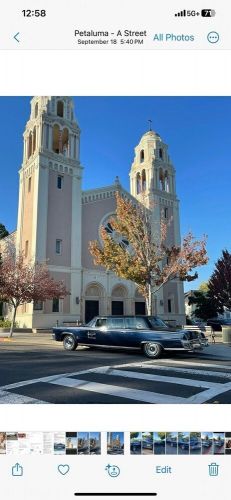

1965 Chrysler Imperial Custom Limousine Barrerios 154 Stretched. on 2040-cars

Petaluma, California, United States

Body Type:Limousine

For Sale By:Private Seller

Fuel Type:Gasoline

Engine:413 V8 4 Barrel

Transmission:Automatic

Year: 1965

VIN (Vehicle Identification Number): Y353209139

Mileage: 33950

Model: Imperial

Make: Chrysler

Exterior Color: Blue

Number of Cylinders: 8

Drive Type: RWD

Trim: Custom Limousine Barrerios 154 Stretched.

Chrysler Imperial for Sale

1967 chrysler imperial(US $34,500.00)

1967 chrysler imperial(US $34,500.00) 1992 chrysler imperial(C $7,500.00)

1992 chrysler imperial(C $7,500.00) Chrysler imperial(US $12,000.00)

Chrysler imperial(US $12,000.00) 1956 chrysler windsor (US $21,600.00)

1956 chrysler windsor (US $21,600.00) 1955 chrysler imperial newport coupe(US $18,320.00)

1955 chrysler imperial newport coupe(US $18,320.00) 1957 chrysler imperial crown(US $12,670.00)

1957 chrysler imperial crown(US $12,670.00)

Auto Services in California

Z Best Auto Sales ★★★★★

Woodland Hills Imports ★★★★★

Woodcrest Auto Service ★★★★★

Western Tire Co ★★★★★

Western Muffler ★★★★★

Western Motors ★★★★★

Auto blog

Merged PSA and Fiat would retain all brands, Tavares says

Sat, Nov 9 2019By Elisa Anzolin and Gilles Guillaume PARIS/TURIN, Italy (Reuters) - Peugeot maker PSA Group and Fiat Chrysler would retain all of their car brands if their planned $50 billion merger goes ahead, the would-be chief executive of the combined group said on Friday. PSA CEO Carlos Tavares, seen as the architect of PSA's turnaround and in line to take the operational helm in the Fiat tie-up, said in a TV interview that the companies complemented each other well geographically and in terms of technology and brands. FCA derives 66% of its revenue from North America compared with only 5.7% for PSA, Refinitiv Eikon data shows. Europe remains the main revenue driver for PSA. "There's no doubt it's a very good deal for both parties. It's a win-win," Tavares told France's BFM Business, in his first interview since the French and Italian companies announced plans to create the world's fourth-largest auto maker last week. Fiat Chrysler (FCA) Chairman John Elkann, who would chair the combined group, said on Friday at an event in Turin that the 50-50 share merger would help the Italian carmaker "seize great opportunities." The deal, which would help the firms pool resources to meet tough new emissions rules and investments in electric and self-driving vehicles, as well as counter a broader downturn in car markers, is still at an early stage. PSA and Fiat have said they aim to reach a binding outline in the coming weeks, but still face questions over potential job losses, as well as scrutiny over whether the transaction favors one party more than the other. Tavares said the brands that would come under the combined group's umbrella PSA's five passenger car nameplates include Citroen, Vauxhall and Opel, while FCA has nine, including Fiat, Alfa Romeo, Maserati, Chrysler, Dodge and Jeep Β were all likely to survive. "As of today, I don't see any need to scrap any of the brands if the deal came to pass. They all have their history and their strengths," Tavares said. Few carmakers have as large a portfolio, with German rival Volkswagen Group counting 10 passenger brands, if newer Chinese ones such as electric vehicle label Sihao are included. The merger will also require approval from anti-trust authorities. Tavares said he did not expect the companies to have to make major concessions to meet competition rules, but added they were ready to do so, without giving details.

Weekly Recap: Lamborghini to build SUV

Sat, May 30 2015Finally, Lamborghini will build a sport utility vehicle. The Italian supercar maker confirmed this week that it will launch a luxury SUV in 2018. It will be built at Lamborghini's soon-to-expand factory in Sant'Agata Bolognese in Italy, and will double the company's current sales volume. Lamborghini did not announce a name for the vehicle or other details, but noted a concept version, the Urus, was displayed at the Beijing motor show in 2012. It will be sold around the world, but it's expected to be a critical offering in the United States, China, and the Middle East. The automaker projects the SUV will sell about 3,000 units per year, and it will be the third product in Lamborghini's portfolio. It currently sells the Huracan and Aventador supercars. "The introduction of a third model line endorses the stable and sustainable growth of the company and signifies for us the beginning of a new era," Lamborghini chief executive Stephan Winkelmann said in a statement. The project is also a boon for Italy, which will get 500 new jobs in the Emilia Romagna region as Lamborghini's factory will nearly double in size. Ian Fletcher, principal analyst for IHS Automotive, said the SUV will position Lamborghini for future growth. "It could well also bring new customers to the brand [who] may find the dramatic styling of Lamborghini products appealing, but find its typical sports cars restrictive," he said. "If it is a success, the SUV could be a catalyst to Lamborghini broadening its portfolio further." OTHER NEWS & NOTES GM invests in Chevy Camaro factory General Motors is investing $175 million to upgrade its factory in Lansing, MI, to build the 2016 Chevy Camaro. The investment will pay for new tooling and equipment. The improvements include three new paint systems and two new robotic framers. GM will add a second shift at the factory to build the Camaro, resulting in 500 jobs. The automaker had dropped the plant to one shift last year amid slow sales for its products, the Cadillac ATS and CTS. GM is spending $5.4 billion over the next three years to upgrade its US facilities. Last week, GM announced plans to spend $439 million to build a new paint shop for the Chevy Corvette. While the Camaro and Corvette plant improvements are intriguing to enthusiasts, GM also confirmed this week that it is investing $1.2 billion in its Fort Wayne (IN) factory that builds trucks.

UAW urging Chrysler to sell shares to investors

Thu, 10 Jan 2013The United Auto Workers union is pushing Chrysler to sell 16.6 percent of its stock to investors in an attempt to establish the value of the shares. The UAW is currently locked in a lawsuit with Chrysler parent company Fiat over how much the Italian automaker should pay to buy shares from the trust fund. Last year, Fiat told the trust it intended to exercise its right to purchase 3.3 percent of the union's shares at issue. But the union contended the 54,154 shares were worth closer to $381 million instead of the $155 million Fiat offered.

Currently, the UAW owns 41.5 percent of Chrysler while Fiat holds 58.5 percent of the company. Currently, it's unclear whether the UAW could force Chrysler to put the shares on the open market. Doing so would be the first step toward a much-anticipated initial public offering. Chrysler has said it will comply with its shareholders agreement, and Fiat has echoed that tune. According to The Detroit Free Press, the UAW Retiree Medical Benefits Trust has declined to comment on the situation.