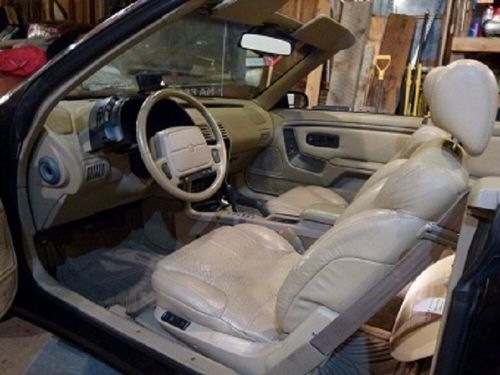

1993 Chrysler Lebaron on 2040-cars

Pinckney, Michigan, United States

Transmission:Automatic

Vehicle Title:Clean

VIN (Vehicle Identification Number): 1C3XU5533PF673718

Mileage: 37600

Model: LeBaron

Make: Chrysler

Chrysler LeBaron for Sale

1985 chrysler lebaron(US $2,000.00)

1985 chrysler lebaron(US $2,000.00) 1988 chrysler lebaron convertible(US $10,995.00)

1988 chrysler lebaron convertible(US $10,995.00) 1986 chrysler lebaron(US $11,500.00)

1986 chrysler lebaron(US $11,500.00) 1991 chrysler lebaron(US $1,000.00)

1991 chrysler lebaron(US $1,000.00) 1995 chrysler lebaron gtc(US $6,000.00)

1995 chrysler lebaron gtc(US $6,000.00) 1985 chrysler lebaron(US $2,000.00)

1985 chrysler lebaron(US $2,000.00)

Auto Services in Michigan

Winners Auto & Cycle ★★★★★

Westborn Auto Service ★★★★★

Weber Transmission Company ★★★★★

Vaneck Auto Body ★★★★★

US Wheel Exchange ★★★★★

U Name IT Auto ★★★★★

Auto blog

UAW may be key to forced FCA merger with GM

Wed, Jul 29 2015Sergio Marchionne doesn't give up on a business deal easily. While outwardly not much has recently been said about FCA's attempted merger with General Motors, Marchionne might be hoping to garner a powerful, new ally that could help break things wide open. The United Auto Workers retiree health care trust is the single largest shareholder of GM with 8.7 percent of the stock, and having its support would certainly improve FCA's position in getting a deal done. "Whatever happens in terms of consolidation, it would never be done without the consent and support of the UAW," Marchionne said when FCA recently began contract talks with the UAW, The Detroit News reports. The boss is also allegedly on good terms with the union president Dennis Williams. Still, using the organization for a hostile takeover could be very difficult because of the way its votes are structured. Other activist investors might already be on board, though. Marchionne believes that consolidation in the industry is vital because automakers are investing to create the same technologies. A GM/FCA merger still has many roadblocks, though, including the fact that Marchionne's company is smaller than GM. From a regulatory perspective, the size of the merged company could raise serious anti-trust concerns among regulators, according to The Detroit News. There's also the concern for lost jobs from redundant work with the two combined businesses. Even if the UAW angle doesn't work out, there are contingency plans afoot for other merger targets. According to The Detroit News speaking to anonymous insiders, FCA bigwigs have a meeting in London on Thursday to take a close look at other options. In addition to GM, they are investigating possible deals with Volkswagen and the Renault-Nissan Alliance. In the past, PSA Peugeot Citroen and multiple Asian automakers have also been brought up as partners, and UBS has reportedly been providing financial advice on what to do.

Stellantis ready to kill brands and fix U.S. problems, CEO Tavares says

Thu, Jul 25 2024Â MILAN — Stellantis is taking steps to fix weak margins and high inventory at its U.S. operations and will not hesitate to axe underperforming brands in its sprawling portfolio, its chief executive Carlos Tavares said on Thursday. The warning for lossmaking brands is a turnaround for Tavares, who has maintained since Stellantis was created in 2021 from the merger of Italian-American automaker Fiat Chrysler and France's PSA that all of its 14 brands including Maserati, Fiat, Peugeot and Jeep have a future. "If they don't make money, we'll shut them down," Carlos Tavares told reporters after the world's No. 4 automaker delivered worse-than-expected first-half results, sending its shares down as much as 10%. "We cannot afford to have brands that do not make money." The automaker now also considers China's Leapmotor as its 15th brand, after it agreed to a broad cooperation with the group. Stellantis does not release figures for individual brands, except for Maserati which reported an 82 million euro adjusted operating loss in the first half. Some analysts say Maserati could possibly be a target for a sale by Stellantis, while other brands such as Lancia or DS might be at risk of being scrapped given their marginal contribution to the group's overall sales. Stellantis' Milan-listed shares were down as much as 12.5% on Thursday, hitting their lowest since August 2023. That brings the loss for the year so far to 22%, making them the worst performer among the major European automakers. Few automotive brands have been killed off since General Motors ditched the unprofitable Saturn and Pontiac during a U.S. government-led bankruptcy in the global financial crisis in 2008. Tavares is under pressure to revive flagging margins and sales and cut inventory in the United States as Stellantis bets on the launch of 20 new models this year which it hopes will boost profitability. Recent poor results from global carmakers have heightened worries about a weakening outlook for sales across major markets such as the U.S., whilst they also juggle an expensive transition to electric vehicles and growing competition from cheaper Chinese rivals. Japan's Nissan Motor saw first-quarter profit almost completely wiped out on Thursday and slashed its annual outlook, as deep discounting in the United States shredded its margins. Tavares said he would be working through the summer with his U.S. team on how to improve performance and cut inventory.

Chrysler, Nissan minivans earn 'dire' crash test results, says IIHS [w/video]

Fri, Nov 21 2014First introduced in 2012, the Insurance Institute for Highway Safety's small-overlap frontal crash test has become the bane of many auto engineers' existence. It's a particularly steep design challenge because it forces just 25 percent of a vehicle's front end to take the brunt of a 40-mile-per-hour impact. The newly released results of four family-minded minivans underscore just how difficult the crash test is: only one scored an Acceptable rating, and the other three did very poorly. The 2008-2015 Chrysler Town & Country and Dodge Grand Caravan, plus the 2011-2015 Nissan Quest, all received Poor ratings in the test, the IIHS' lowest possible score. The three of them showed significant crash intrusion into the driver's area. The dummy in the Nissan actually had to be cut out of the vehicle, with an IIHS spokesperson remarking, "the structure collapsed like a house of cards." In the Fiat Chrysler Automobile vans, the steering wheels moved out of the way, making the airbag less effective and letting the driver's head hit the dashboard. While it was not actually crashed, the agency is also giving the 2009-12 Volkswagen Routan a Poor score because it shares a structure with the FCA models. The newly released results of four minivans underscore just how difficult the small-offset crash test is. The refreshed 2015 Toyota Sienna (shown), conversely, earned an Acceptable rating and is also a Top Safety Pick+ because of its optional forward collision warning and automatic braking system. While the crash test dummy moved around during the impact more than the agency would have liked, sensors showed a low risk of injuries. The IIHS tested the Honda Odyssey last year, and it earned a Good overall score, the agency's best ranking. It's also a Top Safety Pick+ vehicle. The only member of the minivan segment left to test is the latest Kia Sedona, and the Institute is reportedly waiting a little longer for Kia to make changes to improve the model's performance. When reached for comment, Nissan spokesperson Steve Yaeger provided Autoblog with the following statement: "Nissan is committed to vehicle safety and believes that consumers should have information about crash protection so they can make educated buying decisions. Nissan is proud of the 2014 Quest's "good" rating in the IIHS front moderate overlap and side impact tests as well as a "good" head restraint rating.