNS AND DRIVES SUPER

DRIVE IT HOME

NO RUST OR BODY REPAIRS

ORIGINAL EXCEPT FOR SOME PAINT WORK

RADIO AND HEATER WORK

NEW BRAKES

STATE INSPECTED

CALL BOB 717 273 9951 FOR A COMPLETE WALK AROUND ON THIS BEAUTY

SOLD AS IS WHERE IS

MILES MAY BE EXEMPT ON TITLE PER PA STATE LAW

GREAT CAR AND PRICED BELOW RETAIL

Chrysler New Yorker for Sale

1963 chrysler new yorker

1963 chrysler new yorker 1982 chrysler new yorker fifth avenue 22k

1982 chrysler new yorker fifth avenue 22k 1989 chrysler new yorker landau sedan 4-door 3.0l mark cross edition(US $4,300.00)

1989 chrysler new yorker landau sedan 4-door 3.0l mark cross edition(US $4,300.00) 1992 chrysler new yorker fifth avenue sedan 4-door 3.3l(US $800.00)

1992 chrysler new yorker fifth avenue sedan 4-door 3.3l(US $800.00) 1949 chrysler new yorker convertible body off restoration beautiful must see

1949 chrysler new yorker convertible body off restoration beautiful must see 1954 chrysler new yorker deluxe

1954 chrysler new yorker deluxe

Auto Services in Pennsylvania

Zuk Service Station ★★★★★

york transmissions & auto center ★★★★★

Wyoming Valley Motors Volkswagen ★★★★★

Workman Auto Inc ★★★★★

Wells Auto Wreckers ★★★★★

Weeping Willow Garage ★★★★★

Auto blog

Chrysler investing $20M in Toledo plant to support 9-speed auto production

Sun, 28 Apr 2013In 2011, Chrysler announced a $72-million investment in its Toledo Machining Plant to modernize production of the eight- and nine-speed torque-converters for automatic transmissions made there. That upgrade work won't be finished until Q3 of this year, but Chrysler has already announced a further $19.6-million investment to increase production capacity for the nine-speeders.

The extra units will be necessary because the nine-speed transmission they'll be mated to is going into three popular models: it will debut on the 2014 Jeep Cherokee, then go into the Chrysler 200 and Dodge Dart. The company predicted that this year alone it would sell 200,000 units equipped with the nine-speed tranny, and it is spending some $374 million in addition to the investment in Toledo to upgrade production capacity for it.

The work attached to this new investment won't begin until Q3 of 2014, and it will be finished by the end of that year. There's a press release below with all the details.

Fiat pondering swallowing rest of Chrysler, US IPO

Wed, 24 Apr 2013At the moment, Fiat is in court with the United Auto Workers, waiting for the justice system to provide some guidance on a fair price for 41.5-percent of Chrysler it doesn't own. Fiat owns 58.5 percent of the company and wishes to buy the remainder, which is owned by the union's VEBA retiree trust, but the Italian company and the UAW are on different sides of the galaxy when it comes to assigning a fair price to that outstanding stake.

Naturally, Fiat CEO Sergio Marchionne is considering his options. A new report in the The Wall Street Journal says one of the scenarios being considered now is - depending on the outcome of the court case - to purchase the 41.5-percent stake and then issue an IPO to recoup some of the cost. About two months ago, Marchionne put the odds of an IPO for a wholly combined Fiat/Chrysler at 50 percent. Even with the WSJ report, it's not clear if those odds have changed.

The current company structure leaves a lot of options as to how a potential IPO could be issued, but it's said that Marchionne is against it, preferring "to be one company," under Fiat, indivisible. If Fiat is finally able to purchase all of the Pentastar, it would get access to Chrysler's war chest, pegged at $11.9 billion at the end of Q3 in 2012, and that money can't come soon enough for a brand taking a beating in Europe and delaying product over cash concerns.

Chrysler and Google launch virtual 200 factory tour [w/video]

Tue, 23 Sep 2014Google is no stranger to showing off some of the most interesting automotive destinations in the world, like the museums for Lamborghini and Ducati, or even a Tesla showroom. However, it's taking that technology even further with a new, in-depth look of the Sterling Heights Assembly Plant where the Chrysler 200 is made. Unlike these earlier online excursions, the new Chrysler factory tour is a fully guided experience that includes several 360-degree videos explaining many parts of the production process.

"Just as we pioneered a completely new Chrysler 200, we are pioneering a new way for consumers to research a vehicle. The Factory Tour is an opportunity for us to prove to consumers that the all-new 2015 Chrysler 200 is not one ever built before," said Olivier Francois, Chrysler's chief marketing officer, in the company's release.

Chrysler was already pretty proud of its nearly $1 billion in recent updates to the Sterling Heights factory having released a look at the 200's assembly process earlier this year. However, the new Google tour goes far deeper by including 12 videos, and between highlighted stops, viewers can swing the camera all over to get a full view of the action. The whole thing is an intriguing way to show the way a modern car gets built.