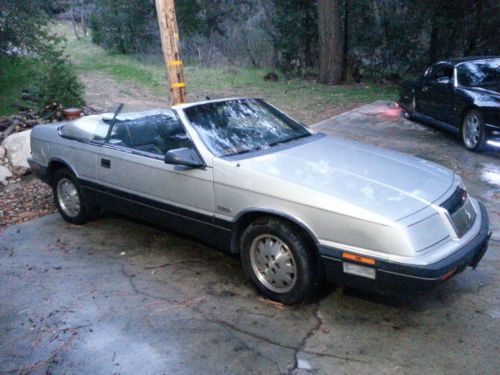

Convertible Classic 1994 Chrysler Lebaron Gtc White On White 55,000 Miles on 2040-cars

Daytona Beach, Florida, United States

|

GREAT GET AROUND CAR AND NICE FOR THE BEACH. HAVE OWNED 17 YEARS. ONLY DRIVING ABOUT 250 MILES A YEAR AS SITS IN FLORIDA 9 MONTHS OF YEAR. NEW TOP 2 YEARS AGO. NEW PAINT 3 YEARS AGO DUE TO JOY RIDING KIDS SCRATCHED IT UP PRETTY BADLY. NOT THE BEST PAINT JOB, BUT LOOKS GOOD AS PICTURES SHOW. FUN TO DRIVE AND RUNS GOOD. INTERIOR NEEDS 1 LENS AND A COUPLE STICK ON PLASTIC PIECES, (SALVAGE YARD). WINDOW RUBBER CHANNELS WOULD HELP TO MAKEWINDOWS WORK BETTER. EMAIL ANY QUESTIONS PLEASE BEFORE YOU BID. I WANT YOU TO BE SATISFIED. |

Chrysler LeBaron for Sale

Beautiful 1988 le baron convertible - looks like almost new

Beautiful 1988 le baron convertible - looks like almost new 1982 chrysler lebaron convertible 1-owner! 45k miles barn find!! ...no reserve!!

1982 chrysler lebaron convertible 1-owner! 45k miles barn find!! ...no reserve!! Gtc 2.2l turbocharged power steering 4-wheel disc brakes front wheel drive a/c(US $9,900.00)

Gtc 2.2l turbocharged power steering 4-wheel disc brakes front wheel drive a/c(US $9,900.00) Collectors k car 1982 chrysler lebaron medallion mark cross edition convertible

Collectors k car 1982 chrysler lebaron medallion mark cross edition convertible 1995 chrysler lebaron gtc convertible , low miles , everything works !!

1995 chrysler lebaron gtc convertible , low miles , everything works !! 1978 chrysler lebaron base sedan 4-door 5.2l

1978 chrysler lebaron base sedan 4-door 5.2l

Auto Services in Florida

Zip Automotive ★★★★★

X-Lent Auto Body, Inc. ★★★★★

Wilde Jaguar of Sarasota ★★★★★

Wheeler Power Products ★★★★★

Westland Motors R C P Inc ★★★★★

West Coast Collision Center ★★★★★

Auto blog

Fiat Chrysler’s Sergio Marchionne throws more cold water on Tesla, EVs

Tue, Oct 10 2017Fiat Chrysler CEO Sergio Marchionne has once again sounded off on industry upstart Tesla and its wunderkind boss, Elon Musk. In the process, he doubled down on FCA's reluctance to follow its competitors headlong into electrifying its vehicle fleet, saying "we're not betting the bank on going fully electric in the next decade. It won't happen." Marchionne made his comments on Monday during remarks at the New York Stock Exchange, where he was marking the 70th anniversary of Ferrari. They come as Tesla struggles to ramp up production of its Model 3 sedan, its first mass-market offering, and the company continues to hemorrhage money. Here's what he said: "We still don't have a viable model for delivering an electric car. As much as I like Elon Musk, and he's a good friend, and actually he's done a phenomenal job of marketing Telsa, I remain unconvinced of a new economic viability of the model that he's pitching. So I think we need to be careful, because when we embrace electrification, and I made comments on the fact that we lose money on every Fiat 500, the electric that we sell in the U.S. Now that's reflective of the 2011-2010 costs in terms of components. Those costs have come down. If I were to do it again, I would certainly reduce the amount of the loss, but I would not make any money. And you can't run economic entities on losses. It doesn't happen. "So how do we find a convergence of technology bringing prices of components down and allows us to price accordingly — or we need to navigate through this process in a combined way between combustion and electrification to yield at least a minimum of economic returns that allows for our continuity? The last thing you want is me to be successful selling cars for 24 months and then go bust. That's not a good story. Especially in a place like this which rewards economic success. Let's not sit here and design our own future in the tank. Let's try and do it properly. We will do all the right things. We are investing without making a lot of noise on electrification. We will combine it with combustion to yield the right level of CO2. But we're not betting the bank on going fully electric in the next decade. It won't happen." It's not the first time Marchionne has publicly expressed doubts about Tesla's business plan.

Honda and Chrysler EV news, and talking with GM's charging ecosystem boss | Autoblog Podcast #781

Fri, May 19 2023In this episode of the Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Senior Editor, Green, John Beltz Snyder. They're excited about the news of the possibility of an electric sports car being revealed for Honda's 75th anniversary, as well as the completely revamped — redesigned and renamed — Chrysler Airflow. They've been driving the Bentley Bentayga EWB, Range Rover, Toyota GR Corolla and the refreshed Buick Encore GX. We listen to a interview Greg conducted with GM's EV charging boss, Hoss Hassani. Finally, a reader is looking to help his in-laws choose an SUV, possibly a hybrid or EV, to replace a BMX X3. Send us your questions for the Mailbag and Spend My Money at: Podcast@Autoblog.com. Autoblog Podcast # 781 Get The Podcast Apple Podcasts – Subscribe to the Autoblog Podcast in iTunes Spotify – Subscribe to the Autoblog Podcast on Spotify RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown News Honda electric sports car could be unveiled this year Chrysler Airflow being redesigned and renamed for production Cars we're driving 2023 Bentley Bentayga EWB Azure First Edition 2023 Land Rover Range Rover SE LWB 2023 Toyota GR Corolla Morizo 2024 Buick Encore GX Avenir Interview with Hoss Hassani, General Motors Vice President and EV Charging Ecosystem Spend my Money Feedback Email – Podcast@Autoblog.com Review the show on Apple Podcasts Autoblog is now live on your smart speakers and voice assistants with the audio Autoblog Daily Digest. Say “Hey Google, play the news from Autoblog” or "Alexa, open Autoblog" to get your favorite car website in audio form every day. A narrator will take you through the biggest stories or break down one of our comprehensive test drives. Related video: Green Podcasts Bentley Buick Chrysler GM Honda Land Rover Toyota Green Automakers Crossover Hatchback SUV Electric Future Vehicles Luxury Performance Sedan

NHTSA looking into non-Takata airbag shrapnel case

Tue, Jul 14 2015The global airbag inflator recall from Takata has been one of the biggest topics in auto safety for months. Now, the National Highway Traffic Safety Administration is opening a preliminary evaluation into the components from Arc Automotive to investigate whether two reported ruptures and two injuries signal a wider problem. So far, only the 2002 Chrysler Town & Country and 2004 Kia Optima are believed to be affected. If a safety campaign is deemed necessary, it could cover an estimated 420,000 of the minivans and 70,000 of the Korean sedans. NHTSA first noticed these ruptures in December 2014. The agency received a complaint of a 2009 case in Ohio about the bursting of the driver's side inflator in a 2002 Town & Country. According to the report, the incident broke the woman's jaw and sent shrapnel into her chest. The government investigated the case, and this was found to be the only known occurrence in these vehicles. The analysis indicated the part's gases were possibly blocked somehow and caused the component to explode. FCA US spokesperson Eric Mayne told Autoblog that the company is "cooperating fully" with NHTSA. "Also, we no longer use that inflator," he said. A second incident came to NHTSA's attention in June 2015 with the driver's side rupture in a 2004 Optima in New Mexico. The agency lists fewer details about the case, and a root cause isn't known. This is also the only currently known example in a Kia vehicle. According to a statement from Kia to Autoblog, "We are taking this matter very seriously and support NHTSA's action and will continue working cooperatively with the agency and suppliers throughout the process." Arc's components are sealed within a steel housing that's meant to protect them from "external atmospheric conditions," according to NHTSA. Multiple suppliers also use them. In the Chrysler, the airbag module came from Key Safety Systems and from Delphi in the Kia. In a statement to Autoblog the company said, "We have received NHTSA's notification and are cooperating fully with its Preliminary Evaluation." At this time, NHTSA admits that it doesn't know for certain whether these two cases are linked. The agency is conducting this preliminary evaluation to learn more.