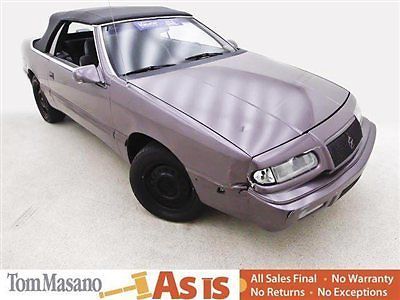

1987 Chrysler Lebaron Convertible 59k Low Miles Automatic 4 Cylinder No Reserve on 2040-cars

Orange, California, United States

Chrysler LeBaron for Sale

1985 chrysler lebaron base convertible 2-door 2.2l

1985 chrysler lebaron base convertible 2-door 2.2l 1977 chrysler lebaron medallion coupe 2-door 5.2l(US $4,000.00)

1977 chrysler lebaron medallion coupe 2-door 5.2l(US $4,000.00) 1983 mark cross black brown leather automatic convertible fwd

1983 mark cross black brown leather automatic convertible fwd 1995 chrysler lebaron gtc convertible (f9632b) ~ absolute sale ~ no reserve ~

1995 chrysler lebaron gtc convertible (f9632b) ~ absolute sale ~ no reserve ~ 1989 chrsyler lebaron convertible turbo

1989 chrsyler lebaron convertible turbo 1978 lebaron 2 door coup(US $6,000.00)

1978 lebaron 2 door coup(US $6,000.00)

Auto Services in California

Zenith Wire Wheel Co ★★★★★

Yucca Auto Body ★★★★★

World Famous 4x4 ★★★★★

Woody`s & Auto Body ★★★★★

Williams Auto Care Center ★★★★★

Wheels N Motion ★★★★★

Auto blog

Dodge Dart pushed toward the grave with simplified lineup

Tue, Apr 12 2016FCA announced a while back that the Dodge Dart and its Chrysler 200 half-sibling are on the way out due to lack of interest. The 2016 model year will be the Dart's last, and Dodge has just reconfigured the lineup mid-year to lower (relative) pricing and streamline ordering. Streamlined is a nice way of saying there will be fewer choices, with three models (down from five) and limited customization beyond choosing the paint color. The odd thing is that the Dart continues to offer three different engines. And while the prices of the individual models have decreased, the former SE base trim is now gone. That means an early-2016 Dart was available for as little as $17,990, while the late-2016 Dart starts at $18,990. For that sum you get the new base model, the SXT Sport, which replaces the SXT and comes with the 2.0-liter Tigershark four-cylinder (160 horsepower, 148 lb-ft of torque) and a six-speed manual; a six-speed automatic is an available option. Standard equipment includes normal entry-level car stuff, black cloth upholstery, 16-inch wheels, and grille shutters that help improve fuel economy. The SXT Sport can be dressed up with one of three different appearance packages; Chrome adds bright accents to parts including the grille and door handles, Rallye has a black grille and a touring suspension, and the Blacktop package makes pretty much everything on the exterior black and includes a sport-tuned suspension. All three packages come with bigger wheels, too. From there it's on to the new Dart Turbo, for $20,490. It comes with the 1.4-liter turbo four (160 hp, 184 lb-ft of torque) and comes exclusively with a six-speed manual transmission. This is supposed to be the model for enthusiasts, which is how Dodge is selling the switch to manual-only. Ditching the disliked dual-clutch automatic that was previously offered with this engine doesn't hurt. This engine was also used in the former Aero model, as it's the most fuel-efficient in the lineup. The Turbo gets the Rallye appearance stuff and a different hood. At the top is the Dart GT Sport, starting at $21,900. It has the 184-hp, 2.4-liter Tigershark four-cylinder and a choice of six-speed manual or automatic transmission. This is the one with features, including a power driver's seat, the 8.4-inch Uconnect infotainment unit, digital reconfigurable gauges, dual-zone auto climate, keyless start, and a rearview camera. The latter-part-of-2016 Dart will be available in eight colors.

Germany says Fiat Chrysler also cheats on diesel emissions

Thu, Sep 1 2016In May, Germany threatened to ban Fiat Chrysler vehicles because they supposedly had diesel emissions cheat devices. The guilty vehicle at the time was a Fiat 500X. Since then, Italian regulators looked into the issue and said they found no such device. But Germany didn't back down, and filed papers today with the European Commission (EC) and the Italian Transport Ministry saying, again, that there were questionable emissions results in four FCA vehicles. According to Reuters, the Germany's new tests proved there was an, "illegal use of a device to switch off exhaust treatment systems" in the four FCA vehicles. According to Der Spiegel, the four vehicles in the latest batch of offenders are the two new 500Xs, a Fiat Doblo, and a Jeep Renegade. Alexander Dobrindt, Germany's Federal Minister of Transport, noted the vehicles in the letter to the EC, which also said that the EC should communicate with Italian regulators as the next step. Related Video: News Source: Reuters, Der SpiegelImage Credit: GIUSEPPE CACACE/AFP/Getty Images Government/Legal Green Chrysler Fiat Diesel Vehicles vw diesel scandal FCA diesel scandal

UAW chooses FCA as lead bargaining company

Mon, Sep 14 2015The United Auto Workers has chosen Fiat Chrysler Automobiles as its lead bargaining company as it seeks to finalize new contracts with the 140,000 or so workers represented by the union. That doesn't mean the UAW won't continue to talk with Ford and General Motors. "All three companies have been working with UAW bargaining teams toward a collective bargaining agreement and continue to do so," UAW President Dennis Williams said in a statement. It does mean, however, that any deal the UAW strikes with FCA will form the basis of bargaining talks with the other two American automakers. Contracts between the UAW and the Detroit Three automakers are set to expire tonight at midnight. If no deal is made, both parties may vote to extend the previous contract. Industry analysts polled by The Detroit News suggest that a deal with FCA might be the most difficult to reach, since it is the smallest and least profitable of the three US car companies, and because of its high percentage of second-tier workers. There's a super short statement on the matter from the UAW, and there's an equally concise confirmation from FCA. Feel free to read them below. Detroit – The UAW this afternoon announced that FCA US LLC will be the lead target in Big Three auto talks. "All three companies are working hard toward a collective bargaining agreement. At this time, the UAW has selected FCA US LLC to be the lead bargaining company," said Dennis Williams, President of the UAW. "All three companies have been working with UAW bargaining teams toward a collective bargaining agreement and continue to do so." -------- Statement regarding the Status of Contract Talks between FCA US LLC and the UAW FCA US LLC confirms that it has been selected as the company to set pattern on a collective bargaining agreement with the UAW. As negotiations are ongoing, the Company can offer no further comment at this time.