1982 Chrysler Imperial Frank Sinatra Edition, Calif Desert Car, Low Miles on 2040-cars

Victorville, California, United States

Engine:318 V8

Vehicle Title:Clear

For Sale By:Private Seller

Exterior Color: Blue

Make: Chrysler

Interior Color: Blue

Model: Imperial

Trim: Frank Sinatra Edition

Warranty: Vehicle does NOT have an existing warranty

Drive Type: Rear Wheel

Mileage: 68,369

I am selling this car for my elderly father-in-law, who is the second owner. The car is in the desert community of Victorville, CA about half way between Los Angeles and Las Vegas. He last drove it six or seven years ago - it has been sitting in his garage ever since.

Chrysler Imperial for Sale

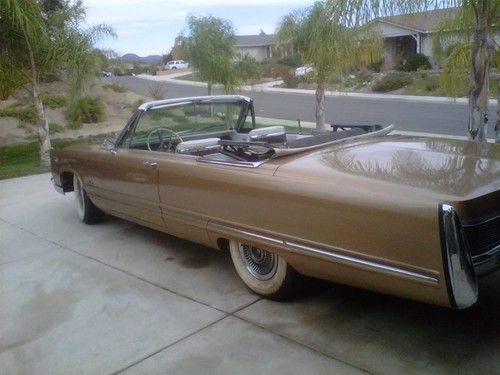

1968 imperial crown coupe mobile director - rarest of rare, executive, dignitary

1968 imperial crown coupe mobile director - rarest of rare, executive, dignitary 1936 36 chrylser imperial airflow series c-10 6 passenger 4 door sedan project

1936 36 chrylser imperial airflow series c-10 6 passenger 4 door sedan project 1967 chrysler imperial convertible- classic, mopar, hot rod, rare, collectible(US $13,000.00)

1967 chrysler imperial convertible- classic, mopar, hot rod, rare, collectible(US $13,000.00) Classic collector car imperial crown 64k miles very clean turnkey driver wow!!(US $5,500.00)

Classic collector car imperial crown 64k miles very clean turnkey driver wow!!(US $5,500.00) Factory a/c, highly optioned, always garaged, meticulous maintenance

Factory a/c, highly optioned, always garaged, meticulous maintenance 1953 chrysler crown imperial 4 door 331cc hemi at

1953 chrysler crown imperial 4 door 331cc hemi at

Auto Services in California

Zip Auto Glass Repair ★★★★★

Woodland Motors Chevrolet Buick Cadillac GMC ★★★★★

Willy`s Auto Repair Shop ★★★★★

Westside Body & Paint ★★★★★

Westcoast Autobahn ★★★★★

Westcoast Auto Sales ★★★★★

Auto blog

Bailout dealership cuts did their job as profits surge

Tue, 01 Oct 2013Almost five years after US taxpayers bailed out General Motors and Chrysler, a large majority of their slimmed-down dealership networks are posting soaring profits, Bloomberg reports, and contributing to the US auto industry on track this year to deliver 15.4 million vehicles, the most since 16.15 million were delivered in 2007.

Consider another important figure: Bloomberg says that more than 90 percent of GM dealerships are profitable, compared to about half of them in 2008 and 2009. At the start of 2013, GM had 4,355 US dealerships and Chrysler had about 2,600. Compare that with just a few years ago, when GM had 6,246 dealers in 2008, while Chrysler had 3,200 in 2009.

As part of their bankruptcy restructuring, both GM and Chrysler decided that their retail networks contained far too many dealerships and insisted that they be slimmed down. The resultant dealership terminations followed by a rebounding auto market - in part due to better new GM and Chrysler vehicles - have increased the number of sales per dealership to record levels. Many dealers are taking advantage of increasing profits and investing in facility renovations and updates, such as Chrysler dealership owner David Kelleher. He's spending $2 million to expand his store.

Google And FCA To Build Self-Driving Minivans In Partnership | Autoblog Minute

Sat, May 7 2016FCA and Google will work together to build self-driving minivans in a Motor City-Silicon Valley partnership. Chrysler Autoblog Minute Videos Original Video chrysler pacifica minivans

FCA and PSA sign merger agreement

Wed, Dec 18 2019Confirming an earlier rumor, PSA Group and Fiat-Chrysler Automobiles (FCA) signed a binding merger agreement to create the world's fourth-largest automaker. The partners hope to leverage the benefits of economies of scale as they develop new technologies and expand their global presence. The announcement ends FCA's years-long search for a partner, which nearly ended earlier in 2019 when it came close to merging with Renault, PSA's rival. It brings Fiat, Chrysler, Dodge, Ram, Jeep, Alfa Romeo, Maserati, Lancia, Peugeot, Citroen, DS, and Opel/Vauxhall under the same roof. That's a huge portfolio of brands that often overlap, but executives pledged to keep them all open, as well as all their respective factories as a result of the transaction. They're committed to making this big family of automakers work by building on each one's strengths, whether they're technical or regional. FCA and PSA jointly predicted they'll sell about 8.7 million cars annually around the globe, while posting an ˆ11 billion (about $12.2 million) profit. North America, a strong market for FCA, will provide 43% of its revenues, and 46% will be generated in Europe, where Peugeot's brands are doing better than ever. Together, they plan to achieve ˆ3.7 billion (about $4.1 million) in annual run-rate synergies. They'll notably have the purchasing power to negotiate a better price with suppliers, and they'll merge their research and development efforts where it makes sense to do so. Over two thirds of the group's annual volume will be built on two shared platforms. One will underpin about three million small cars annually, and the other will serve as the foundation for approximately three million compact and mid-sized cars. Details about these architectures haven't been made public yet, but a quick look at both companies' product portfolios reveals the small car will very likely come from Peugeot. Recent additions to its range, like the second-generation 208, are built on a new architecture named Common Modular Platform (CMP) developed with electric powertrains in mind. Meanwhile, Fiat is still making the cheeky 500 on an evolution of the platform found under the second-generation Panda released in 2003. The bigger architecture could come from FCA, however. The group's brands will share engines, transmissions, electric powertrains, infotainment systems, various sensors used to power electronic driving aids, and other components like wiring looms, but each one will retain its own identity.