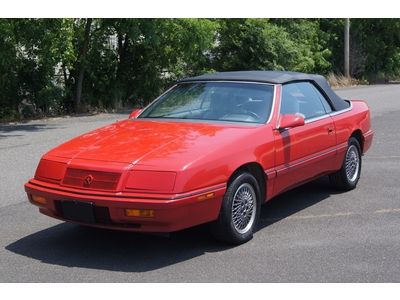

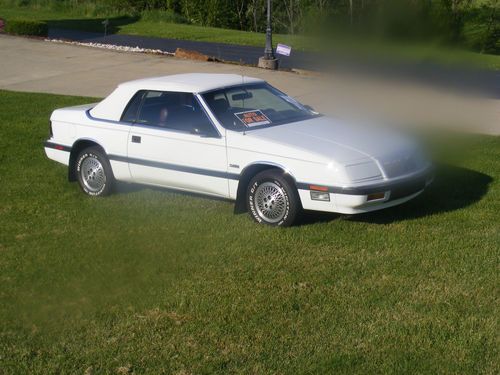

1986 Chrysler Lebaron Base Convertible 2-door 2.2l on 2040-cars

Jackson, Michigan, United States

Body Type:Convertible

Engine:2.2L 135Cu. In. l4 GAS SOHC Naturally Aspirated

Vehicle Title:Clear

Fuel Type:GAS

For Sale By:Private Seller

Number of Cylinders: 4

Make: Chrysler

Model: LeBaron

Trim: Base Convertible 2-Door

Warranty: Vehicle does NOT have an existing warranty

Drive Type: FWD

Options: Cassette Player, Leather Seats, Convertible

Mileage: 120,000

Power Options: Air Conditioning, Power Windows

Sub Model: Convertible

Exterior Color: Tan & Yellow

Disability Equipped: No

Interior Color: Tan

Chrysler LeBaron for Sale

(C $4,500.00)

(C $4,500.00) 1986 chrysler lebaron base convertible 2-door 2.2l

1986 chrysler lebaron base convertible 2-door 2.2l Only 66k miles gtc convertible 2 dr runs drives great xtra clean must see coupe(US $4,995.00)

Only 66k miles gtc convertible 2 dr runs drives great xtra clean must see coupe(US $4,995.00) 1984 chrysler lebaron base convertible 2-door 2.2l

1984 chrysler lebaron base convertible 2-door 2.2l 1979 chrysler lebaron 2dr coupe w/ super six.

1979 chrysler lebaron 2dr coupe w/ super six. 1988 chrysler turbo convertible excellent no reserve 45000 actual miles

1988 chrysler turbo convertible excellent no reserve 45000 actual miles

Auto Services in Michigan

Winners Auto & Cycle ★★★★★

Westborn Auto Service ★★★★★

Weber Transmission Company ★★★★★

Vaneck Auto Body ★★★★★

US Wheel Exchange ★★★★★

U Name IT Auto ★★★★★

Auto blog

Fiat Chrysler posts $690M Q1 loss

Mon, 12 May 2014If there is one thing that should be remembered when looking at quarterly and annual earnings, it's that the headline numbers rarely tell the whole story when it comes to an automaker's health. Chrysler's first-quarter earnings are just such an example.

Yes, the Auburn Hills-based manufacturer lost $690 million, which is quite a large sum of money. The reasons for the loss, according to Chrysler, were "Unfavorable infrequent items," which includes a $504 million payment to rid itself of the debts it took on for prepaying the UAW's VEBA healthcare trust. Chrysler was also hit with a $672 million charge to the UAW, which was part of a deal that allowed Fiat to purchase the remaining shares of Chrysler owned by the VEBA.

Ignoring those one-time deals, the first quarter was quite a successful one for Chrysler. It would have made $486 million if you erased the merger costs, which would have been a year-over-year increase of $320 million. Even more promising is the fact that Chrysler snagged the largest increase in market share of any automaker during Q1 at 1.1 percent, bringing its overall share to 12.7 percent of the US market. Chrysler saw a 30-percent improvement in sales of trucks and SUVs, along with an 11-percent increase in year-over-year sales and a 23-percent increase in revenue, to $19 billion.

5 reasons why GM is cutting jobs, closing plants in a healthy economy

Tue, Nov 27 2018DETROIT — Even though unemployment is low, the economy is growing and U.S. auto sales are near historic highs, General Motors is cutting thousands of jobs in a major restructuring aimed at generating cash to spend on innovation. It's the new reality for automakers that are faced with the present cost of designing gas-powered cars and trucks that appeal to buyers now while at the same time preparing for a future world of electric and autonomous vehicles. GM announced Monday that it will cut as many as 14,000 workers in North America and put five plants up for possible closure as it abandons many of its car models and restructures to focus more on autonomous and electric vehicles. The reductions could amount to as much as 8 percent of GM's global workforce of 180,000 employees. The cuts mark GM's first major downsizing since shedding thousands of jobs in the Great Recession. The company also said it will stop operating two additional factories outside North America by the end of next year. The move to make GM get leaner before the next downturn likely will be followed by Ford Motor Co., which also has struggled to keep one foot in the present and another in an ambiguous future of new mobility. Ford has been slower to react, but says it will lay off an unspecified number of white-collar workers as it exits much of the car market in favor of trucks and SUVs, some of them powered by batteries. Here's a rundown of the reasons behind the cuts: Coding, not combustion CEO Mary Barra said as cars and trucks become more complex, GM will need more computer coders but fewer engineers who work on internal combustion engines. "The vehicle has become much more software-oriented" with millions of lines of code, she said. "We still need many technical resources in the company." Shedding sedans The restructuring also reflects changing North American auto markets as manufacturers continue to shift away from cars toward SUVs and trucks. In October, almost 65 percent of new vehicles sold in the U.S. were trucks or SUVs. That figure was about 50 percent cars just five years ago. GM is shedding cars largely because it doesn't make money on them, Citi analyst Itay Michaeli wrote in a note to investors. "We estimate sedans operate at a significant loss, hence the need for classic restructuring," he wrote. The reduction includes about 8,000 white-collar employees, or 15 percent of GM's North American white-collar workforce. Some will take buyouts while others will be laid off.

As it did with Ferrari, Fiat Chrysler spinning off Magneti Marelli

Thu, Apr 5 2018MILAN — Fiat Chrysler said on Thursday its board had tasked management to proceed with spinning off Magneti Marelli and distributing shares in a new holding for the 99-year old parts business to FCA investors. The spinoff is part of a plan by FCA Chief Executive Sergio Marchionne to "purify" the Italian-American carmaker's portfolio and to unlock value at Magneti Marelli, which sits within FCA's components unit alongside robotics specialist Comau and castings firm Teksid, and which analysts say could be worth between 3.6 and 5 billion euros ($4.4-6.1 billion). "The separation will deliver value to FCA shareholders, while providing the operational flexibility necessary for Magneti Marelli's strategic growth in the coming years," Marchionne said in a statement. Magneti Marelli, which employs around 43,000 people and operates in 19 countries, is a diversified components supplier specialized in lighting, powertrain and electronics, and its spinoff is part of a five-year business plan FCA is due to present on June 1. "The spinoff will also allow FCA to further focus on its core portfolio while at the same time improving its capital position," Marchionne added. Marchionne has a long history of such moves. The 65-year-old was behind the spinoff and listing of trucks and tractor maker CNH Industrial and supercar brand Ferrari. The Magneti Marelli separation is expected to be completed by the end of this year or early 2019, with shares in the company expected to be listed on the Milan stock exchange. FCA's advisers initially looked at a possible initial public offering for the business to raise cash to cut FCA's debt, but the Agnelli family - FCA's main shareholder - were put off by low industry valuations and did not want their stake in Magneti Marelli to be diluted, three sources close to the matter told Reuters last month. Magneti Marelli has often been touted as a takeover target and FCA has fielded interest from various rivals and private equity firms over the years. South Korea's Samsung Electronics made a bid approach in 2016 but negotiations fell through as it was only interested in parts of the business, other sources have said. The spinoff is subject to regulatory approvals, tax and legal considerations and a final approval by the FCA board. The carmaker may modify or call off the transaction at any time and for any reason, it added.